There were almost 300 InsurTech deals completed in Europe between 2014 and H1 2019, with more than $2.6bn raised across these transactions.

Investors such as Finch Capital see the real momentum in the InsurTech space in Europe coming from company that enable incumbents to transform rather than those startups that are a ‘disruptive’ force.

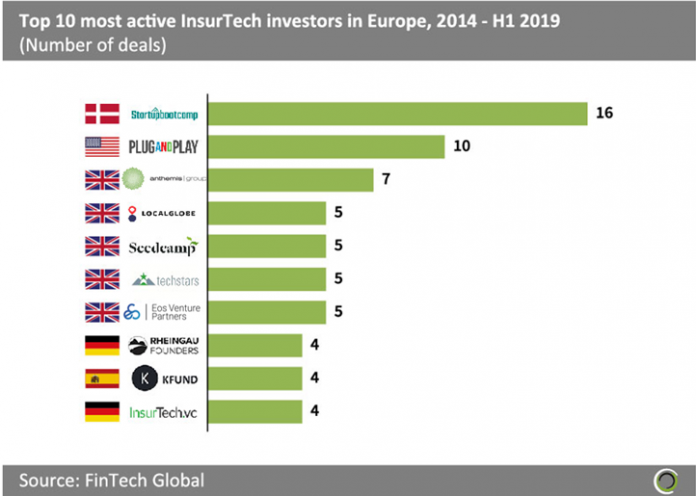

The ten most active investors in Europe are made up solely of accelerators (Startupbootcamp, Plaug and Play, Seedcamp, Techstars) and venture capital firms (Anthemis Group, LocalGlobe, Eos Venture Partners, Rheinagau Founders, K Fund, InsurTech.VC).

Startupbootcamp has been the most active investor in the InsurTech space in Europe, completed 16 deals between 2014 and H1 2019. The accelerator runs Startupbootcamp InsurTech to foster innovation in the InsurTech space and counts large insurance companies such as Lloyds, Munich Re, Swiss Re, Zurich and XL Catlin as partners.

Anthemis Group is a FinTech investor based in London and has been the most active venture capital firm investing in InsurTech in Europe. The firm’s largest InsurTech deal in Europe was a $22.3m Series A investment in omni:us, an AI-driven end to end claims management provider based in Berlin, in Q4 2018. This funding was led by Target Global, MMC Ventures, and Talis Capital, and omni:us counts several large insurance companies such as Allianz as clients.

![Flutterwave teams up with Acquired.com to streamline outward remittances in EU and UK Temenos (SIX: TEMN) today announced that National Bank of Iraq (NBI), part of the Capital Bank Group, has successfully gone live with Temenos core banking and payments. NBI, which has 27 branches across Iraq, offers a comprehensive range of services to individuals and businesses in the country. Since 2005, NBI has been majority owned by Capital Bank, one of the top financial institutions operating in the Jordanian and regional markets, with assets of approximately JOD 7.6 billion[1]. With this implementation, NBI moved from its legacy systems onto the same core banking platform as other entities in the Capital Bank Group. This will enable NBI to operate more efficiently and integrate seamlessly with other systems to develop new products faster and deliver an improved customer experience. Capital Bank Group is a long-standing Temenos customer with other entities in the Group including Capital Bank of Jordan, Bank Audi, Société Générale Bank Jordan and NBI Saudi Arabia, already on the Temenos platform. NBI also becomes the first part of the group to adopt Temenos Payments, which enabled the bank to process more than 100,000 transactions of incoming and outgoing domestic and international payments in the first 15 days of operation, with a 99% straight-through processing rate. The migration to the Temenos platform for core banking and payments at NBI was completed in under 12 months thanks to Temenos’ pre-configured banking and payments capabilities and APIs which reduced the need for complex customizations, as well as close collaboration between Temenos, NBI, Capital Bank and delivery partner ITSS. This success was recently recognized in the IBS Intelligence Innovation Awards, with Capital Bank winning ‘Best Implementation of Core Banking Services'. The implementation at NBI follows several other successful transformation projects with Temenos for Capital Bank in the last few years, including the launch of NBI’s branch operations in Saudi Arabia in just 45 days, as well as the integration of Bank Audi and the former Jordanian operations of Société Générale, each of which was achieved in under four months. Collectively, these projects helped Capital Bank to increase operational efficiency by more than 50% within three years, bringing significant cost savings and an improved customer experience. With faster, more accurate processing and immediate service requests, the bank has maintained high customer retention rates and a reputation for service excellence. Izzidin Abusalameh, Chief Operations Officer, Capital Bank Group, commented: “This achievement marks a significant milestone in our digital transformation journey and positions us as a leading player in the banking industry. We have seamlessly transitioned the National Bank of Iraq to a cutting-edge core banking system which will not only enhance operational efficiency but also support providing our customers with a superior digital banking experience. Our continued partnership with Temenos has not only provided us with an advanced technological platform but has also facilitated a culture of flexibility and adaptability, enabling us to execute our ambitious growth plans.” Lee Allcorn, Managing Director, Middle East & Africa, Temenos, said: “Congratulations to National Bank of Iraq and the Capital Bank team on this successful implementation that gives NBI business agility and the same modern technology platform and ability to deploy fast with pre-configured banking capabilities as the rest of the group. With Temenos, Capital Bank Group is future-ready, and we are proud to support them as they continue to innovate and leverage our platform to grow sustainably and enhance the banking experience for customers.”](https://fintech.global/wp-content/uploads/2024/04/rupixen-Q59HmzK38eQ-unsplash-2-100x70.jpg)