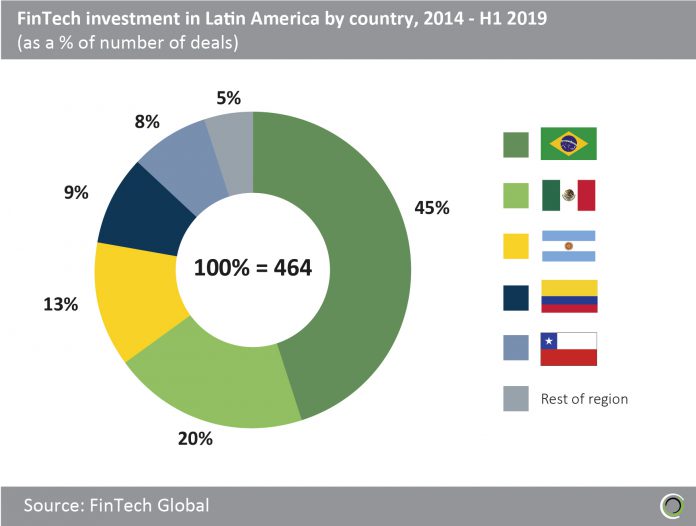

Nearly half of all deals closed since 2014 have been in Brazil

- There have been 464 FinTech deals completed in Latin America since 2014, with companies in Brazil accounting for 46% of these transactions.

- Brazil, Mexico and Argentina are dominant, having captured 80% of deal activity in the region in the past five years.

- This is to be expected considering Brazil’s large unbanked population. According to research from The World Bank just under one third of Brazil’s population is unbanked, citing reasons such as accounts being too expensive and large distances from financial institutions as to why they remain this way. This leaves a gap in the market for FinTech companies to target these consumers, hence large FinTech investment in the region.

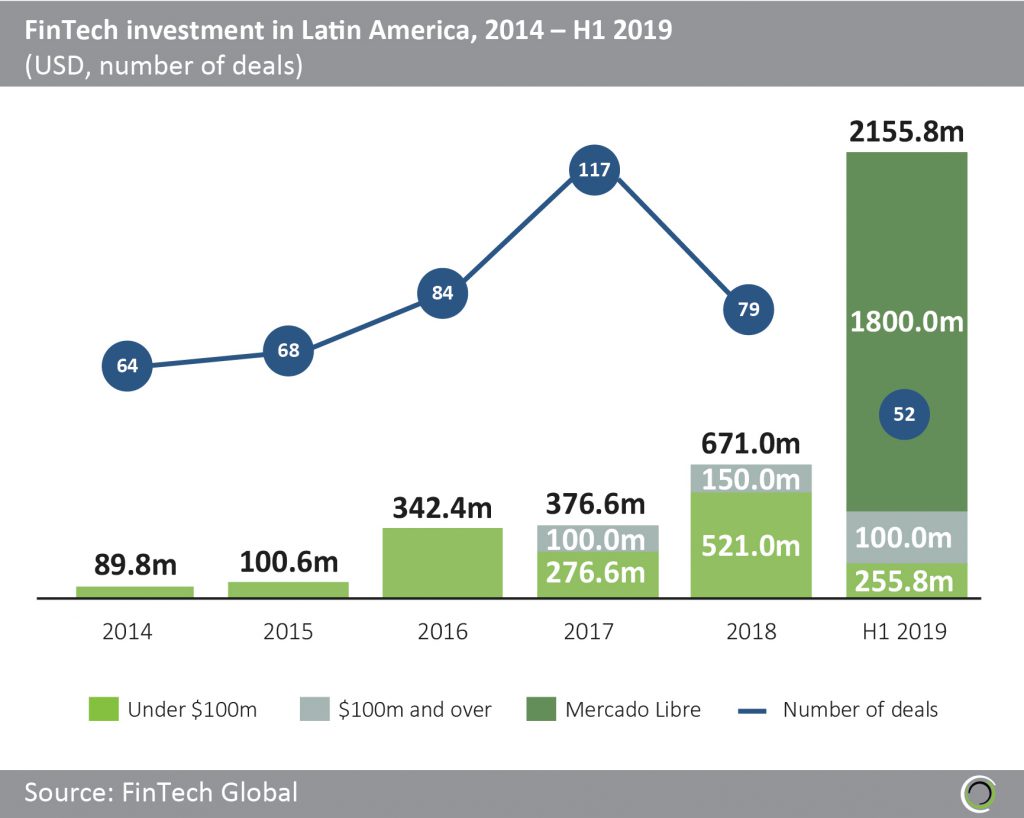

Total value invested in FinTech companies in Latin America has already reached over three times 2018’s level in the first half of the year

- FinTech companies in Latin America raised over $3.7bn across 464 deals between 2014 and H1 2019.

- Investment increased at a CAGR of 65.3% between 2014 and 2018, reaching over $670m last year, with $2.2bn raised across 52 deals in the first half of 2019.

- Funding in Latin America was already more than three times higher in the first half of the year compared to last year’s total investment, with two transactions valued above $100m and only one in 2018, setting strong expectations for the rest of 2019.

- Of the $3.7bn raised since 2014, $1.8bn was raised in a post-IPO equity round from MercadoLibre. This round alone makes up 48% of capital raised in Latin America in the past five years. This funding was led by PayPal, who are looking to use Mercado Libre to diversify their client base.

- When excluding MercadoLibre’s post-IPO equity round, total investment has decreased by 14.7% compared to the same period last year, however deal activity still outperforms H1 2018 by 18.6%.

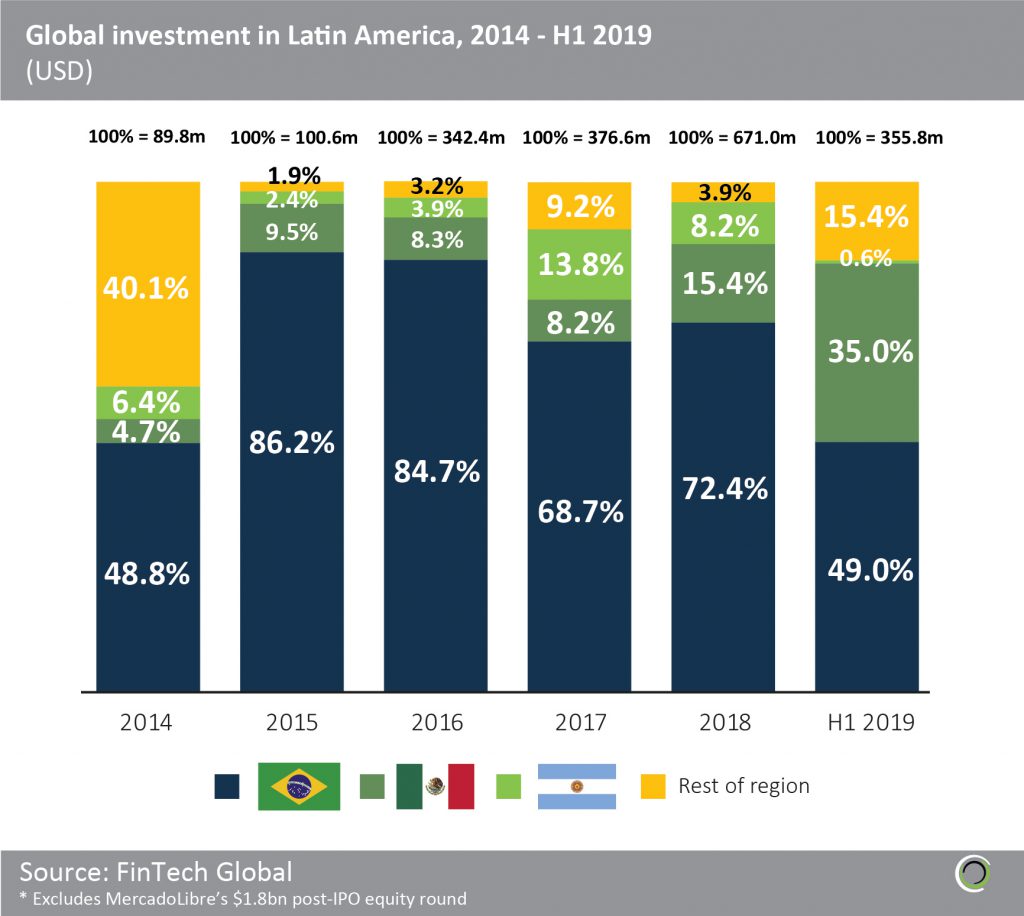

FinTech investment in Brazil drives growth in Latin America over the last five years

- Investment in Brazilian FinTech companies made up on average 69% of total investment in the region between 2014 and H1 2019. The decision was taken to not include the Q1 2019 $1.8bn post-IPO equity round from MercadoLibre in the calculation of this figure as it is a one-off massive transaction compared to historical average deal size.

- Between 2015 and 2018 Brazil accounted for an average of 79% of total investment in the region. However, in H1 2019 the share dropped back to 2014’s level of 49%. Although still accounting for nearly half of all investment in Latin America, this shows that other countries in the region are now on investors’ radar due to the growing confidence in the FinTech sector in Latin America.

- The significant growth in the Latin American FinTech space can be explained by FinTech companies’ response to the financial exclusion of poorer sectors of society, with 45% of Latin American adults unable to open a bank account according to research from the World Bank. Coupled with the rapid growth of mobile devices in the region, more and more people are skipping traditional banking systems and accessing financial services on their mobile instead.

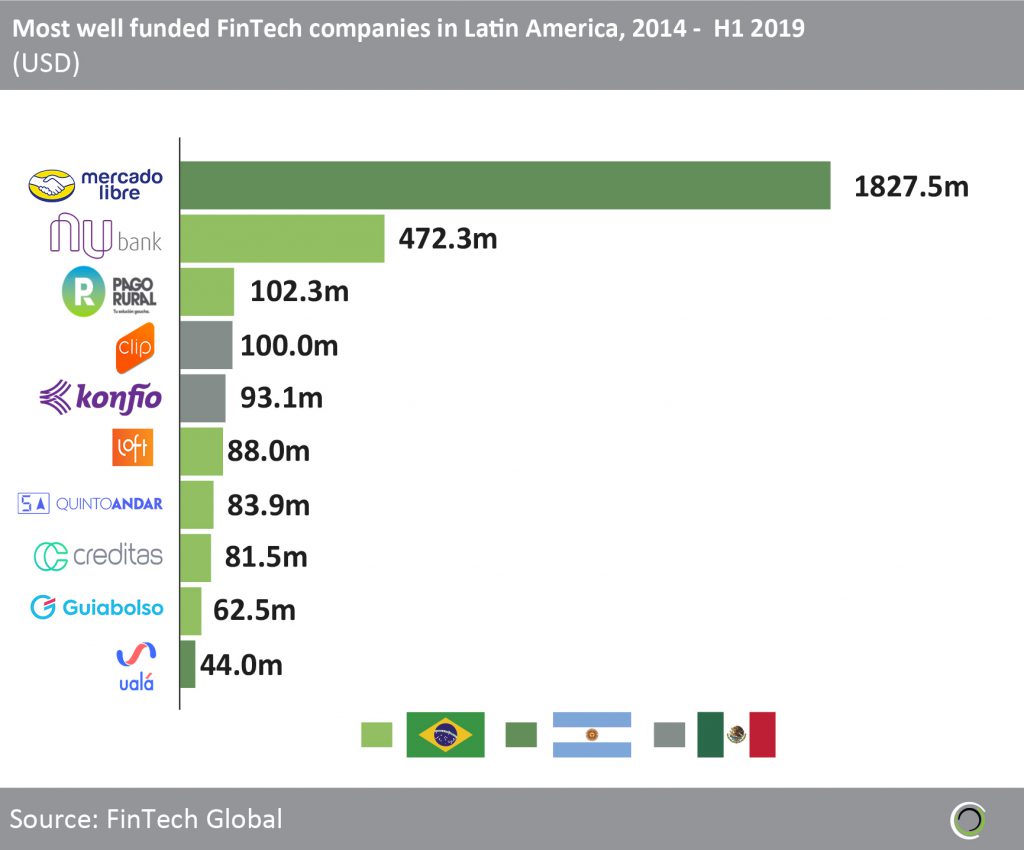

Six of the ten most well-funded FinTech companies in Latin America are based in Brazil

- The 10 most well-funded FinTech companies in Latin America have raised nearly $3.0bn since 2014, 79.3% of the total capital raised in the region since 2014.

- Brazilian FinTech companies make up over half of the most well-funded FinTech companies in the region, accounting for $890.4m, highlighting Brazil’s dominance in the sector.

- The most well-funded FinTech company in the region, MercadoLibre, has raised over $1.8bn over two funding rounds since 2014, including the $1.8bn post-IPO equity round, which was the largest funding round in the region to date. The Argentina-based e-commerce platform plans to use the funding to improve its infrastructure and invest in financial technologies.

- The second most well-funded FinTech in Latin America is Brazil-based Nubank who have raised $472.3m over 7 funding rounds since 2014. In Q4 2018 Tencent Holdings, a Chinese internet giant, invested $180m in a Secondary Market round, bringing the value of the company to $4bn. The partnership with Tencent Holdings will enable Nubank to apply strategies learned from the Chinese financial market, which is at the forefront of financial services globally due to its use of technology, back to the Brazilian market. Tencent also participated in Nubank’s recent $400m Series F round in July 2019, which pushed the company’s valuation to $10bn.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global