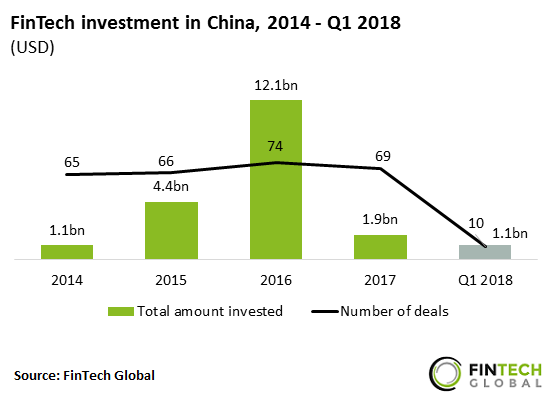

FinTech investment in China hit $1.1bn across 10 deals in Q1 2018

- More than $20bn has been invested in Chinese FinTech companies since 2014, with funding topping $1bn in Q1 2018.

- Investment grew 11-fold between 2014 and 2016, as political uncertainty in Europe and valuation concerns in the United States pushed investors eastward.

- Chinese FinTech companies raised $12.1bn in 2016, driven mainly by later-stage deals. Investment was buoyed by blockbuster deals such as the $4.5bn Series B funding raised by Ant Financial Services Group, an affiliate of Alibaba, in Q2.

- FinTech investment in China dipped significantly to just under $2bn last year, as the People’s Bank of China (PBOC) emphasized greater scrutiny on regulating the Chinese FinTech landscape.

Q1 2018 showed signs of a recovering FinTech funding landscape in China

- Investment in Chinese FinTech companies was at subdued levels relative to 2016, as a stricter regulatory environment deterred investment.

- Q4 2017 investment was just $200m, driven lower by increased scrutiny of FinTech companies and their links to capital outflow, as well as concerns over ICOs. China implemented measures to manage outbound payments and investments after its foreign-exchange reserves fell by nearly $1 trillion since June 2014.

- FinTech investment in Q1 2018 reached $1.1bn setting strong expectations that investment will surpass 2017 levels. OneConnect, a financial technology platform provider for smaller banks and is a subsidiary of Ping An Insurance Group, raised $650m in series A funding in as it prepares itself for a potential $2bn IPO.

- FinTech investment can be fuelled further as Ping An plans to invest $15.8bn over the next 10 years, to accelerate development of financial technologies backed by innovations such as artificial intelligence and blockchain.

Marketplace Lending companies have dominated the top 10 FinTech deals in China since January 2017

- The top 10 FinTech deals in China raised $2.1bn between Q1 2017 and Q1 2018, with more than $1bn of this raised in Q1 2018 alone.

- Previously mentioned OneConnect raised $650m in Series A funding from IDG Capital and SBI Group. This was the largest FinTech deal in Q1 2018, valuing the company at $7.4bn.

- Six of the largest 10 FinTech deals in China involved Marketplace Lending companies, with $970m raised across these deals.

- Tuandaiwang, a peer-to-peer lending platform, raised $262.6m of private equity funding in Q2 2017. This pre-IPO funding was led by China Minsheng Investment Group and was the largest Marketplace Lending deal listed in the top 10 deals in China.

The share of later-stage FinTech deals in Chinese declined by 50% last year

- The share of sub-$10m FinTech deals in China decreased from 27.9% in 2014 to just under 10% in 2016. Over the same period, the proportion of deals valued above $100m grew from 9.3% to 21.9%.

- JD Finance, an SME and consumer credit provider, raised $1bn in Q1 2016, led by Sequoia Capital and others. This valued the company at $7.1bn, positioning it to better compete with Alibaba, Baidu and Tencent who all offer online financial services in China.

- The proportion of deals valued above $50m more than halved to 20% in 2017, compared to the previous year, as the market held back due to tightened capital controls and the prospect of increased regulation of Chinese FinTech companies by the PBOC.

- However, $1.1bn was raised across 10 deals in Q1 2018, setting strong expectations that the Chinese FinTech funding landscape will see a higher proportion of larger deals this year.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global