Rebel, a digital lending platform for consumers in Brazil, has secured $10m in new equity to help build new products.

The round was supported by Brazil-focused venture firm Monashees, New York-based investor FinTech Collective and others.

With the fresh funds, the company will look to build new products and improve its distribution channels to help fuel its growing customer base.

Rebel has received over $1bn in loan requests since it was founded in 2017, it claims. A consumer can apply for loans for marriage, relocation, personal use, retirement and vehicles.

It works by selecting a loan between $1,000 and $25,000, answering some questions and then connecting a bank account. Rebel’s technology analyses a borrower’s bank statements to build a credit score and establish loan terms.

Rebel CEO Rafael Pereira said, “For decades our banking system has made no sense, resulting in a distorted relationship between consumers and credit.

“’We want to offer democratic and accessible credit products. When put to good use, they can be an extremely beneficial tool in people’s lives. Traditional banks claim that credit in Brazil is expensive because of delinquency rates; but in reality, delinquency is high because the country has the highest interest rates in the world. It is a perverse and vicious cycle, and a difficult one to overturn. That’s why we are rebels: our goal is to break up with this loop and start a new and virtuous cycle.”

The FinTech raised a $4m funding round in 2018, with contributions coming from XP and a host of angel backers.

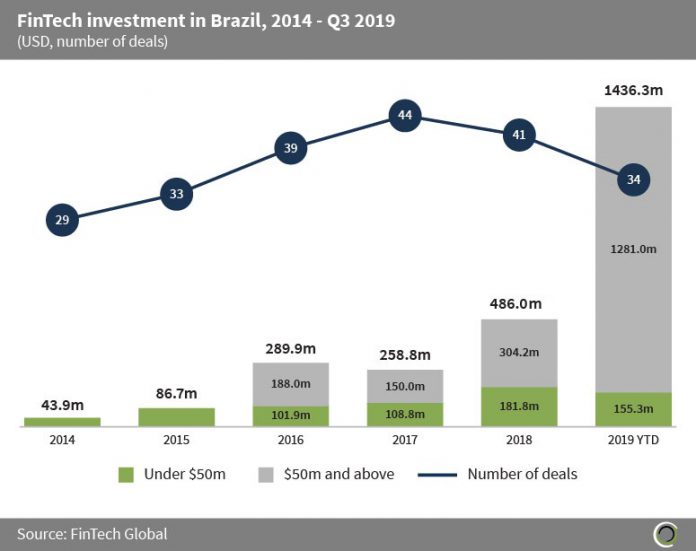

Investments into Brazil’s FinTech sector have skyrocketed during 2019. In 2018, a total of $486m was deployed across 41 transactions; however, the first three quarters of 2019 have seen $1.4bn invested through 34 deals.

Copyright © 2019 FinTech Global