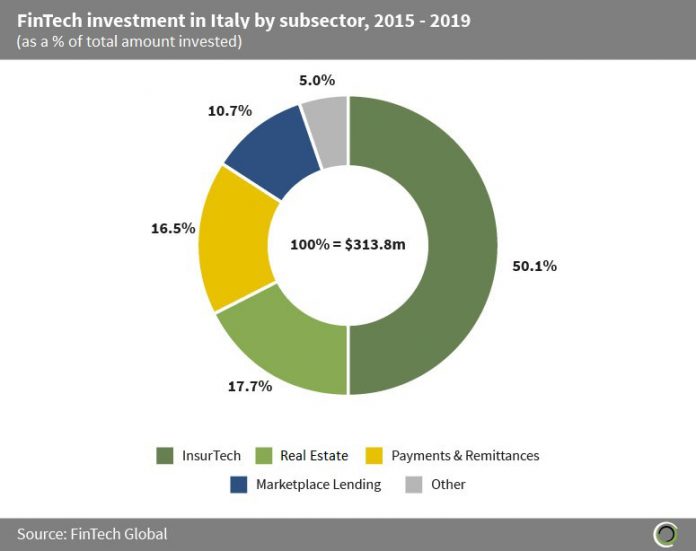

Italian FinTech companies raised $313.8m across 65 transactions between 2015 and 2019. As the fourth largest economy in Europe, Italy was one of the worst hit during the financial crisis, leaving consumers with distrust for large companies in the region, hence flocking to innovative startups for their financial needs.

InsurTech companies in the country captured the lion’s share of investment, accounting for just over 50% of total capital raised during the period. The European InsurTech landscape has grown in recent years in response to the consumer appetite for digital innovation, with Italy particularly open to this as less than half of all customers in a recent Oliver Wyman study stated that they would choose traditional insurers over FinTech competitors.

Real Estate companies in the region also attracted a healthy share of investment with 17.7% of total investment being raised by companies in this subsector. Italy’s diverse landscape and mild climate makes it an ideal place for the development of luxury real estate for the booming luxury vacation rentals segment. The country is also a lucrative option for both investment and temporary habitation because the average real estate sale price in Italy is significantly lower than many other European nations. Moreover, the tax regulations in the region have been relaxed to attract more foreign investment from high net worth individuals.

The other category includes companies in Infrastructure & Enterprise Software, Data & Analytics, RegTech, Funding Platforms, WealthTech and Blockchain & Cryptocurrency collectively accounting for 5.0% of capital raised since 2015.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global