Mobile-based financial service company Paytm is reportedly close to closing a new $2bn funding round, which would value it at $16bn.

Investors to the round include Ant Financial and SoftBank Group, according to an article from Bloomberg which cites people familiar with the deal. Discovery Capital Management is another investor which is currently in talks regarding a contribution to the round.

The funds will be split equally between equity and debt and is being raised to help Paytm contend against the rising number of competitors.

While the discussions are in the final stages, the deal terms could change before it closes, the article states.

India-based Paytm is an e-commerce payment system which offers a range of financial services including payments, banking, lending and insurance products. Its solutions include QR-based payments, mobile transactions, and a digital banking app which serves more than 500 million consumers in India.

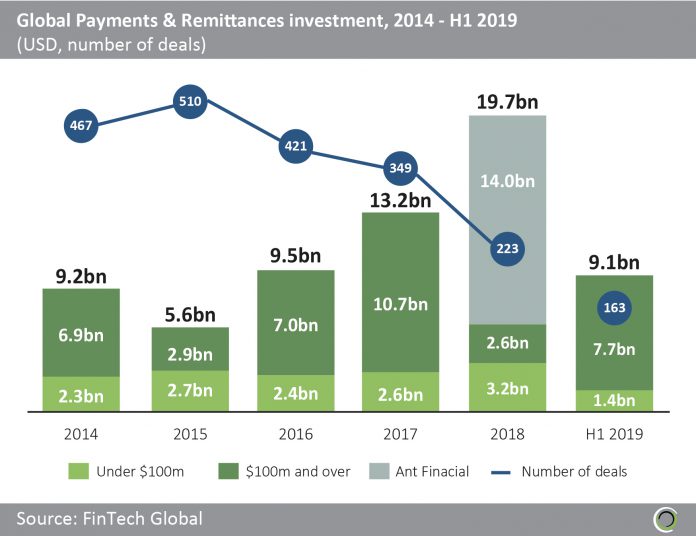

Ant Financial is a payments giant in China, which closed a colossal $14bn Series C round. The investment put its valuation up to an estimated $150bn.

The payments and remittance sector has been showed in venture capital funding, with $66bn being invested into the sector globally since 2014. Last year, a total of $19.7bn was invested into the space; however, a large portion of this came from the previously mention Ant Financial deal.

Copyright © 2019 FinTech Global

Copyright © 2019 FinTech Global