Mobile payments platform Payconiq has raised more than €20m in a funding round led by existing shareholders.

The capital has been earmarked for pursuing new developments on its platform, enhancing the integration with banks and merchants, and cement Payconiq in the Benelux region.

Luxembourg-based Payconiq offers an open-API mobile payments system which lets consumers pay their friends, invoices, and complete payments at stores through their mobile phone. Its services are used by over 60,000 merchants across Belgium, Luxembourg, and the Netherlands.

Current participating banks include asn bank, Belfius, ING, KBC, Rabobank, Regio Bank, and SNS.

Payconiq CEO Duke Prins said, “At Payconiq, we believe that every person owning a bank account and a smartphone is entitled to be part of the digital journey – no need of a credit card for that!

“We wanted to keep it simple and safe and we found a way of doing it while using what is already available. We’re actually using banks’ secure infrastructure to provide everyone in Europe with a simple, mobile solution for payments.”

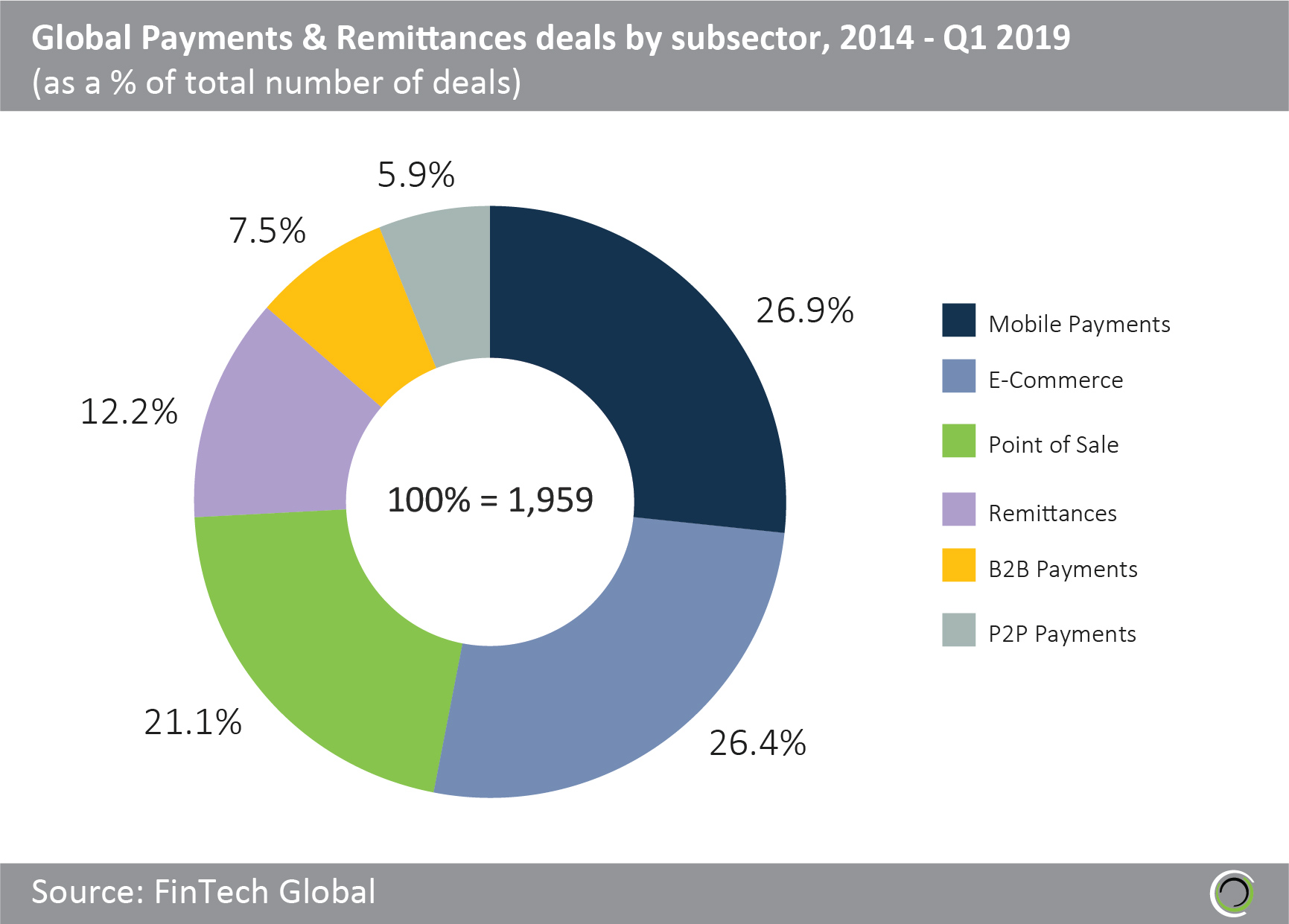

The payments and remittance FinTech sector has received a lot of traction over the years. A colossal $19.6bn was deployed into the space in 2018 alone, FinTech Global data shows. Since 2014, there have been over 1,900 transactions in the payments space, of which mobile payments has received 26.9 per cent of these – representing the largest share in the sector.

Copyright © 2019 FinTech Global

Copyright © 2019 FinTech Global