The San Francisco and Lagos-based FinTech startup Flutterwave aims to leverage a new partnership with e-commerce giant Alibaba to take a slice of the China-Africa trade. This trade is estimated to be worth $200bn.

Founded in 2016, Flutterwave is a B2B company enabling payments between businesses whether they are Africa-based or on another continent. Having joined forces with Alibaba, this service can now be extended to offer digital payments between Alipay, Alibaba’s digital wallet and payments platform, and digital payments between Alipay and African merchants.

“There’s a lot of trade between Africa and China and this integration makes it easier for African merchants to accept Chinese customer payments,” Olugbenga Agboola, CEO of Flutterwave, told TechCrunch.

As part of the deal, Flutterwave will reportedly earn money by charging its standard 2.8 per cent on international transactions.

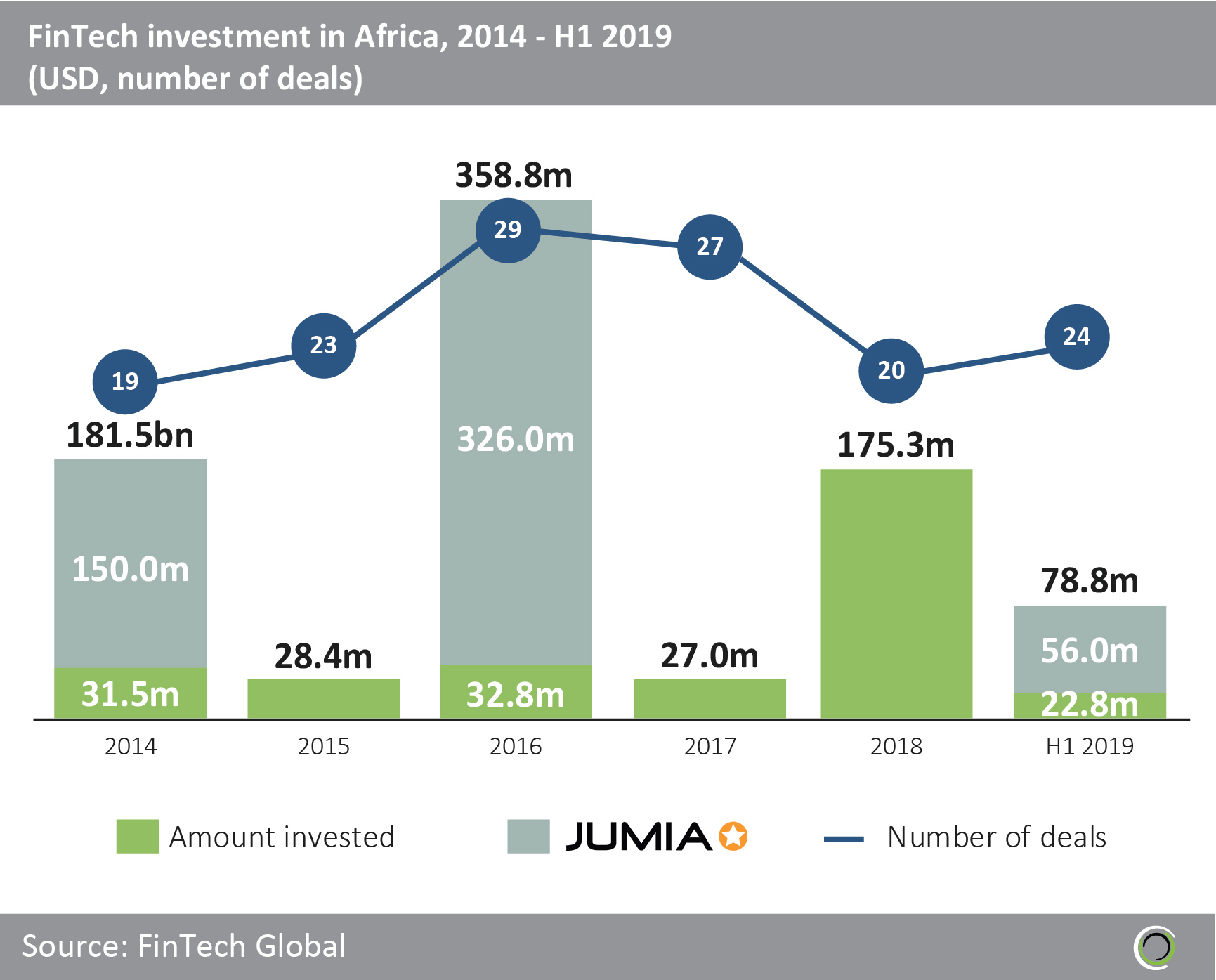

Flutterwave isn’t the only African FinTech success story. FinTech Global’s own research showed that the continent is drawing in investments to its FinTech startups. In the first six months of 2019 alone, the continent saw the closure of the 24 deals worth $78.8m. That’s already more deals than the 20 African ones signed in the full year of 2018. Although, those 20 deals were worth $175.3m in total.

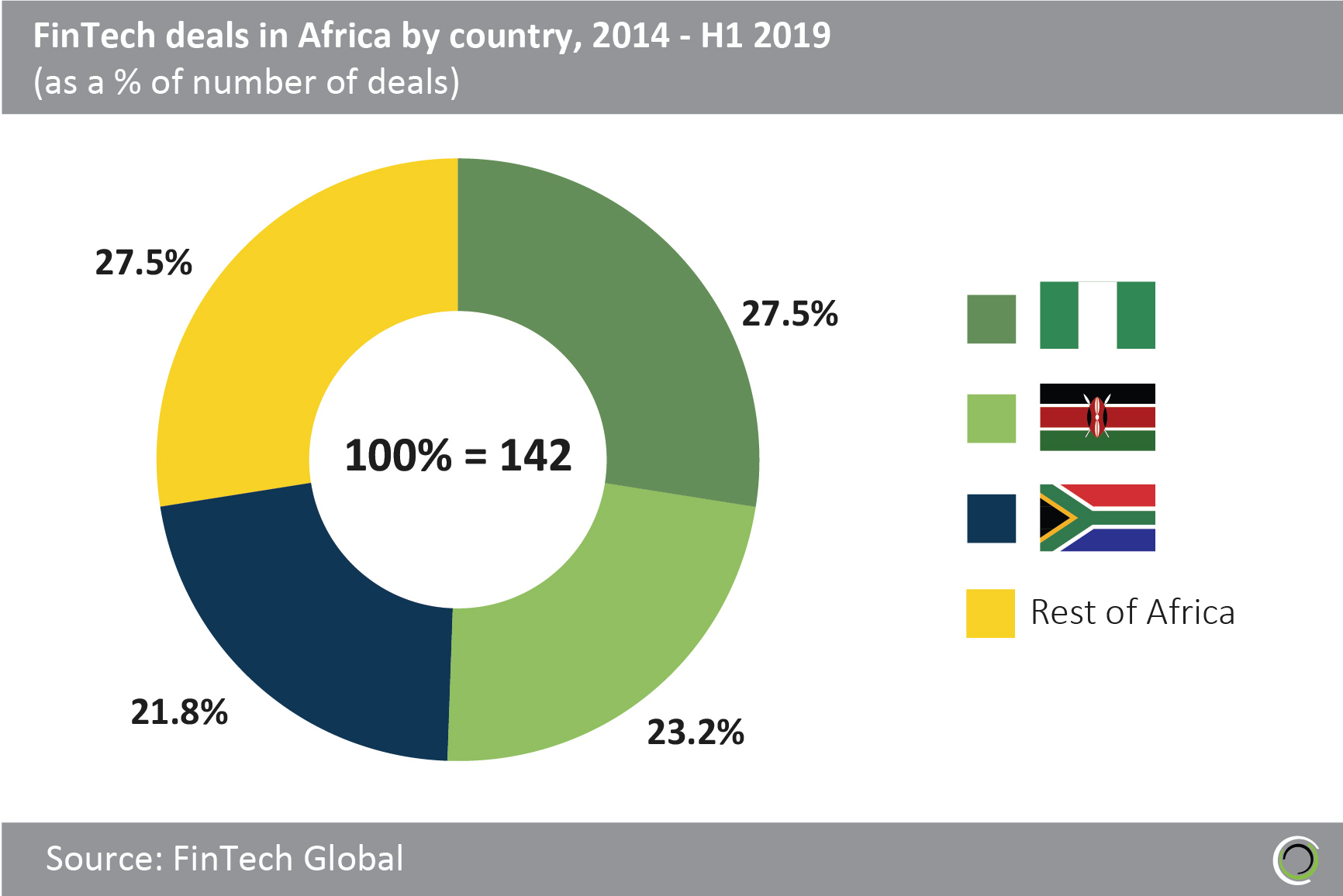

Moreover, Flutterwave’s native Nigeria has led the investment league together with 27.5 per cent of the investments between 2014 and the first six months of 2019 going into the country. Nigeria together with Kenya and South Africa dominated the funding league, having captured almost three quarters of all deals during the period.

In other related news, Africell, the telecom company, announced in the end of July 2019 that it was going to spend part of a $100m loan from the US government on beefing up its infrastructure and its FinTech capabilities.

Copyright © 2019 FinTech Global