The Swedish government has proposed new e-commerce regulations and Klarna is not happy about them.

Since the launch in 2005, the payment instalments venture has grown to become the biggest FinTech success story in Sweden’s history, having reached a valuation of $5.5bn earlier this summer.

Co-founder and CEO Sebastian Siemiatkowski (pictured) has previously hailed the country’s government’s digital infrastructure initiatives in the 1990s for paving the way for both the success of Klarna and its fellow Stockholm-born unicorn Spotify.

However, Klarna has now found itself at loggerheads with the country’s minister for financial markets, Per Bolund.

The reason behind the schism is Bolund’s proposal to ban having buying things on credit online as a pre-selected option. The aim of proposed law is to prevent consumers from ending up in debt by buying things on credit.

“It’s absurd that the consumer would be pushed into paying with credit for goods or service through e-commerce,” said Bolund. “Research suggests that we are more inclined to opt for whatever pops up first or pre-selected options in regards to different financial alternatives. This proposal prohibits that type of marketing and ensures that consumers take on credit because they chose to and not just because it is pre-selected.”

If passed, the new regulations would take effect in July 2020.

Bolund suggested the regulatory change this summer, which Klarna was critical of from the get-go

“It’s generally great that the government wants to protect the consumers, which is something we want to do too,” said Aoife Houlihan, vice president of global communications and public affairs at Klarna, in a blog at the time.

“However, the proposal that’s before us – and that affects both consumers, payment services and e-commerce – actually risk harming the opportunities to develop and to offer Swedish consumers and clients payment solutions and services that is created just for them.”

Adding that Klarna would respond to the proposal by offering its view through the official consultation with concerned parties that the government would undertake, Houlihan said Klarna could “already and with some measure of surprise conclude that the government isn’t just proposing a significant intrusion into Swedish companies’ right to act freely and to innovate and develop digital services for consumers, but also trying to tell its citizens what’s good for them.”

Now, as the government has moved to make the official draft proposal of the new law, David Fock, chief product officer at Klarna, stated that “the picture that has been presented [by Bolund] is horribly deceptive.”

In a new blog entry, he stated that customers do not want to pay more for things than they need to. Neither are they, according to Fock, willing to pay for things not yet delivered, controlled or that they may be unsure of whether or not they want to keep.

He added that what customers really want is for the transaction to be smooth.

Fock argued that Klarna offers a service that is cheaper and offers higher protection than what the minister for financial markets give the FinTech unicorn credit for.

He added that numbers from the Swedish Enforcement Authority suggest that the public sector increased its number of injunctions to pay from 8% to 12% between 2016 and 2018 whereas Klarna’s share of orders to pay remained stable at 1.4% during the same period.

“In short, we’re concerned that the government has identified a problem, found a scapegoat (payment services) and through a rushed process that lacks sufficient analysis has proposed actions that won’t solve the issue,” Fock continued. “You could even argue that the government is affecting the consumers’ online protection negatively with this proposal.”

Klarna is not alone in being skeptical about the new proposal. Several concerned payment parties have questioned how the proposal defines credit, with Mastercard Sweden arguing that credit cards should not be classified as credit but as a direct payment, according to Ehandel. Similarly, American Express has said that no option should be pre-selected at all.

The legislative dust-up comes at a time of tremendous FinTech growth in Sweden and in the rest of Scandinavia.

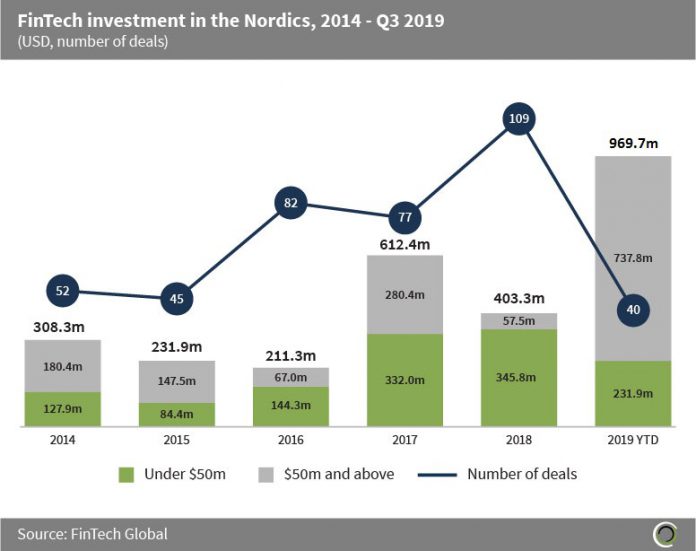

The FinTech sector in the Nordics have gone from strength to strength over the past decade. The region’s FinTech companies has attracted over $2.7bn across 394 deals between 2014 and the third quarter of 2019, according to FinTech Global’s data.

Payment companies like Klarna have drawn in more than half of that money, with Klarna raising the top five FinTech deals in the Nordics between 2014 and the third quarter of 2019.

Sweden’s ecosystem has spearheaded this rise, having captured 79.1% of total FinTech investment raised in the Nordics during that period.

Copyright © 2019 FinTech Global