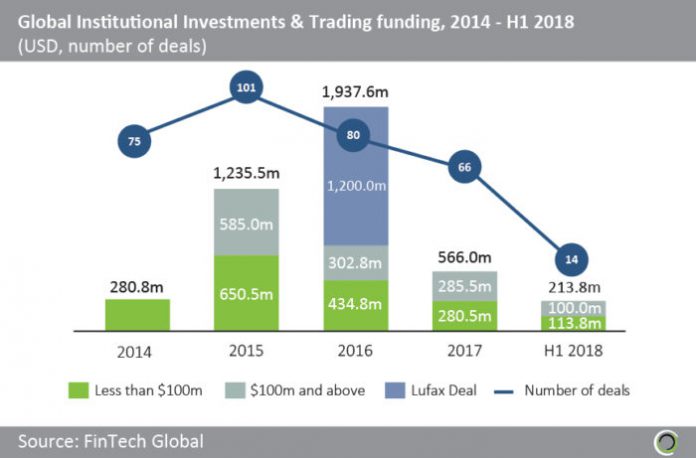

Capital invested in the first half of 2018 equates to just 37.8% of last year’s total

- Funding to the Institutional Investments & Trading sector peaked in 2016 at $1.9bn. This was as a result of a $1.2bn investment in Lufax, a financial assets trading platform. The Series B round was led by COFCO, with participation from Guotai Junan Securities and China Minsheng Bank.

- When the Lufax deal is excluded, funding actually declined between 2015 and 2017. If investment activity progresses at the current pace, this trend will continue in 2018.

- Deal activity peaked in 2015 and has been declining since. This downtrend is also projected to continue in 2018, with the 14 deals closed during H1 equating to just 21.2% of last year’s total.

Institutional Investments & Trading funding was historically low in Q2 2018

- Capital invested and deal activity were both historically low in Q2 2018, with just $40.9m invested across four deals.

- The largest deal in Q2 was a $16m investment in TradeIX, a blockchain-powered trade finance platform. The Series A round was led by ING Ventures with co-investment from BNP Paribas, Tech Mahindra and Kistefos Venture Capital.

- Institutional investment technology within the real estate sector saw notable activity in H1 2018 when Cadre, a data-driven real estate investment platform, partnered with Goldman Sachs. Goldman’s private wealth clients committed $250m to the platform, which will be invested directly into Cadre’s real estate portfolio.

North America’s share of deals is declining

- Between 2014 and 2017, North America’s share of deals decreased by 14.9 percentage points (pp) from 69.3% to 54.4%. This dropped further in the first half of 2018 to reach just 50%.

- This decline was mainly offset by the increase in Asia’s share of deals from 6.7% in 2014 to 18.2% in 2017. This trend continued in H1 2018 when 21.4% of all deals closed were by companies based in Asia. One notable deal in this category is the $5m investment in TigerWit, an online trading technology platform, from Susquehanna International Group. The funding will be used to support the development of TigerWit’s platform, as well as investing in new technology to enhance the client trading experience.

- Europe’s share of Institutional Investments & Trading deals ranged between 16.8% and 22.7% from 2014 to 2017. In H1 2018, they accounted for almost a third of all investments.

The top 10 deals in H1 2018 raised over $200m

- The combined total of the top 10 Institutional Investments & Trading deals in H1 2018 is $208.7m. The largest of these was a $100m private equity investment in YieldStreet, an alternative investment platform, from an unnamed New York-based family office. Alongside this, the company also raised $12.8m in a Series A round led by Raine Ventures and Greycroft.

- tryb Group, a Singapore-based firm which acquires and develops middle market FinTech companies, raised $30m in the second largest deal. Makara Capital made the private equity investment which will go towards acquiring, developing and scaling up growth stage FinTechs within the SME lending, trade finance and micro-credit sectors.

- Half of the top 10 investments were raised by companies based in North America, while three were located in Asia and the remaining two in Europe.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global