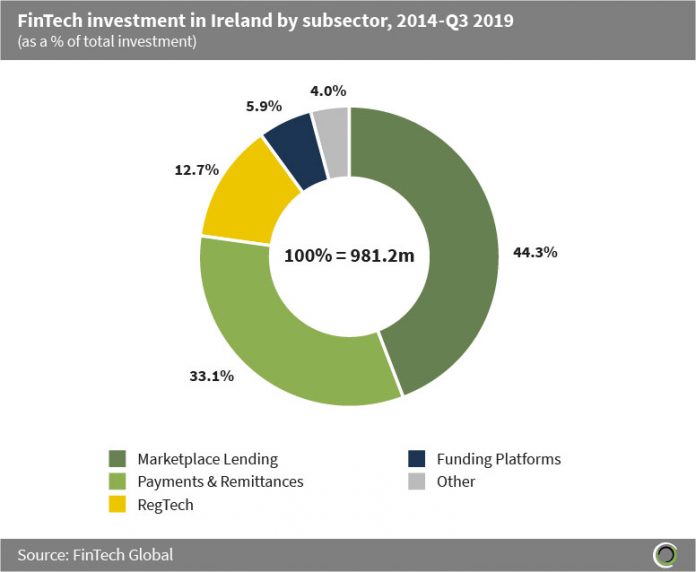

$981.2m was raised by FinTech companies in Ireland between 2014 and Q3 2019, with investors participating in 80 deals during the period.

Marketplace lending companies in the country captured 44.3% of investment between 2014 and the first nine months of this year. Marketplace lenders have experienced significant growth since the great financial crisis of 2008 as mainstream banks retreat from the space due to tighter regulations around lending standards. As some FinTech businesses such as B2B or P2P lending fall outside the regulatory ambit in Ireland, they can operate without requiring authorisation from the Central Bank of Ireland.

Payments & Remittances companies have also captured a healthy share of investment since 2014 with 33.1% of funding. The payments sector has been particularly disrupted in recent years as traditional institutions are bypassed in favour of technology-driven payments processes. The barrier to entry into the payment services market for third party providers was lowered by the Payment Services Regulations 2018, coupled with the relocation of several firms to Ireland due to Brexit uncertainty makes Irish Payments companies an attractive investment opportunity.

The other category consists of Data & Analytics, WealthTech, Infrastructure & Enterprise Software, Institutional Investments & Trading, Blockchain, InsurTech and Real Estate companies who collectively account for only 4.0% of total funding since 2014.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global