UK-based digital wealth management company Nutmeg has stormed past its £1m crowdfunding target.

The WealthTech has raised up to $4.1m on its Crowdcube campaign, with investors still able to contribute more. It is unclear whether the fundraise has a hardcap.

So far, 2,091 retail investors have taken part in the sale – combined, they have received 1.63 per cent of Nutmeg’s total equity. Nutmeg has raised the capital at a pre-money valuation of £251m.

This crowdfund has come just months after the company closed its Series E round on £45m, following contributions from Goldman Sachs and Convoy.

The startup aims to open the world of financial advice and investments to everyone, whether they have £100 or £10m. The low-cost wealth management services span three investment styles through an ISA, a lifetime ISA, a pension, or a general investment account. Investment styles available are fixed allocation, fully managed and socially responsible.

Currently, Nutmeg manages more than £1.7bn for over 70,000 customers across the UK. The platform is also live in Taiwan and is looking to continue its expansion internationally.

Earlier in the month, fellow retail investing startup Bux closed its own funding round, securing $12.5m from investors including Velocity Capital and Holtzbrinck Ventures. The startup is a digital stock trading app which is aimed at first-time investors and helps educate them on the ecosystem.

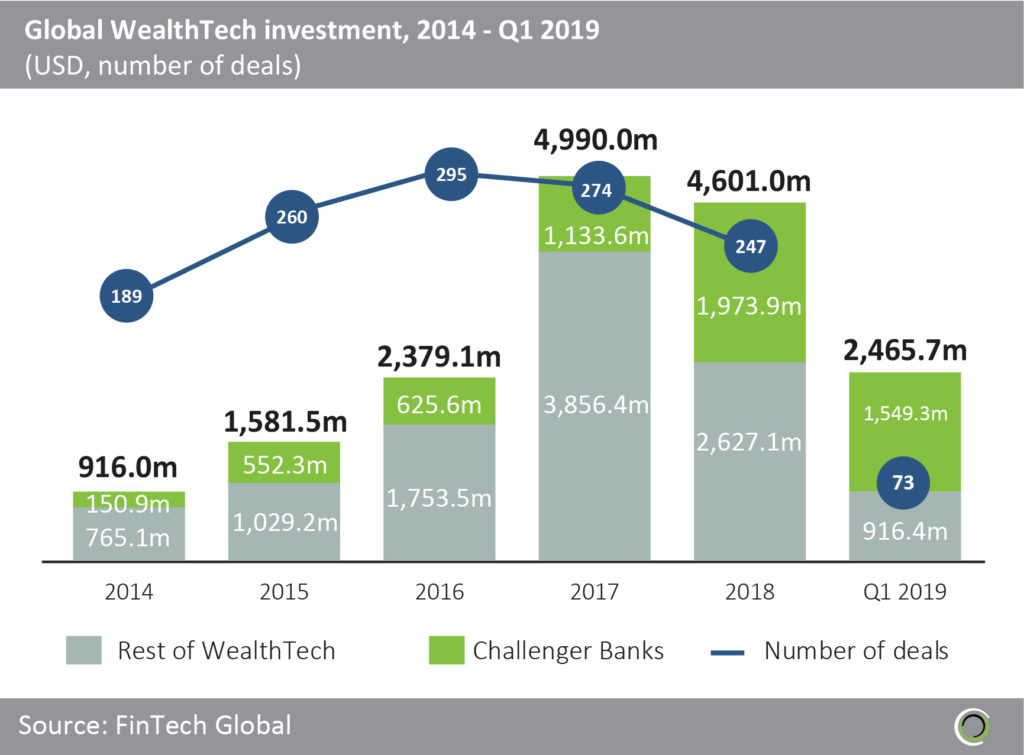

Despite the WealthTech sector’s high level of appetite, last year saw a fall in the annual investment volume – the first time since 2014. Funding levels only dropped by $390m and if Q1 2019 is a precursor of the whole year, funding in WealthTech is set to skyrocket.

Copyright © 2019 FinTech Global

Copyright © 2019 FinTech Global