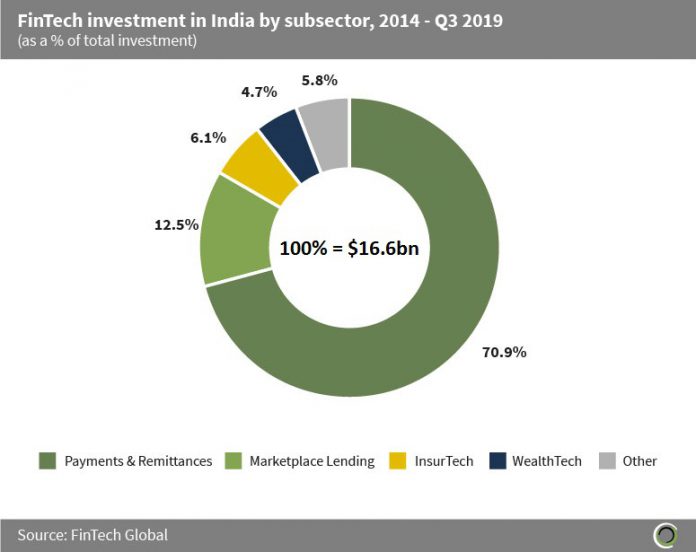

Over 70% of total investment in the country since 2014 has gone to companies in the Payments & Remittances subsector

- The FinTech landscape in India has experienced a concentration of capital investment primarily in Payments & Remittances businesses, with over 70% of capital since 2014 being raised by companies in this sector.

- It is unsurprising that the Payments & Remittances sector has attracted such a great share of investment in India considering the demonetisation efforts by the Indian government, shifting merchants away from cash, while producing growth in digital payments solutions and providing investors with an attractive investment opportunity.

- The other category consists of companies in Infrastructure & Enterprise Software, Real Estate, Institutional Investments & Trading, Data & Analytics, Funding Platforms, RegTech, Blockchain and Cryptocurrency sectors.

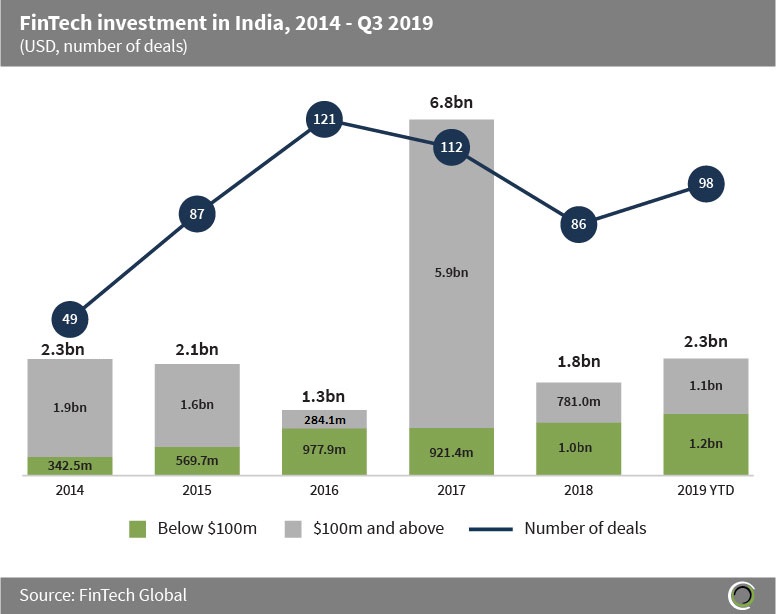

Deal activity in India on track to reach record levels by the end of 2019

- FinTech investors have poured over $16.5bn into FinTech companies in India since 2014, with 553 deals completed during the period.

- Following the late-2016 demonetisation drive from the Indian government, the FinTech sector in the country was brought into the national spotlight in 2017 with investment surging to $6.8bn. This record year was driven by large deals from Payments & Remittances company Flipkart, which raised over $4bn alone that year across five deals, three of which were valued at $1bn or over.

- Funding so far this year has reached $2.3bn, 125.3% of last year’s total. This is driven by the fact that there have been eight deals valued at $100m or above so far this year compared to only four in the same period of 2018, setting strong expectations for the remainder of 2019.

- In terms of deal activity, 2016 set a record with 121 deals completed during the year. So far in 2019, 98 transactions have been completed in India, compared to 94 deals in the first three quarters of 2016, setting strong expectations for a new record for deal activity to be set.

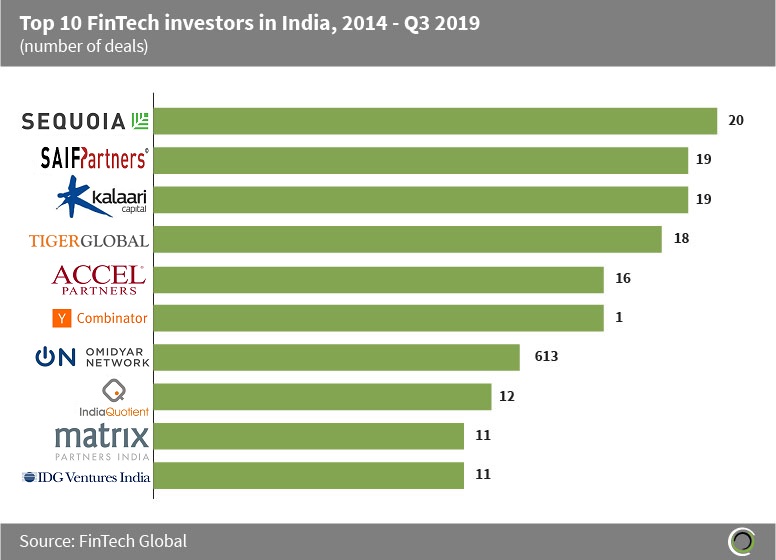

The top FinTech investor in India has participated in 20 deals since 2014

- Of the 553 transactions that took place in India between 2014 and Q3 2019, with each of the top 10 investors participating in at least 10 deals.

- Sequoia Capital have been the most active investor in the country since 2014 having completed 20 deals during the period. The venture capital firm’s most recent investment in India was the $21.4m Series B round raised by Groww, an app which aims to make investing easier for customers.

- SAIF Partners was the most active private equity investor in India, having participated in 19 deals in the country since 2014. The firm’s largest investment was the $50m Series B round raised by ClearTax, a platform to help businesses with tax, compliance and mutual fund investment. The firm were joined on the round by Sequoia Capital, Naval Ravikant and Composite Capital Management.

- Of the top 10 investors five were venture capital firms (Matrix Partners India, India Quotient, Accel Partners, Kalaari Capital and Sequoia Capital), two were private equity firms (IDG Ventures India and SAIF Partners), and one of each were family investment offices, accelerators and hedge funds respectively (Omidyar Network, Y Combinator and Tiger Global Management).

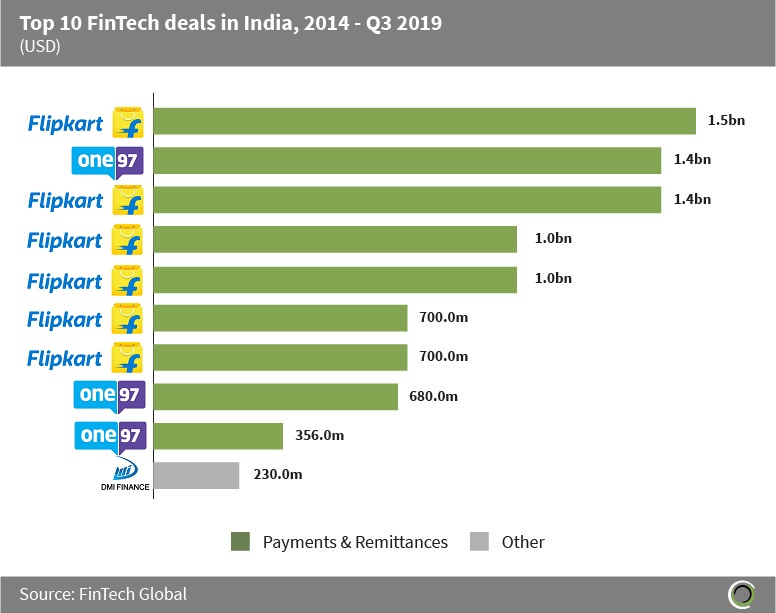

Payments & Remittances companies account for nine of the top 10 FinTech deals in India since 2014

- Almost $9bn has been raised in the 10 largest FinTech deals in India since 2014, accounting for 54.1% of total capital raised across the region during the period. Of the top 10 deals, nine were raised by companies in the Payments & Remittances sector.

- Flipkart is responsible for six of the top 10 deals raised in India since 2014, with one being the largest deal of the period – the $1.5bn private equity round in Q3 2017 led by SoftBank. Flipkart is an online shopping platform selling over 80 million products across 80 categories, according to their website. The company was the first Indian app to cross 50m users.

- One97, a mobile communications platform which owns mobile payments provider Paytm, also raised multiple deals to make the top 10, taking three spots on the list. The largest deal they raised was a $1.4bn round led by SoftBank in Q2 2017.

- Only one deal from 2019 made the top 10 list, and this deal took the bottom spot. It came from DMI Finance with their $230m funding round in Q1 2019. DMI Finance provides both consumer and home loans as well as offering asset management services.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global