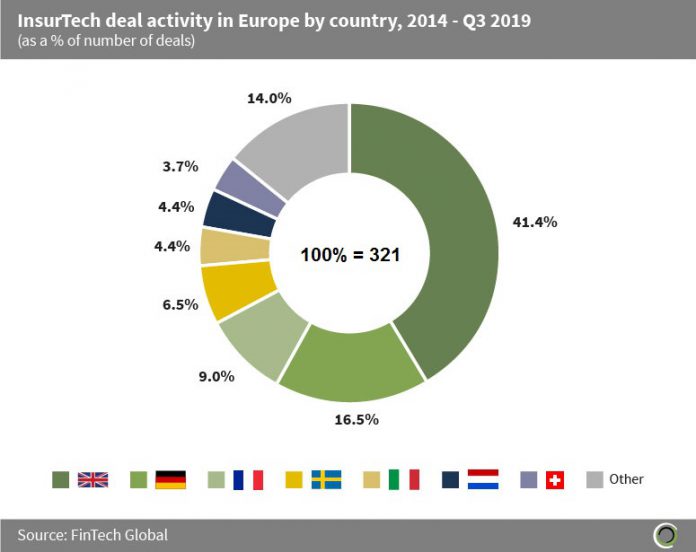

Companies based in the UK captured 41.4% of total InsurTech deal activity in Europe between 2014 and Q3 2019. Unsurprisingly, companies in London have been the driving force for this investment with 86.5% of InsurTech deals in the UK since 2014 being raised by companies based in the capital.

Germany also captured a healthy share of InsurTech deal activity during the period with 16.5% of deals transactions raised by companies based in the country. The German insurance space has traditionally been known for its caution rather than its innovation, according to EY, however the response to the global digital revolution has resulted in changing customer behaviour, prompting insurance companies to invest more heavily in their technological innovation.

The InsurTech sector across the world is growing as investors respond to a global appetite for digital transformation. Europe offers a large market of more than 700 million people, with areas of homogenous regulation, making scaling across Europe from a regulatory perspective easier than in the US, where regulation differs from state to state, and therefore an attractive market to investors.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global