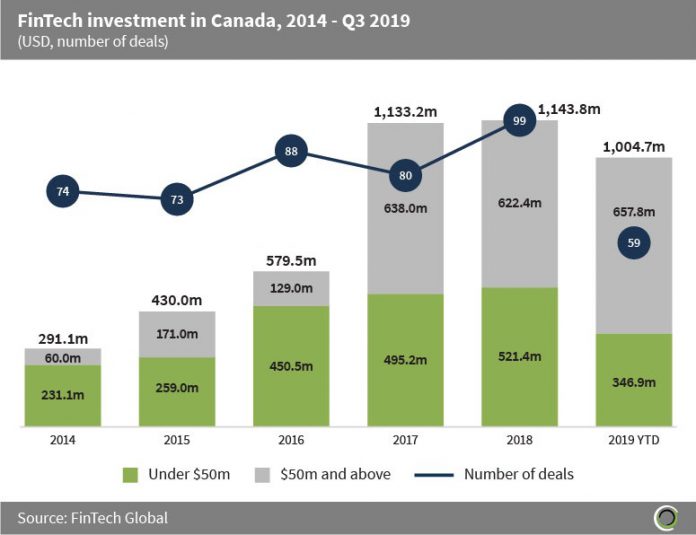

Just over $1bn has been invested in the first three quarters of the year so far

- FinTech companies in Canada have raised over $4.6bn across 474 transactions since 2014, growing at a CAGR of 31.5% between 2014 and 2018.

- Investment in the first three quarters of this year alone accounts for 87.8% of last year’s record total, setting funding on track to reach new record levels by the end of this year.

- Deal activity has experienced a drop so far this year with only 59 deals completed compared to 75 in the same period last year. Deals in the first three quarters of 2019 have been top heavy with the five deals over $50m accounting for 65.5% of total investment.

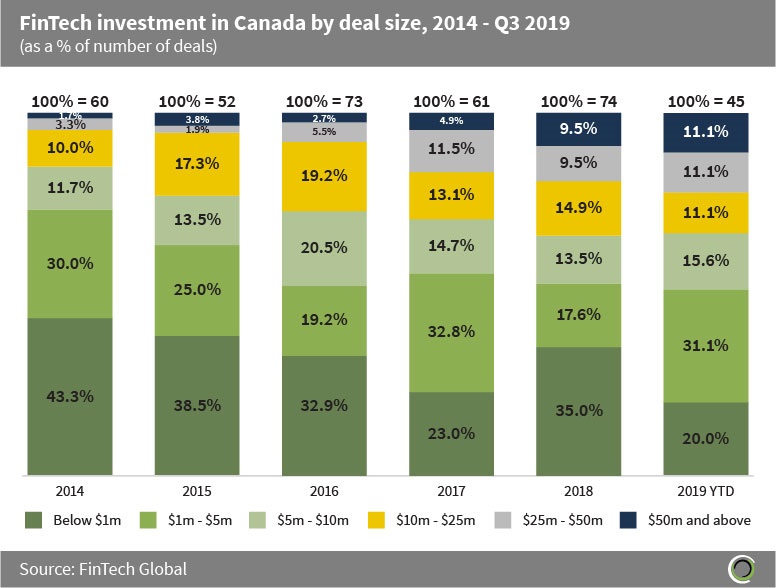

The proportion of FinTech deals valued over $50m has increased over 6.5x since 2014

- The Canadian FinTech landscape has witnessed a shift since 2014 from investors predominantly backing smaller deals, towards backing more later-stage deals.

- The proportion of deals valued below $1m has dropped by 23.3 percentage points (pp) from 43.3% in 2014 to only 20.0% in the first three quarters of 2019. Investors are willing to invest more money in the region as the FinTech landscape in Canada matures and becomes more established.

- The share of deals above $50m has increased by 9.4 pp from 1.7% in 2014 to 11.1% in 2019 so far.

- Average deal size has grown over four-fold between 2014 and the first three quarters of this year, from $3.9m to $17m, as we see annual investment in Canadian FinTech increase at a higher rate than the volume of deals.

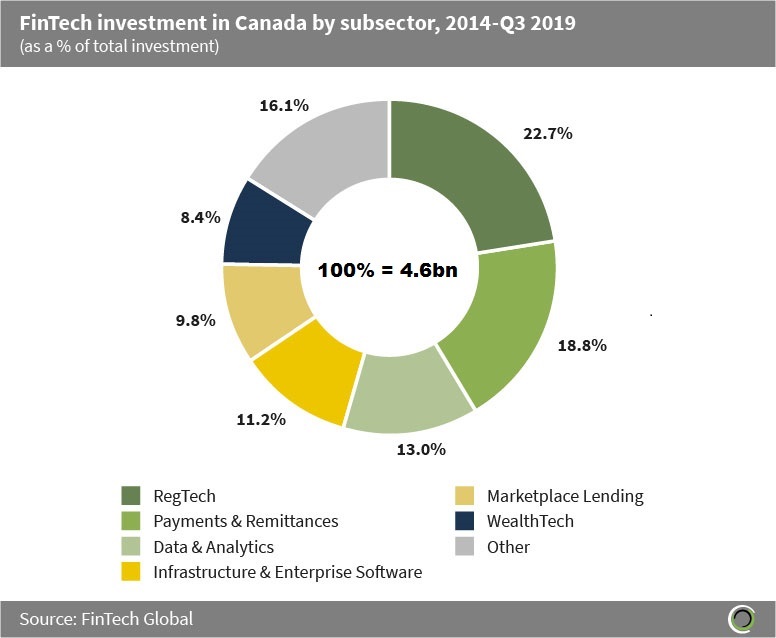

RegTech, Payments & Remittances and Data & Analytics companies account for over half of FinTech funding in Canada since 2014

- The Canadian FinTech market has experienced a concentration of investment primarily in three subsectors, with companies in the RegTech, Payments & Remittances and Data & Analytics spaces capturing over half of total investment.

- RegTech companies are responsible for 22.7% of Canada’s FinTech investment between 2014 and Q3 2019. The proportion of deals in this subsector has increased over 10-fold since 2017 with RegTech accounting for only 4.6% of deals in 2017 to accounting for 47.5% in the first three months of 2019, exemplifying the growing importance of RegTech in order to keep up with modern regulations.

- The other category includes companies in the Blockchain, Real Estate, Cryptocurrencies, InsurTech, Institutional Investments & Trading and Funding Platforms subcategories, with over 16% of investment coming from solutions in one of these six subsectors.

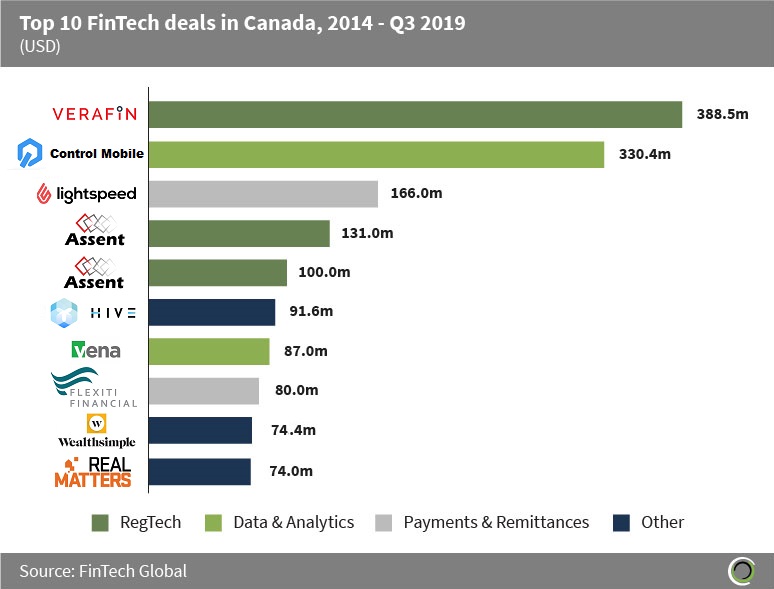

Over $1.5bn has been raised in the top 10 FinTech deals in Canada since 2014

- Over $1.5bn has been raised in Canada across the top 10 FinTech transactions in the country since 2014, accounting for 33.2% of total capital raised during the period. All the top 10 deals have occurred since 2016, with three occurring this year.

- Of the three deals occurring in 2019, only one was closed in Q3 2019, Verafin’s $388.5m private equity round, taking the top spot on the list. Verafin provides a software platform specialising in financial crime management and plan to use the funding to expand their sales and marketing initiatives into large financial institutions and accelerate the company’s product innovation roadmap.

- The largest Payments & Remittances deal of the period came from Lightspeed POS, a point of sale and e-commerce solution for retailers and restauranteurs, with their $166m Series D round led by Caisse de Depot et Placement du Quebec. The company used the funding to expand its business geographically and deeper into payments.

- Capital allocation of the top 10 transactions was widely distributed across subsectors with RegTech companies accounting for three transactions, Data & Analytics and Payments & Remittances companies accounting for two transactions each and Blockchain, Real Estate and WealthTech companies accounting for the other three transactions.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global