Almost four out every five Canadian consumers use at least one FinTech payment or money transfer service, according to EY’s new report.

The professional services firm’s new Global FinTech Adoption Index 2019 report is based on over 27,000 online interviews with digitally active adults across 27 markets.

When looking at the Canadian market, the researchers found that adoption has jumped to 32% over the past two years, with 78% of Canadian consumers using at least one FinTech solution.

“FinTech adoption has evolved significantly in Canada over the past two years alongside the evolution of customer priorities and the rise of money transfers and payments,” said Ron Stokes, EY Canada FinTech Leader. “FinTechs are no longer seen as just disrupters to the traditional financial services industry – they’re sophisticated competitors, ready to meet the changing expectations and needs of customers.”

That being said, the report noted that Canadians are slower at adopting these solutions than their peers in other markets, with 50% of them being FinTech consumers, compared to 64% around the world.

Part of this seems to be that the residents of the Great White North would rather trust incumbents rather than challengers.

Still, EY notes that the one-third stated that they are ready to use the technology.

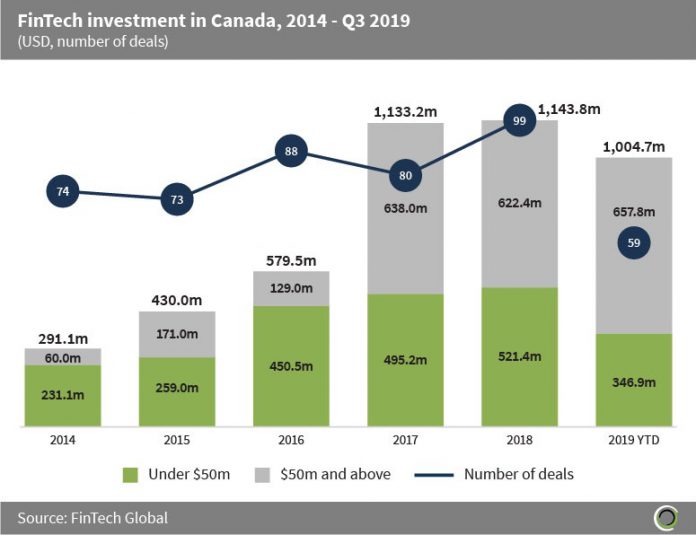

FinTech Global’s data shows that FinTech firms in Canada has raised over $4.6bn since 2014, with 2019 potentially becoming a new record year. In 2018, FinTech companies attracted $1.14bn. The Canuckian scene has already raised $1bn in the first three quarters of this year.

Copyright © 2019 FinTech Global