Thailand’s next FinTech unicorn could be spun out of Siam Commercial Bank.

The bank has announced plans to spin several of its FinTech divisions into independent businesses in a push to monetize its push into technology investment at a time of slow earnings from traditional lending, according to Bangkok Post.

Orapong Thien-Ngern, co-president at Siam Commercial Bank, believed one of these enterprises could reach a valuation of $1bn.

“We will spin off some of them to allow them more freedom and independence, including raising their own funds from other investors,” Orapong told Bangkok Post.

The co-president did not specify which divisions would be spun out.

“Thai banking like most other countries is a sunsetting industry, as existing lenders and new players are competing for limited pools of customers,” said Orapong. “Venture capital and technology investments will be the key survival strategies for SCB in attracting new customers and boosting earnings.”

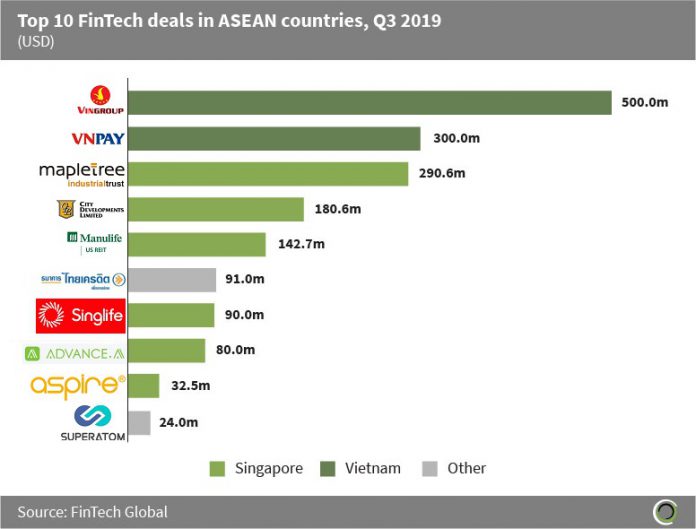

While FinTech investment levels in Thailand is dwarfed by those in other countries in the region, it did account for one of the ten biggest deals in the ASEAN region in the third quarter of 2019, according to FinTech Global’s data.

Singapore had six of the top ten deals, Vietnam two and Indonesia had the remaining one.

In August 2019, Siam Commercial Bank was one of the investors behind Pagaya’s, an asset management support solution powered by machine learning, $14m Series B round.

In the same month, the bank’s venture arm also supported Nyca Partners’ $129m Nyca Investment Fund III.

Copyright © 2019 FinTech Global