FinTech investors have invested over $230m into French RegTech companies across just four transactions in the first nine months of 2019

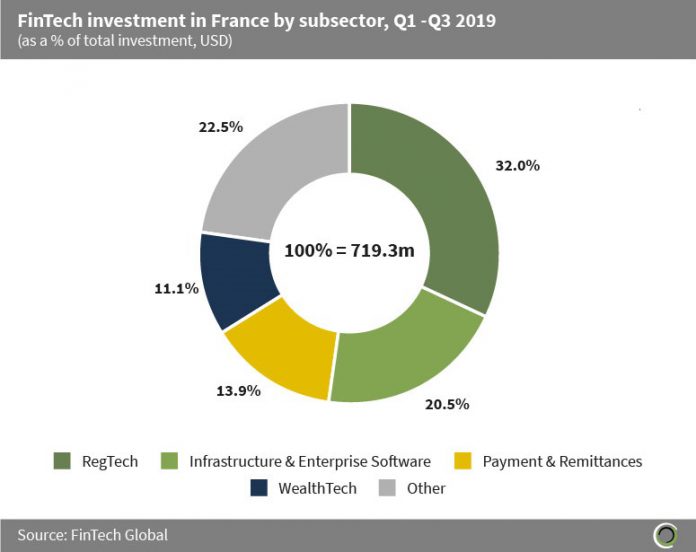

- Nearly a third of the $719.3m capital raised by French FinTech companies in 2019 has gone to companies in the RegTech space, with three RegTech transactions listed among the top 10 deals in the country this year to date.

- The largest RegTech deal in France in 2019 so far came from Vade Secure in their $79.1m Series A round, which was one of the largest RegTech deals globally in Q2 2019. The email security solution provider plans to use the funds to build its go-to-market strategy focused on servicing business customers through Managed Service Providers.

- Infrastructure & Enterprise Software companies have also captured a healthy proportion of investment, with 20.4% of funding going to this subsector. This was driven by one large deal from HR Path, the largest deal of the period, accounting for 15.7% of funding in France during the period alone.

- The other category consists of companies in the Data & Analytics, InsurTech, Cryptocurrencies, Real Estate and Blockchain subsectors, capturing 22.5% of investment in the country so far this year.

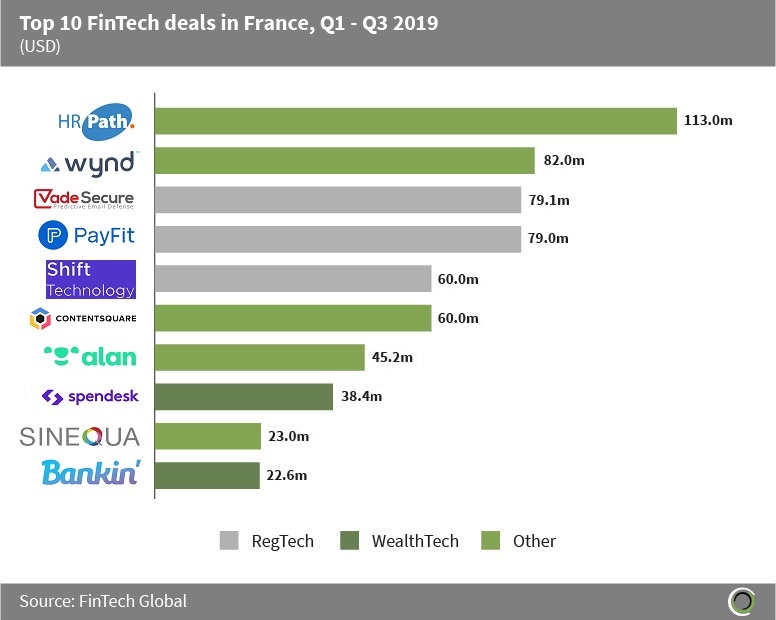

RegTech and WealthTech deals account for half of the top 10 deals in France so far this year

- Over $600m has been raised in the top 10 FinTech transactions in France in 2019 so far, accounting for 83.7% of total funding in the sector during the period.

- Of the top 10 deals, three came from RegTech companies and two came from WealthTech companies. The other deals came from Infrastructure & Enterprise Software (HR Path), Payments & Remittances (Wynd), Data & Analytics (Contentsquare), InsurTech (Alan) and Cryptocurrencies companies (Sinequa).

- The largest deal of the period came from the aforementioned HR Path, a payroll and HR outsourcing solution who raised $113m in a Private Equity round in Q2 2019. The company plans to use the capital raised to continue its international expansion by strengthening its networks in Asia, Europe and the US.

- The largest WealthTech deal of the period came from Spendesk, a payments management software designed for both finance teams and employees, which is used by 1,500 companies in Europe. The company raised $38.4m in a Series B round led by Index Ventures and will use the capital to open offices in Berlin and London, further develop new features and add more currencies to its platform.

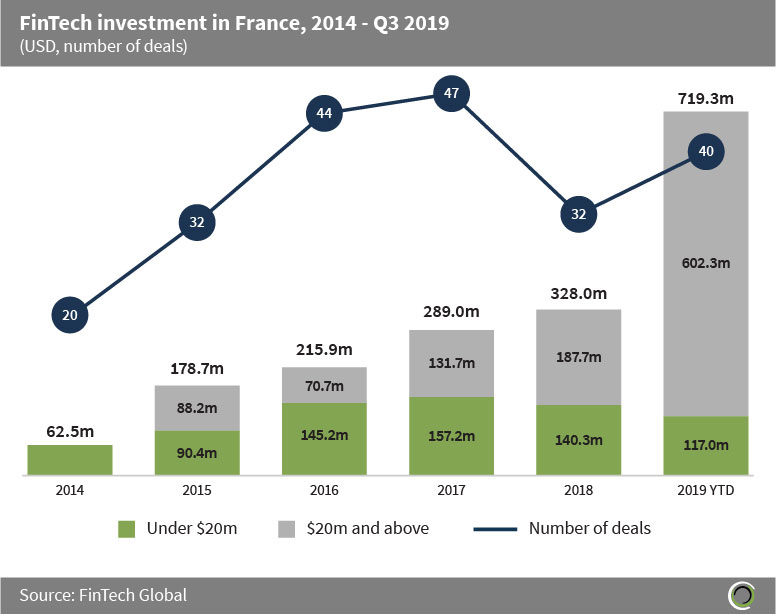

Investment in French FinTech companies in 2019 is already over two-times higher than last year’s total

- FinTech companies in France raised almost $1.8bn across 215 deals between 2014 and Q3 2019, with 40.1% of this investment being raised in the first nine months of 2019.

- Investment increased at a CAGR of 51.4% between 2014 and 2018, with average deal size increasing over three-fold during the period from $3.1m to $10.6m. The surge in large FinTech deals in 2019 pushed the average deal size to nearly $18m during the first nine months of the year.

- Funding in France so far this year is already over two times the total of last year, with 10 deals valued above $20m compared to only five deals in the same size bracket last year, setting strong expectations for the rest of the year.

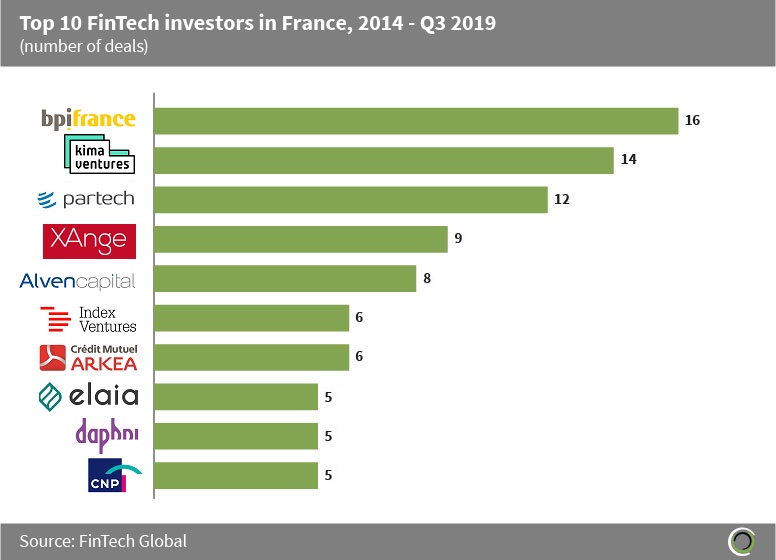

Bpifrance was the most active FinTech investor in France between 2014 and Q3 2019

- Of the 215 transactions that took place in France since 2014, the top FinTech investors in the region have been involved in 86 deals between them.

- Bpifrance has been the most active FinTech investor in France, having completed 16 deals since 2014. The investment bank’s most recent investment in France was the $7.7m venture funding raised by Checkmyguest, a rental management platform dedicated to short-term rentals.

- Kima Ventures was the most active venture capital investor in the region, having completed 14 deals since 2014. The firm’s largest investment was the $9.3m Series A round raised by Shine, an online bank providing a financial management platform for freelance workers. Kima Ventures were joined in the round by XAnge and Daphni.

- Of the top 10 investors, seven were Venture Capital firms (Kima Ventures, Partech, XAnge, Alven Capital, Index Ventures, Elaia Partners and Daphni), two were investment banks (BpiFrance and Crédit Mutuel Arkéa), and one was a corporate investor (CNP Assurances).