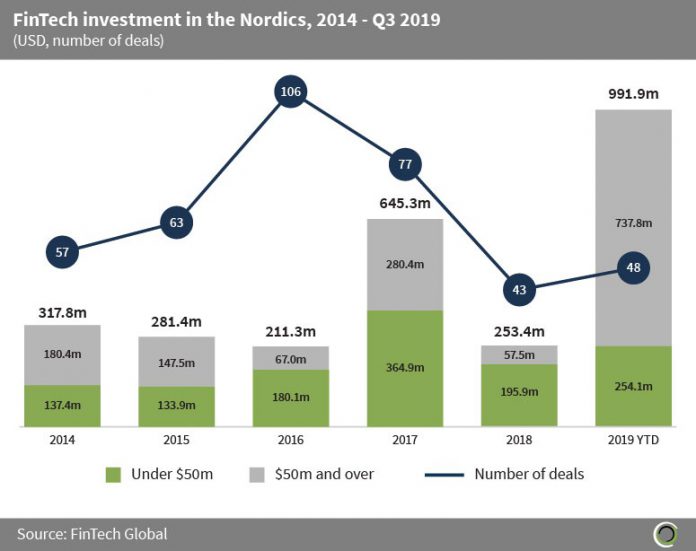

Investment in the first three quarters of 2019 has reached over $990m

- FinTech companies in the Nordics raised over $2.7bn across 394 deals between 2014 and Q3 2019, with 36.2% of this investment being raised in 2019 alone.

- Investment increased at a CAGR of 46.1% between 2014 and 2017, to a record of $645.3m. Investment then dropped in 2018, however it has rebounded this year reaching a new record of $991.9m as of Q3 2019.

- Average deal size has increased over four-fold from just $5.6m in 2014 to $20.7m in the first three quarters of this year, as investors back already established firms with more capital to expand.

- Deal activity nearly doubled between 2014 and 2016, however there has since been a drop in the number of FinTech deals completed. This happens as the FinTech landscape in the region matures and investors look to back larger later-stage deals rather than lots of smaller deals.

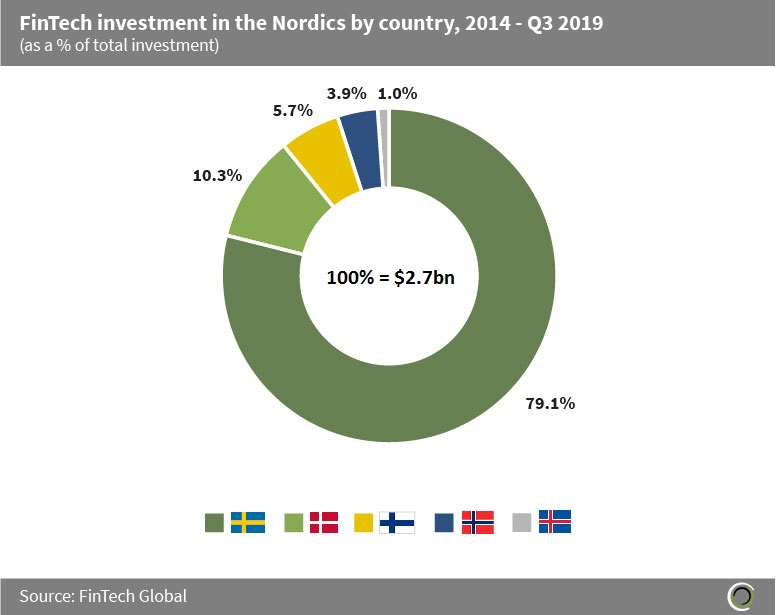

Sweden has captured the most FinTech investment of all Nordic countries between 2014 and Q3 2019

- Companies based in Sweden captured 79.1% of total FinTech investment raised in the Nordics between 2014 and Q3 2019. This is unsurprising as Sweden is one of the leading countries in the world for FinTech innovation due to its population who are quick to adapt to new financial technologies.

- Companies based in Stockholm have been the driving force for this investment with 82.4% of deals in Sweden since 2014 being raised by companies based in the capital. Stockholm offers an attractive fiscal climate for FinTech innovation, with more billion-dollar companies per capita being produced here than any other region in the world after Silicon Valley.

- Sweden is home to one of the largest private FinTech companies in Europe – Klarna, which is valued at $5.5bn. Funding rounds raised by Klarna alone account for 38.1% of total FinTech funding in the Nordics since 2014.

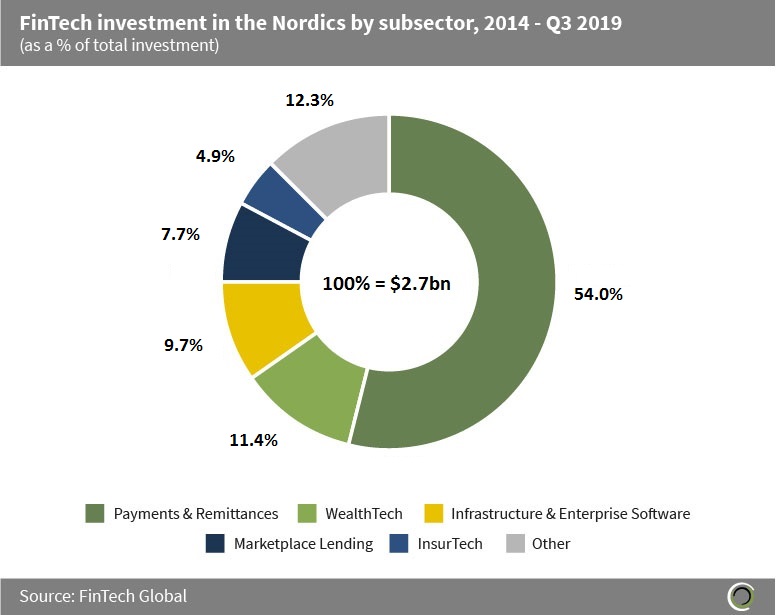

Payments & Remittances companies have raised over 50% of all FinTech funding in the Nordics since 2014

- The Nordic FinTech market has experienced a concentration of investment primarily in the Payments & Remittances subsector with 54% of total funding since 2014 being raised by companies in this subsector. This has been driven by three large deals over $100m raised by Klarna.

- WealthTech companies in the region have also raised a healthy amount of capital with 11.4% of total funding since 2014 being raised by companies in this subsector. This is unsurprising given the tech savvy millennial population which is prominent in the Nordics who are quick to adopt the latest product developments in personal finance.

- The other category consists of companies in Data & Analytics, Institutional Investments & Trading, Cryptocurrencies, RegTech, Funding Platforms, Blockchain and Real Estate, collectively accounting for 12.3% of funding in the region since 2014.

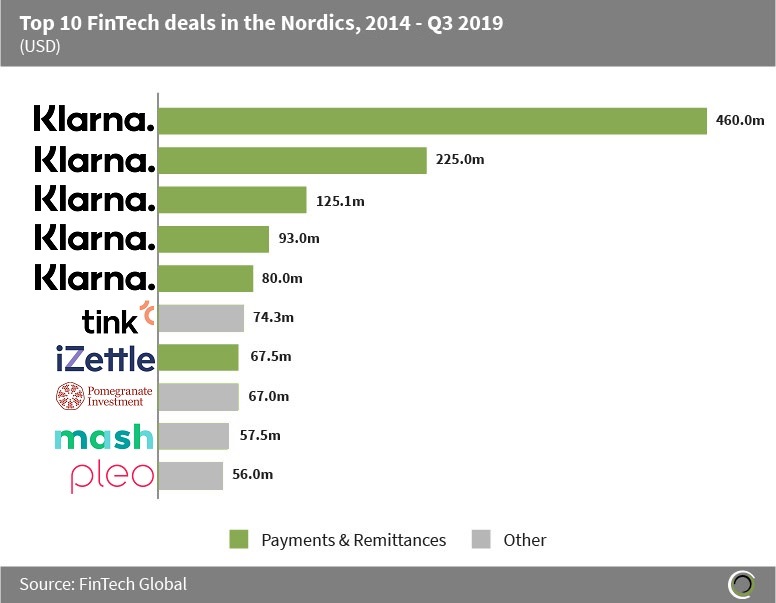

Payments & Remittances companies have completed six of the top 10 FinTech transactions in the Nordics since 2014

- Over $1.3bn has been raised in the top 10 FinTech transactions in the Nordics since 2014, which accounts for 47.7% of the total capital raised in the region during the period. Just over 80% of the capital raised in the top 10 transactions of the period went to Payments & Remittances companies.

- The largest deal of the period was raised by Klarna. The Stockholm-based payment solutions platform for online merchants raised $460m in Q3 2019 led by Dragoneer Investment Group. This round values the company at $5.5bn, making it the third most valuable FinTech in Europe, and the funding will be used to continue expansion in the US market where it is currently growing at a rate of six million new US customers per year.

- The largest transaction raised by a company outside of the Payments & Remittances subsector was raised by open banking platform Tink. The company raised $74.3m in a Series D round led by Insight Venture Partners, with funding enabling Tink to expand into the UK, Austria, Germany, Spain and Belgium.

- Of the top 10 transactions eight were raised by companies based in Sweden, with companies headquartered in Finland and Denmark accounting for one deal each on the list.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global