UK FinTech investment this year is on track to outperform 2017 as size of deals keeps increasing

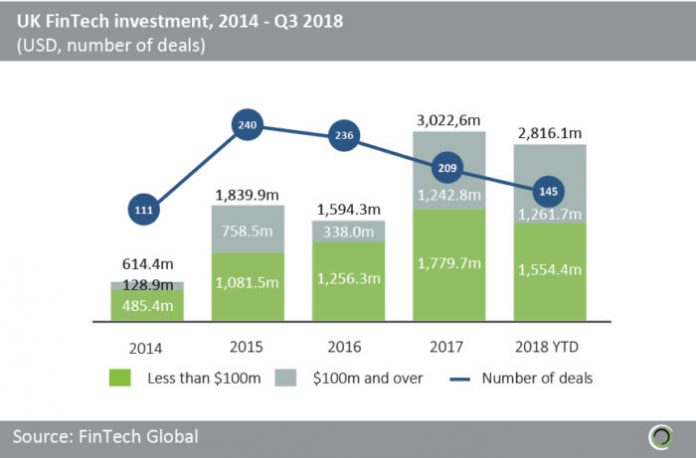

- So far this year the value of FinTech Investments in the UK has reached $2.8bn across 145 deals. The capital raised is already 93.1% of last year’s level. Funding in 2017 almost doubled from the previous year and this year looks set to beat the funding record.

- Total investment from deals over $100m is already greater than 2017 and constitutes for 44.8% of the total funding raised in 2018. There have been seven of these deals this year and the two largest transactions raised $250m each. The first was raised by Revolut in a series C round. The other was a private equity round for digital supply chain finance company Greensill Capital.

- Another notable deal was raised by Purplebricks, a company based in Solihull, which offers full estate agency services online at low cost. The company raised $177m in post IPO equity. They launched in the United States in September 2017 and plan to put $71m of the funding toward their operations and expansion in the US.

- However, the number of deals looks set to slightly decrease from the previous year. Currently, deal activity is 69.3% of 2017’s level.

- Looking at geographical distribution, more than 80% of this investment was raised by companies based in London. This figure has fluctuated around 80% for the past four years showing a stable distribution of FinTech Investments across the country.

FinTech investment in Q3 2018 down more than 15% compared to same quarter last year

- Q3 2018 is the strongest quarter so far this year. It has seen the largest number of deals and the total value invested makes up almost 50% of 2018’s total.

- The biggest deals in this quarter have been the previously mentioned round for Greensill Capital and a debt financing round for Capital on Tap, a SME finance company, which raised $177.6m.

- Last quarter has seen 17.2% less investment than in Q3 2017. The record high in Q3 2017 was partly due to the larger number of high value deals; five funding rounds over $100m as opposed to three in Q3 2018. These deals in Q3 2017 included a $200m round for P2P lender Prodigy Finance and $158.4m of debt financing raised by an online loans company 1st Stop Group.

- However, deal activity remains similar having only decreased by five deals to 64 this quarter, from 69 deals in Q3 2017.

UK FinTech deal sizes have continued to grow

- The percentage of deals under $1m has more than halved from 23.4% in 2017 to 10.9% this year.

- The proportion of deals for less than $1m has been markedly decreasing since 2014. The mean decrease for this deal size is 11.3 pp per year and its percentage share as a proportion of total deals is now more than five times smaller than in 2014.

- The share of deals above $20m has increased year on year. 2018 has shown a 2.9 pp increase from last year.

- In 2014 the percentage of deals above $10m was just 13%, so far this year it is more than 40%. This is a testament to the maturing of the FinTech Industry in the UK.

Marketplace Lending and WealthTech companies have completed the most FinTech deals in 2018

- Almost 20% of the 145 FinTech deals in 2018 have been in the Marketplace Lending subsector. This includes the two largest and previously mentioned deals in Q3 2018 with Capital on Tap and Greensill Capital. The popularity in Marketplace Lending is partly caused by the lack of SME financing available from banks since the 2007-2008 crisis, which has caused SMEs to look for other ways to raise capital. Also, these digital platforms need much lower costs to operate than banks and these savings benefit the customers. As a result, debt funding through FinTech platforms is become increasingly popular.

- WealthTech is the second largest subsector, receiving 16% of total deal activity. This includes one of the two largest deals in 2018 raised by Revolut. Also, Atom Bank, an online banking company based in Durham, raised $207.1m in the second largest funding round for this subsector.

- Investment in InsurTech, RegTech and Infrastructure & Enterprise Software companies has also remained active, with each subsector making up 14%, 12% and 11% of deal activity, respectively.

- The Other category includes companies that operate in the Cryptocurrencies, Blockchain, Institutional Investments & Trading and Data & Analytics. The biggest deal in this subsector was $40m raised in an ICO by a cryptocurrency company, SPiCE VC. The company, founded just last year, invests in startups that disrupt industries. Their vision is to utilize blockchain technologies to disrupt the venture capital industry.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.

©2018 FinTech Global