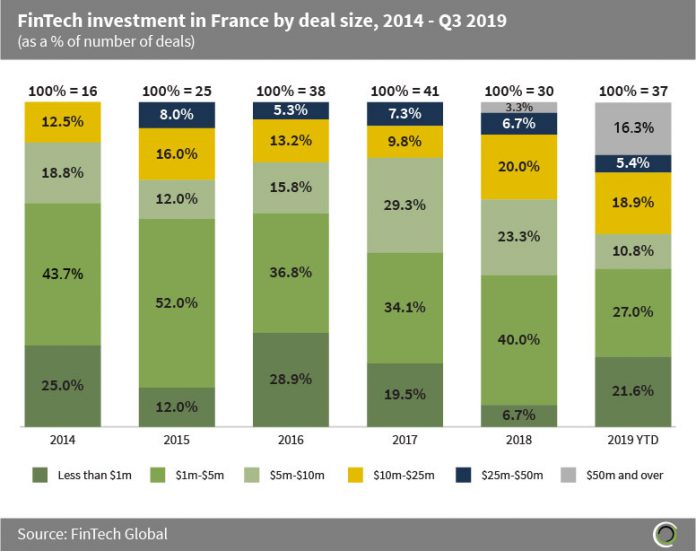

The French FinTech landscape has witnessed a shift since 2014 from investors predominantly backing smaller deals towards putting more money via later-stage funding rounds.

Back in 2014, deals valued below $10m made up 87.5% of all deals across the country, however this has dropped significantly and in the first nine months of 2019 deals in this size bracket account for only 59.4% of deals.

In 2014 all FinTech deals completed in France were valued under $25m. As the French FinTech landscape matures, investors move to back established players and their expansion plans hence in 2019 so far, 21.7% of deals completed were valued at $25m or more.

As a result, the average deal size increased nearly five-fold from $3.9m in 2014 to $19.4m in the first three quarters of this year.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global