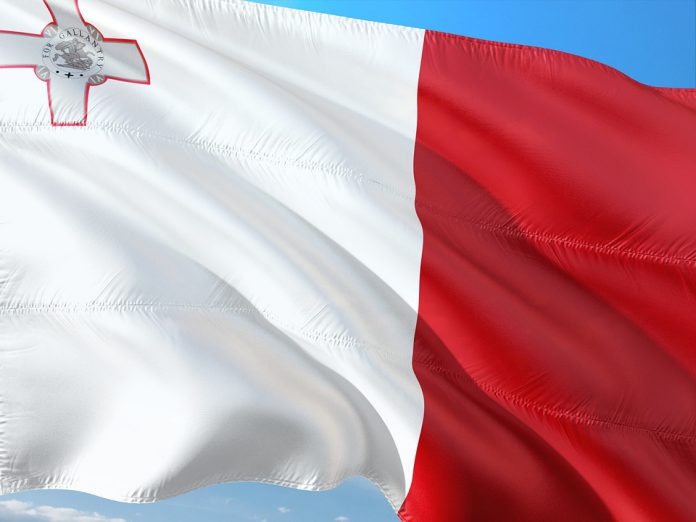

The Malta Financial Services Authority (MFSA) has published its three-year strategic plan, highlighting priority on financial innovation and technology.

Its new strategic plan has been created in the context of challenges faced by the local and international financial markets, such as labour supply and emerging risks from financial innovation and financial technology. Additionally, the plan provides “due consideration to international regulatory developments and instances of misconduct on both a local and global level, which may have negatively impacted the trust in the financial services market worldwide.”

The strategic plan came after a consultation process with licence holders, where they were given the opportunity to rate the performance of the regulator and provide feedback on challenges and strategic areas which need to be addressed.

Alongside the strategic plan, the authority is developing a new five-year business plan which aims to reform the financing model of the MFSA. Changes will include the introduction of new ancillary fees to cover services currently offered free of charge, as well as a revision in authorisation and supervisory fees.

This new model should ensure the regulator is self-funded by 2024.

Some of the other plans include the strengthening the governance and culture within the financial services market, cement its commitment to preventing, detecting, and addressing money laundering and financing of terrorism, and the safeguarding of the local financial market.

The regulator also aims to embrace the opportunities given by technology within the financial space.

MFSA CEO Joseph Cuschieri said, “Our Strategic Plan is focused on strengthening the MFSA and preparing it for the next generation of financial services. This roadmap defines the specific programmes and actions we will be taking to achieve this objective, with substantial investment in our human resources, capacity building and investment in cutting-edge technologies. This reflects our commitment to provide a more agile, safe, dynamic and efficient environment to the benefit of consumers and regulated firms.”

Copyright © 2019 FinTech Global