More than 200 InsurTech deals were completed globally during the first nine months of the year, with over $3.7bn raised in these transactions, making 2019 the strongest year for InsurTech funding to date.

The InsurTech ecosystem is growing and Willis Towers Watson believes that a number of InsurTechs are already adding some genuine value to the industry however, they remain pragmatic, as the explosion of new InsurTech companies may oversaturate the market.

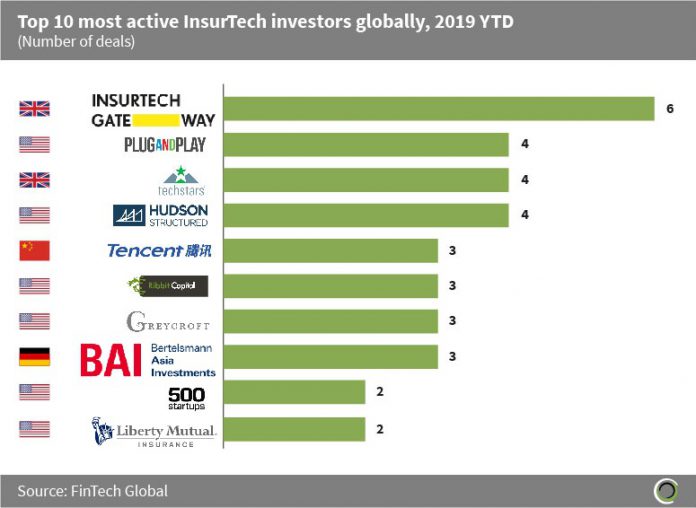

The ten most active investors globally this year are made up of accelerators (InsurTech Gateway, Plug and Play, Techstars, 500 Startups), venture capital firms (Ribbit Capital, Greycroft), corporate investors (Tencent Holdings, Bertelsmann Asia Investments, Liberty Mutual insurance) and an asset manager (Hudson Structured Capital Management).

InsurTech Gateway is a London-based incubator backed by Hambros Perks and Lumleys. The incubator has been the most active InsurTech investor globally during the first three quarter of 2019, having completed six deals so far this year. InsurTech Gateway participated in the $6.7m (£5m) Series A round that By Miles, the UK’s first real-time pay-per-mile car insurance provider, raised in Q1 2019.

Tencent Holdings, a Chinese technology conglomerate, was the joint most active corporate investor in InsurTech companies globally this year, tied with Bertelsmann Asia Investments, having completed three transactions during the first nine months of 2019. Tencent invested in $145m Series C round raised by Waterdrop, a medical insurance company based in Beijing, which is the largest InsurTech deal in Asia this year. This funding will be used to explore artificial intelligence (AI) applications in health insurance and values the company at $1bn.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global