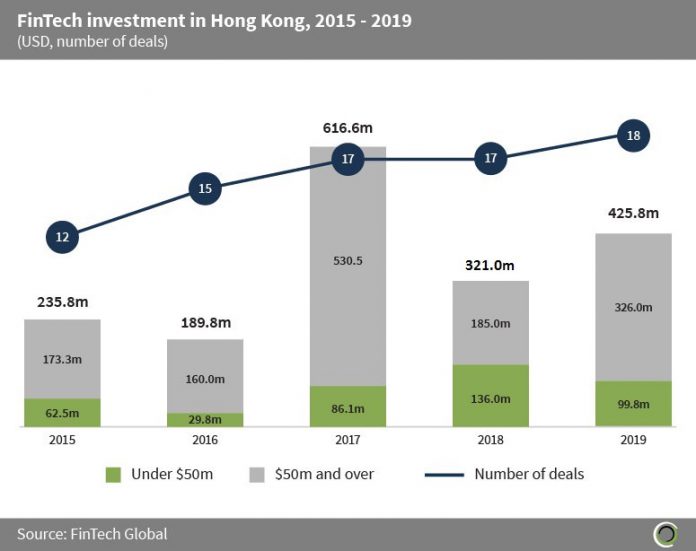

FinTech companies in Hong Kong have raised over $1.7bn across 79 deals between 2015 and 2019, with 76.8% of this funding being raised in deals valued at $50m and over.

Funding increased at a CAGR of 61.7% between 2015 and 2017 to a record of $616.6m, which is yet to be beaten. The record year was driven by four large deals valued at $50m and over including the largest FinTech funding round in the country to date, WeLab’s $220m Series B in November 2017. The mobile lending startup used the funding to advance its credit technology, accelerate expansion into new products and geographies and to scale the business.

Deal activity in the region has been increasing year-on-year to a record of 18 deals completed in 2019. However, funding total is yet to beat 2017’s record due to an increase in seed level rounds; only 11.8% of funding rounds in 2017 were seed rounds compared to 44.4% in 2019.

Hong Kong is one of the world’s financial hubs, however its FinTech sector is only just emerging, with barriers such as a relatively small consumer base compared to the rest of the Asia-Pacific market, and increased regulations which require lengthy processes to get around. Additionally, Hong Kong has historically been a buyer and adapter of technology rather than an innovator, presenting a challenge for FinTech growth in the region.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global