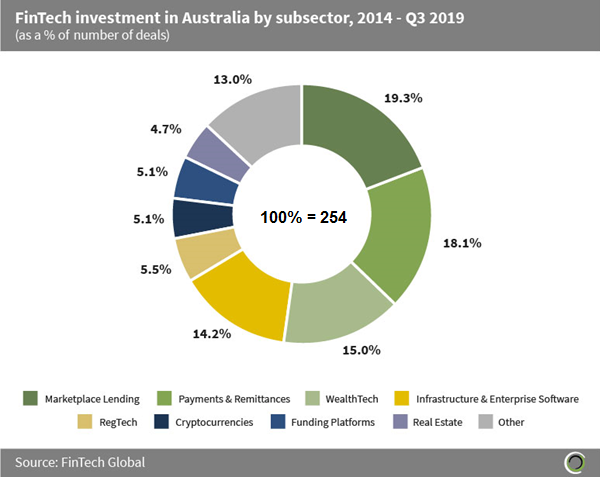

FinTech deal activity in Australia since 2014 has been widely distributed among all subsectors. Australia is placed to become a global FinTech hub, with the government looking to support the development of the ecosystem with funds set aside to help Australian consumers access their own data, build up the country’s AI and machine learning capabilities and initiatives such as the open banking regime giving consumers the power to give third-parties access to their banking data.

Marketplace Lenders attracted the largest share of deals in the country since 2014. The financial crash of 2008 caused consumers to lose trust in mainstream banks, hence Marketplace Lenders look to capitalise on this, disrupting the market with their lower interest rate solutions to lending. Marketplace Lending subsectors such as P2P are well established in the US and the UK, but are still in their infancy in Australia, hence offering an attractive investment opportunity for investors in the country.

The Payments & Remittances subsector in Australia has also attracted a healthy amount of deal activity between 2014 and Q3 2019, with 18.1% of deals being raised by companies in this sector. The prominence of the Payments & Remittances sector can be put down to the move towards a cashless society, which has been seen globally but is particularly strong in Asia and the Oceanic regions. Therefore, Australia has experienced an increase in FinTech deals involving companies specialising in digital payments.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global