The UK has seen the fastest growth rate of challenger banks across Europe, given that Britain is not as saturated with banks like countries such as Germany, and UK consumers have also been early adopter of digital banking, dating back to the dotcom era of the late 1990s.

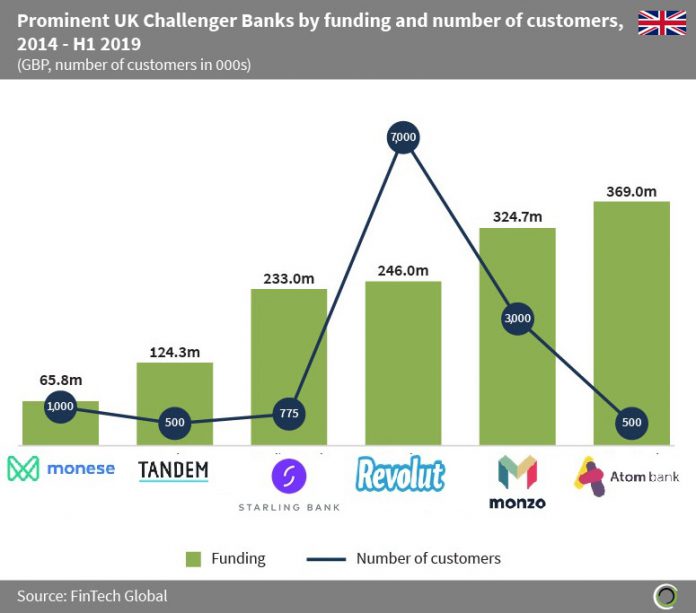

Atom Bank is one of the most well-funded challenger banks in the UK, having raised £369m between 2014 and H1 2019. Atom Bank offers both personal and businesses accounts, has 500,000 customers and is backed by investors such as BBVA and Anthemis Group.

Revolut provides global fee free spending and money transfers at the interbank FX rate. The digital bank has accumulated more customers than any other challenger bank in the UK, seven million and counting, which in part has propelled its valuation to $1.7bn.

The challenger Bank space in the UK has witnessed increased competition not only from incumbent banks engaging in digital transformations, but from the creation of even more neo banks and the introduction of German challenger bank N26, to the UK market this year. Consequently, Tandem Bank acquired Harrods bank in 2017 in order to obtain a banking license, and has since acquired 500,000 customers for its credit card and fixed savings account offerings. Tandem is growing, but is still significantly smaller than Monzo, which raised £324.7m between 2014 and H1 2019, and has over one million customers.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global