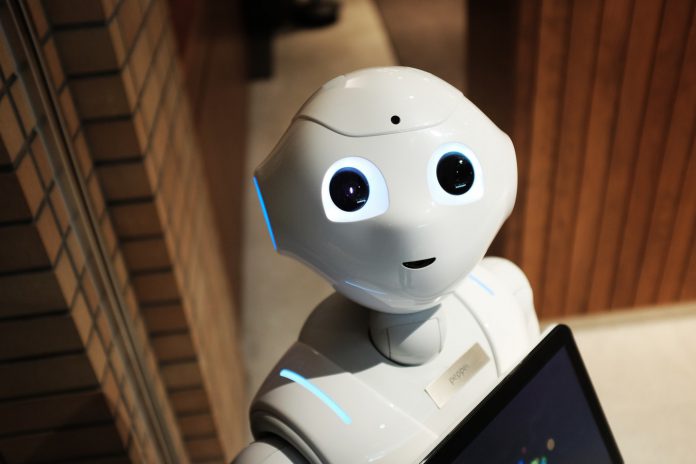

A pension dashboard would help robo advisors to improve the obstacle course of retirement planning, according to EValue chief development director Andrew Storey in a research interview with FinTech Global.

The implementation of the PSD2 regulation across the EU has meant financial institutions need to share consumer data with third-parties if they are asked to do so by the customer. This has opened up a lot of opportunities to players in the field, and while there is increased competition for traditional financial institutions, many have welcomed it with open arms. The improved access to data, alongside the open banking initiative which aims to open institutions to more external platform integrations, has given consumers more options and better services.

However, while the implementation of these will have big benefits to robo advisors collating all necessary information for investing advice. Storey believes there are still some limitations, such as the length of transaction history you can access. Something that he would also love to see implemented alongside open banking would be a pensions and investment dashboard. This would make it much easier to find answers to some of the toughest questions when planning for retirement.

Andrew Storey said, “The hardest question we have to ask is how much is your pension and where is it invested – most people have no idea.” Having a pension dashboard would make this a much simpler process, as it would be identify where the entirety of consumer’s holdings and pots. PSD2 would already make this relatively easy to achieve. He explained that open banking is already improving robo advisory by enabling businesses to monitor a user’s spending, which many people do not pay attention to, such as amount spent on coffee or phone bills. But in order to have the best results around investing for the future, you need to have this more holistic dashboard which could pull everything together.

“The obvious benefit is that you’ll actually understand which pensions you got. People will often lose pensions, or they forget that they have them and don’t really understand them. The second one is being able to do something useful with that information, so reducing amount time and effort that an advisor or even you, need to put in to understand what your current situation is. So, for example, quite a lot of our retirement planners are holistic and you can take into account everything else you’d like to have before retirement.”

Having a pension dashboard would enable companies like EValue to speed up this whole process. Instead of having to ask consumers awkward questions or trying to get them to remember things they most likely have forgotten about, they could just pull data from a centralised location which covers everything. He said this would allow the advisers to inform consumers that based on all of their pension pots how retirement would look, and what they can do to improve. It would ensure deeper advice and insights would be given for the landscape of a consumer’s future.

Unfortunately, there is no indication that a pension dashboard will be established, and this is down to handful of reasons. The first is Brexit, as this has made it harder for things to get things done with the uncertainties it has brought. Another issue is from a more technical side as it would be an onerous task making sure all of the data would be compiled.

“Its usefulness would only be fully appreciated if you’re actually getting all the information passed across. There could be quite a few chunks of pensions being missed off. Also, you’ve got to be able to use it across the board as advisers have to be able to use it as well as a consumer. So that all boils down to who’s going to pay for it and how. As it’s a joint effort, somebody’s going to have to run it and that’s kind of been passed around pillar to post at the moment.”

Blockchain technology has found a wide variety of uses within the financial services, being adopted for banking, insurance and regulation, among other spaces. The technology could also be a natural fit for the creation of a pension dashboard as it would provide a stable ledger for all of the information and make it a secure place to store it. The only problem Storey sees would be if it would be able to keep up with the sheer volume of transactions and giving varying levels of access.

“I live in hope that it [pension dashboard] will be completed one day, but I don’t know if it will,” he added.

A human and AI hybrid system

UK-based EValue provides digital personal finance advice solutions to help financial institutions, such as banks, product providers, advisers and employers, better prepare their customers for their futures. Its solutions include automated robo advice, adviser planning, consumer guidance, risk suitability, asset modelling and an API portal. Its automated robo advice solution is fully customisable and lets users build personalised suitability reports.

The company also works alongside clients to further adapt the software to enhance a variety of areas such as risk assessments, advice processes, behavioural finance and gamification, and investment risk profiling.

One of the things EValue is looking at, in lieu of a pension dashboard, is a solution which would let consumers take an image of a benefit statement and the software would be able to take the necessary information from it. Pulling data from this documentation would help the platform remove a lot of the laborious tasks that are currently involved in getting data for the robo advisor systems.

Although, a fully automated platform is not the end-all, as Storey believes that a hybrid of both automation and human interaction is still a greatly beneficial system to implement. Having technology to remove a lot of the ‘donkey work’, will let the human advisor spend more time on important tasks and catering to a larger number of investors, as they’re not bogged down as much.

“They all fit on a bell curve of complexity. At one end where they’re really simple investment processes, and, might not necessarily even need to give you advice. But at the other end where it’s really complicated and you would probably need to get involved. Then the bit in the middle is the sweet spot for automation.”

At first the circumstances where advice is offered might be relatively small, but as there are more cases for the system to learn from, the amount the automated advice handles can just keep growing. Eventually it can start to handle more complex scenarios, with just a human behind it monitoring. Eventually the human interaction falls from 100 per cent to around 20 per cent, and this just enables the advisor to monitor a lot more people.

Storey compared it with self-checkouts, as while these are automated, there is still someone on-hand to help if there is an error or a customer needs some help. Automated advice is much the same, and one person can just support a larger number of portfolios.

Copyright © 2018 FinTech Global