The record investment has been driven by seven deals over $100m

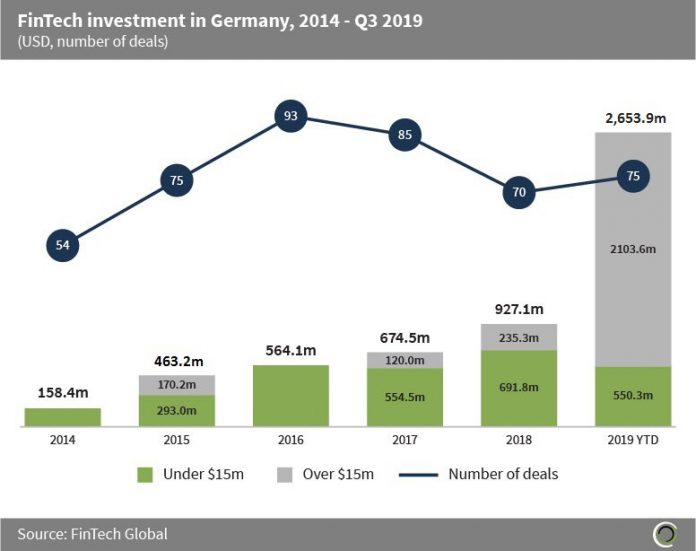

- FinTech companies in Germany have raised over $5.4bn across 454 deals between 2014 and Q3 2019. Funding increased at a CAGR of 55.5% between 2014 and 2018, and investment has continued to grow into 2019 with total investment in German FinTech companies topping $2.6bn across 75 deals in the first three quarters of 2019. This equates to 95.2% of total investment in the country between 2014 and 2018.

- Average deal size has increased over 12-fold from $2.9m back in 2014 to $35.4m in the first nine months of this year as investors look to back more established firms’ later-stage deals.

- Deal activity increased year-on-year from 2014 to 2016, reaching its peak of 93 deals completed. The number of completed transactions has dropped since then, however the trend is set to reverse this year with 75 deals completed, surpassing the 71 deals closed in the same period in 2016, setting strong expectations for a new record for deal activity to be set this year.

German Payments & Remittances companies have accounted for nearly a quarter of total FinTech investment in the country since 2014

- Transactions completed by German Payments & Remittances companies have been a significant driver of investment in the German FinTech space. Companies in this subsector have captured 24.8% of total investment in the country since 2014. Investment in this subsector has been driven by Wirecard’s $1bn post-IPO equity round, accounting for 80.7% of investment in the subsector in Germany since 2014, and 20.0% of total investment in the country since 2014.

- WealthTech companies in Germany have also captured a healthy share of investment with 23.1% of total investment being raised by companies in the subsector.

- The other category consists of companies in Cryptocurrencies, Funding Platforms, Data & Analytics, Blockchain and Institutional Investments & Trading subsectors which collectively account for 3.2% of investment since 2014.

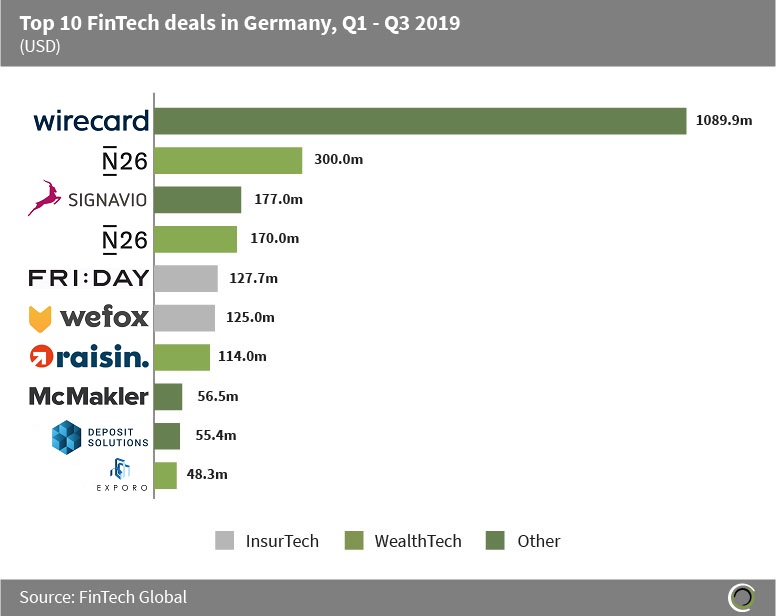

InsurTech and WealthTech companies account for six of the top 10 FinTech deals in Germany so far this year

- The top 10 FinTech transactions in Germany between Q1 2019 and Q3 2019 have collectively raised $2.3bn, which accounts for 85.5% of the total capital raised by FinTech companies in the country so far this year.

- The largest transaction raised in the period was raised by Wirecard in a $1bn post-IPO equity round led by SoftBank. The company offers electronic payment transaction solutions worldwide, alongside issuing and processing physical and virtual cards. The capital raised will be used to expand the company’s business to the Asian market.

- The largest WealthTech transaction of the period came from N26, which offers mobile banking solutions to customers in the European Union, providing international money transfer, investment, overdraft and cash withdrawal and deposit at stores. The company raised $300m in a Series D in Q1 2019 led by Insight Partners and plans to use the funds to launch its app in the United States with a goal of reaching 100 million customers around the world.

- The other category consists of the subsectors Payments & Remittances, RegTech, Real Estate and Infrastructure & Enterprise Software, with one deal from each making the list.

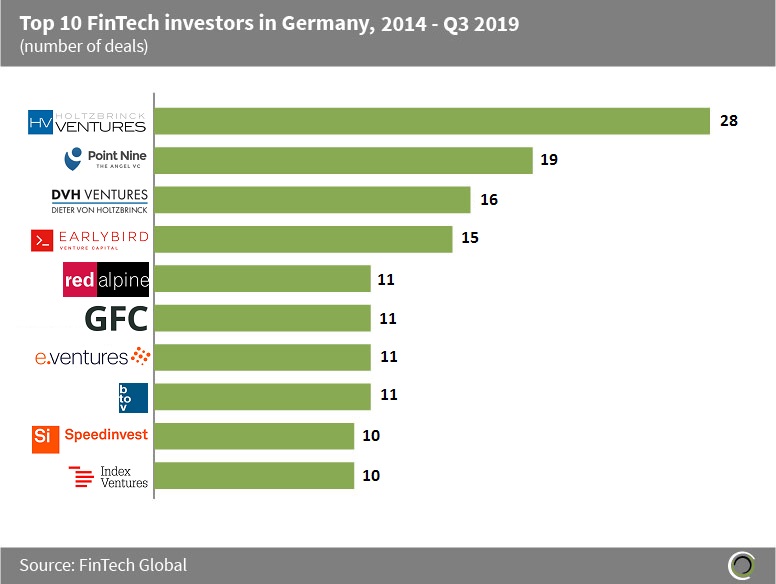

HV Holtzbrinck Ventures has been the most active investor in German FinTech since 2014

- Of the 455 deals that took place in the FinTech sector in Germany, the top investors in the country have been involved in 142 deals between them since 2014. All of the top 10 investors in Germany of the period were Venture Capital firms.

- HV Holtzbrinck Ventures has been the most active FinTech investor in the country participating in 28 deals during the period. The VC firm’s most recent FinTech investment in Germany was the $9m Series A raised by Penta in Q3 2019. HV Holtzbrinck Ventures was joined on the round by finleap.

- The second most active investor in the country since 2014 was PointNine Capital which participated in 19 transactions. The Venture Capital firm’s largest investment in Germany was Kreditech Holding’s $40m Series B in Q2 2014. PointNine Capital was joined on the round by Värde Partners, Blumberg Capital and HPE Growth Capital.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2019 FinTech Global