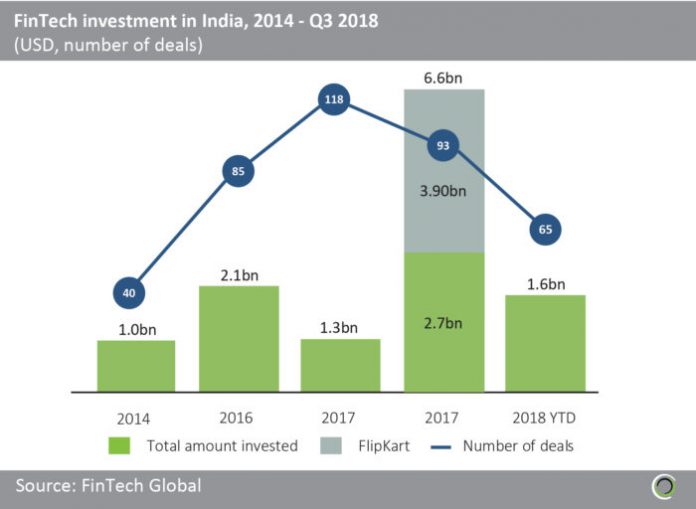

Capital raised by FinTech companies in India looks set to decrease compared to 2017, due to several large deals that took place last year

- In the first three quarters of this year the value of FinTech investments has reached $1,599.2m across 65 deals. So far the total amount invested is only 24.1% of last year’s total. The record-breaking year in 2017 can be attributed to three funding rounds raised by Flipkart. The e-commerce giant, which focuses on goods such as electronics, books and music, raised a total of $3.9bn across 3 deals. In May of this year the American multinational retail corporation Walmart acquired 77% of the company for $16bn and it has since raised its stake to 81.3%. Not including these three Flipkart deals capital invested so far this year is at 58.8% of last year’s level.

- The largest deal in India this year was $356m raised by One97 Communications. The investment was made by Berkshire Hathaway, a multinational conglomerate headed by Warren Buffet. Berkshire Hathaway has made several sizeable investments in FinTech companies this year. In October, the conglomerate purchased a 11% stake in Brazilian online payments processor Stoneco at its IPO. One97 Communications company’s sub-organisation Paytm is a digital e-commerce payment system and digital wallet company. Earlier this year Paytm partnered with the Life Insurance Corporation of India in order to expand its services by offering customers the opportunity to pay for their insurance though its platform.

- The second largest deal was $200m raised by Policybazaar in a Series F round. The company, which offers an insurance comparison portal and its own digital insurance, accounts for more than a quarter of India’s life cover and has over 100 million visitors on its website every year. Policybazaar is currently in the process of preparing to go public.

- Deal activity in the first three quarters of 2018 which is currently 30.1% less than last year’s level looks set to decrease slightly this year.

The third quarter is the strongest so far this year in India

- Last quarter funding rounds totalling nearly $700m were raised by FinTech companies across 17 deals. The biggest deal in this period was the previously mentioned One97 Communications deal, which makes up more than half of the total value invested in this quarter.

- The second largest deal was raised in post-IPO equity by Mahindra Finance, a non-banking finance company based in Mumbai. It is one of the top tractor financers in India and offers housing finance for the rural and semi-urban population among many other products.

- However, FinTech investment in Q3 2018 is down more than 75% compared to same quarter last year. Q3 2017 saw a record-breaking $3.1bn invested, this is partly due to two funding rounds raised by previously mentioned Flipkart which together totalled $2.5bn. Not including these two funding rounds the total amount invested is higher last quarter than Q3 2017.

- Deal activity in Q3 2018 was the lowest out of the three quarters this year and also significantly less than the same quarter last year. The high amount invested and small deal activity in the third quarter means the period has the largest average deal size so far this year.

Marketplace Lending companies have received more than a quarter of all FinTech deals in India since 2014

- 29% of the 401 FinTech deals completed by Indian FinTech companies have been in the Marketplace Lending subsector. The biggest deal in this subsector was the previously mentioned Mahindra Finance deal. The second largest deal in the period, which also occurred this year, was a $87m Series C round raised by Lending Kart. A company which aims to make capital finance more readily available for entrepreneurs.

- Payments & Remittances is the second largest subsector, receiving 27% of total deal activity. The nine largest deals in the subsector since 2014, which were all raised by either the previously mentioned Flipkart or One97 Communications, have reached a total of $7.9bn. Another large funding round in this subsector was $125m raised by Pine Labs in a private equity round. The company offers point of sale solutions to simplify payment acceptance and creates business opportunities for merchants to connect with consumers. This year the startup reported a 55.25% growth in revenue.

- There is also active investment into companies operating in the WealthTech and Infrastructure & Enterprise Software subsectors, with 12% and 8% of deal activity, respectively. The five largest deals in the WealthTech subsector amounting to $471.2m were all raised by Jana small finance bank. The new bank started its commercial banking operations this July.

- The other category includes the Institutional Investments & Trading, Funding Platforms, RegTech, Cryptocurrencies and Blockchain subsectors.

Most of the top FinTech investors in India are American based seed accelerators and venture capital firms

- The 12 most active FinTech investors have completed 129 deals since 2014. This constitutes 32.2% of total deal activity since 2014. Nine out the 12 companies are American based and two are headquartered in India.

- The majority of these top investors are venture capital firms and seed accelerators of which there are nine altogether. The most active investor Kalaari Capital, which has been involved in 17 funding rounds since 2014, is an Indian based early-stage tech focused venture capital firm.

- Sequoia Capital is the second most active investor and has taken part in 16 deals. The Silicon Valley based company has partnered with the founders of companies which now have an aggregate, public market value of over $3.3 trillion.

- The three most active investors which are not venture capital firms or seed accelerators include American hedge fund and family office Tiger Management Corp., Asian private equity firm SAIF partners, and philanthropic investment firm Omidyar Networks. Omidyar Networks which has committed over $1bn to both profit and non-profit organisations since 2004, invests in ideas that create opportunities for people to improve their own lives and the community around them.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global