Investors injected $24.1bn into WealthTech companies globally between 2014 and Q3 2019, with over 1,600 deals completed during the period.

The WealthTech ecosystem includes companies that provide digital transformation solutions to wealth managers, which will likely be key to success in the future, not only as an enabler of growth, but also to reduce costs and manage risks.

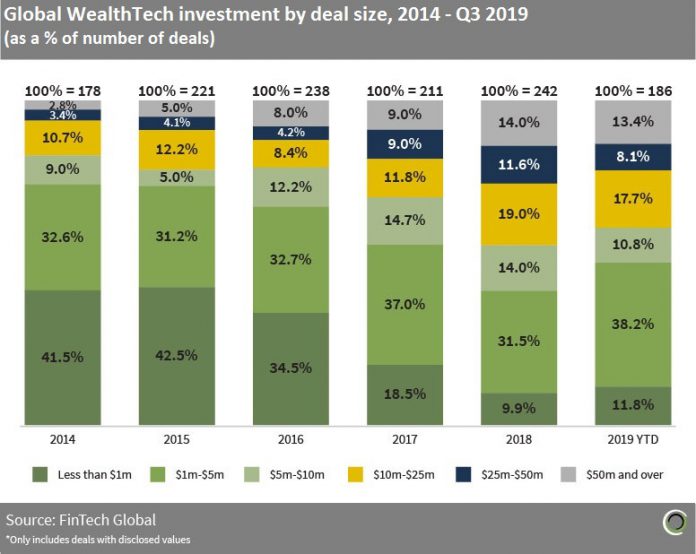

The proportion of transactions valued below $1m fell from 41.5% of deals in 2014 to 9.9% in 2018. The large capital requirements to support significant digital transformation in the space has forced investors to concentrate on later-stage transactions, which saw average deal sizes increase from $4.9m in 2014 to $28.5m last year.

The share of deals valued above $50m increased from less than 3% of deals in 2014 to more than one in eight transactions during the first nine months of 2019. OakNorth, the London-based business only Challenger Bank, raised $440m from Softbank in February 2019. This deal, which is the largest challenger bank deal this year to date, was done at a $2.4bn valuation, cementing OakNorth’s status as a leading European FinTech Unicorn.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global