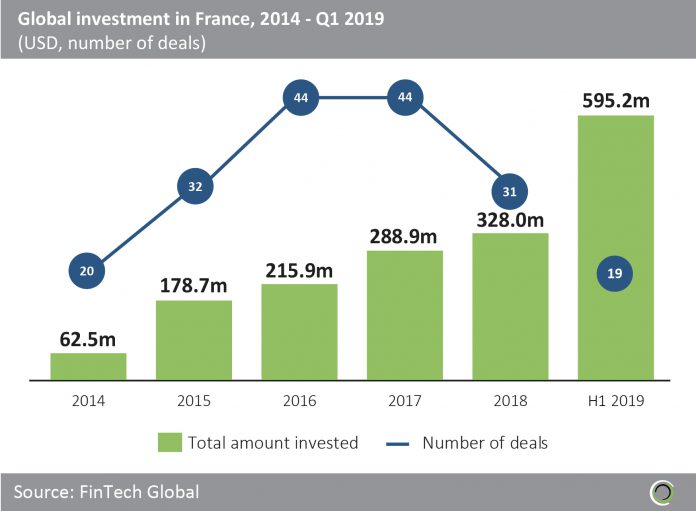

Investment in FinTech companies in France in 2019 is already 80% higher than last year

- FinTech companies in France raised almost $1.7bn across 190 deals between 2014 and H1 2019, with 86.3% of deals in the country involving companies based in Paris, as the city positions itself as a major FinTech hub in competition with London and Berlin.

- Investment increased at a CAGR of 51.4% between 2014 and 2018, which saw the deal size more than treble from $3.1m to $10.6m, and further funding growth pushed the average deal size to $31.3m during the first six months of 2019.

- Funding in France was already more than 80% higher in the first half of the year compared to full year 2018, with six transactions valued above $50m and only one in 2018, setting strong expectations for the rest of 2019.

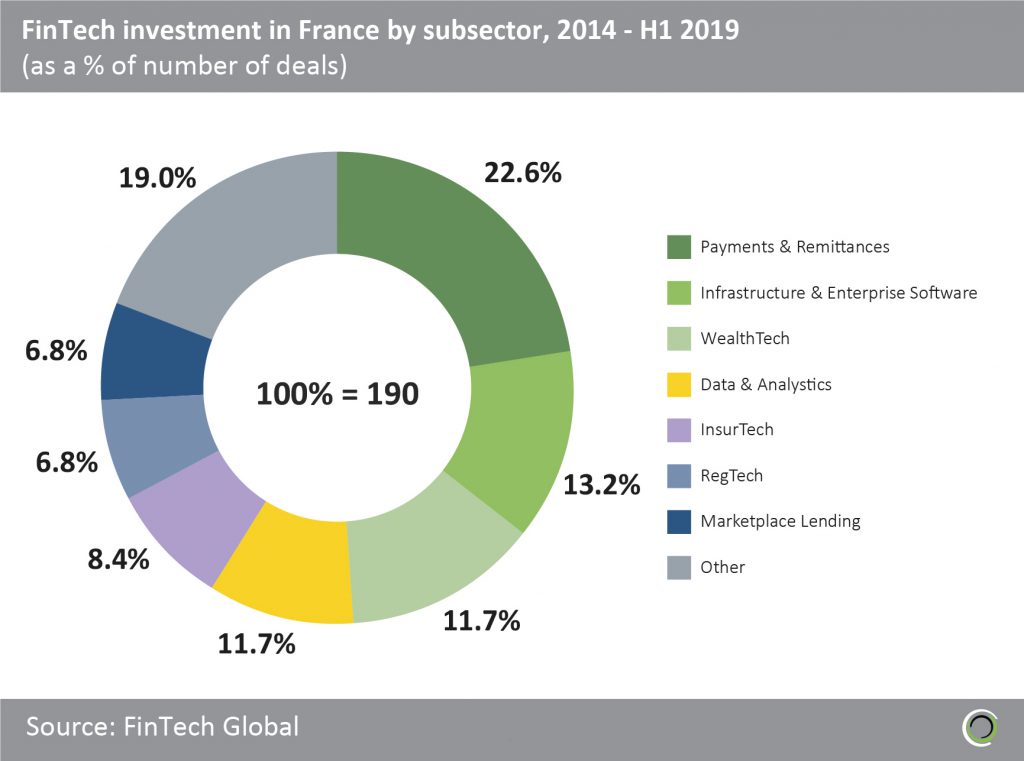

Investors in France have funded companies across all subsectors in FinTech over the past five years

- Although nearly one out of every four FinTech deals in France since 2014 have involved Payments & Remittances companies, there has been a lot of subsector diversity in terms of where investors have been allocating capital, with Infrastructure & Enterprise Software companies and WealthTech companies claiming more than a quarter of the deals combined.

- Wynd, a point of sale solution provider, raised an $82m Series C round in Q1 2019, led by Sofina and Natixis, which is the largest Payments & Remittances deals in France to date.

- The ‘Other’ category includes Real Estate, Cryptocurrency, Funding Platforms, Institutional Investments & Trading and Blockchain companies, which together have accounted for almost a fifth of all FinTech deals in France since 2014.

- Paris-based Ledger provides infrastructure solutions for cryptocurrencies and blockchain applications and raised a $75m Series B round in Q1 2018 from investors such as Draper Esprit and Digital Currency Group. This is the largest FinTech deal in the ‘other’ FinTech category in France to date and funding was used to ramp up production of its ledger wallet.

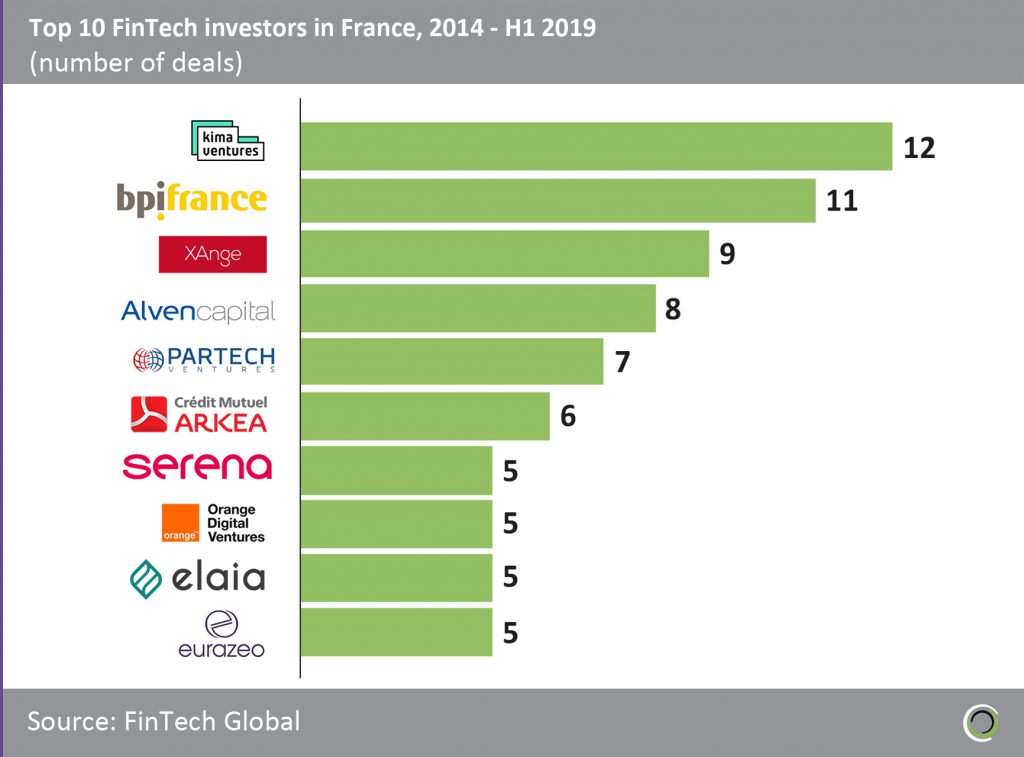

All of the top 10 FinTech investors in France over the past five years are based in Paris

- Of the 190 FinTech deals that took place between 2014 and H1 2019, the top FinTech investors in France have been involved in 73 transactions between them, with all ten of them based in Paris.

- Kima Ventures has been the most active FinTech investor in France, having completed 12 deals since 2014. The venture capital firm’s most recent FinTech investment was the $5.8m venture funding that Acorus Networks, a cybersecurity solution provider, received from Kima Ventures, Elaia Partners and Partech Ventures in Q4 2018.

- Although Partech Ventures has offices in San Francisco and Berlin, the French investor is headquartered in Paris. Partech has completed seven deals in France since 2014, with the largest being the $37m that SME lending platform Lendix raised in Q2 2018. Partech Ventures was joined by French investors Decaux Frères Investissements, CNP Assurances and Idinvest Partners (now part of Eurazeo) in the deal.

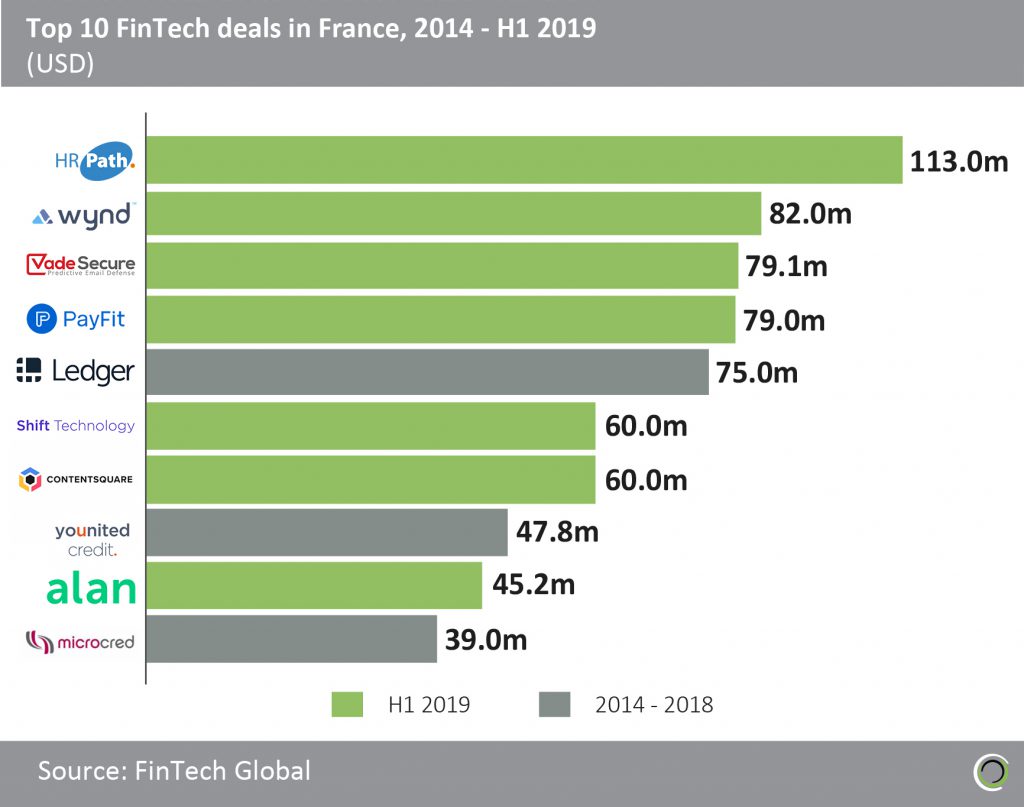

Deals in H1 2019 dominate the list of top 10 FinTech deals in France over the past five years

- Just over $680m was raised in the top 10 FinTech deals in France between 2014 H1 2019, which is equal to 40.7% of the total capital raised by FinTech companies in the country during the period, with seven of the top 10 deals occurring in H1 2019.

- The breakdown by subsector shows four RegTech companies (Vade Secure, Shift Technology), two Infrastructure & Enterprise Software companies (HR Path, Payfit), two Marketplace Lending companies (Younited Credit, Microcred Group), a Data & Analytics company (Contentsquare), a Payments & Remittances company (Wynd) an InsurTech (Alan) and a Blockchain company (Ledger).

- HR Path provides HR and payroll outsourcing solutions and raised $113m of Private Equity funding from Andera Partners in April 2019, which was the largest FinTech deal in France last quarter. HR Path now has over 1,200 customers, employs 800 people and has a turnover of over €95m.

- RegTech was one of the most represented subsector in the list with two of the top 10 transactions involving RegTech solutions providers. Vade Secure provides anti-phishing, email filtering and ransomware solutions to companies across a wide range of industries including financial services. The Cybersecurity solutions provider raised a $79.1m Series A round led by General Catalyst in June 2019. This is the largest RegTech deal in France to date, with Vade Secure planning to invest in advancing its platform’s core machine learning-based threat detection capabilities.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global