From: RegTech Analyst

Stone & Chalk has urged the Australian government to change its strategy to support the two industries quickly or risk losing out to neighbouring countries.

The startup accelerator’s warning was presented in its response to the Australian Select Committee on Financial Technology and Regulatory Technology probe into the opportunities of the two sectors that was launched in October.

While several of the FinTech and RegTech companies welcomed the health check of their industries, Stone & Chalk’s response to the probe suggested that more was desired from the country’s lawmakers.

“If an effective, comprehensive strategy to encourage technological innovation and the ability to support emerging companies is not implemented as a matter of urgency, Australia is at risk of losing the regional race in positioning itself as a market of choice for FinTech and RegTech resources – natural, human and financial,” the submission said, according to ZDNet.

It added that the industry has to date suffered from ad hoc solution, half-baked analysis and a failure to copy successful tech strategies from other states.

The accelerator also accused the Australian government of not being able to comprehend the sectors and criticising its slow response to policy reforms.

Stone & Chalk also put bigger corporates in its crosshairs, accusing them of destroying jobs by increasing their adoption of automation, artificial intelligence and machine learnings.

The Sidney-based accelerator also presented ways to future-proof Australia’s position as an innovative FinTech and RegTech hotbed.

Firstly, it stated that the government should create more incentives for individual taxpayers to invest in startups in an attempt to close the seed funding gap in the country.

Similarly, Stone & Chalk urged lawmakers to allocate money to an early-stage fund instead of outsourcing that responsibility to cooperative research centres and Australian Research Council industry grants.

The accelerator also suggested that businesses should be nudged to invest in RegTech and FinTech companies’ solutions by creating tax initiatives to do so.

Looking at regulations, Stone & Chalk urged Australian lawmakers to take a page or two from the US and from the, both of which were hailed as nations that had created a regulatory landscape where innovation could thrive through investments and policies championing growth.

Even though Stone & Chalk criticised the government to not make enough for the landscape, the fact of the matter is that 2019 was a record investment year for Australian FinTech businesses.

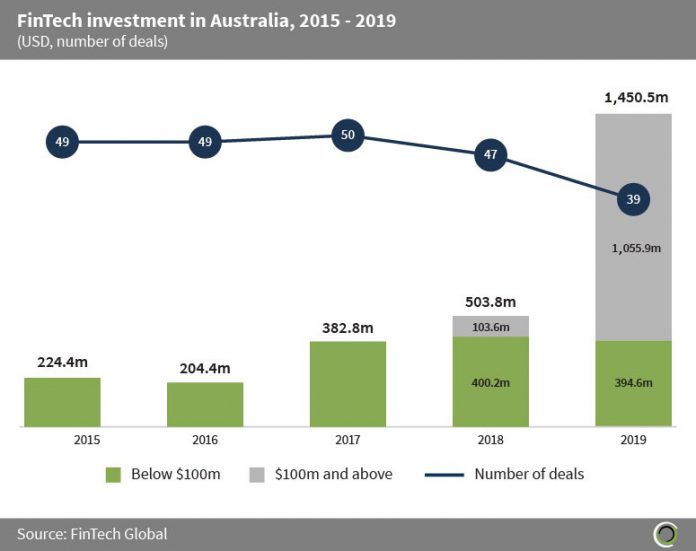

FinTech Global’s data shows that over $1.4bn was raised by FinTech companies in the country in 2019. That is more than half of the $2.7bn raised across 234 deals between 2015 and 2019.

FinTech Global’s data shows that over $1.4bn was raised by FinTech companies in the country in 2019. That is more than half of the $2.7bn raised across 234 deals between 2015 and 2019.

The news comes just days after Dilip Mohapatra, founder of Cognitive View, the RegTech company, said that “2019 has been a fully controversial year for the Australian banking and financial services industry” as the country experienced the fallout of the Australian Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry handing in its final report in February last year.

He added, “Although the 2019 year has been a year full of scandals and compliance challenges across the industry, the RegTech adoption has been slower.

“This will change in 2020, with better industry adoptions of regtechs with compliance risk, AI-based automation initiatives. We are also expecting regulators will be taking an active role and will be creating a conducive environment for better adoption of RegTechs.”

Copyright © 2020 FinTech Global