Finnish digital banking platform for small and medium-sized enterprises Holvi has reportedly released its services in the UK.

The UK is set to leave the European Union within a matter of days, putting a lot of uncertainty on the market. Holvi CEO Antti-Jussi Suominen said he was excited about the launch regardless of how Brexit turns out due to the UK being such a major market for FinTechs, according reports in the media.

By using Holvi, a small business can open an account, which can be split between personal and business. The mobile app has around 200,000 customers and operates in Finland and Germany.

To further support companies, the platform saves receipts, tracks income and expenses automatically and aids tax processes. A user can also create and send professional invoices with a few clicks.

Earlier in the week, fellow Finnish FinTech startup Bankify established a partnership with payments service provider Nets. The deal was made to enable Nets users’ access Bankify services through their apps.

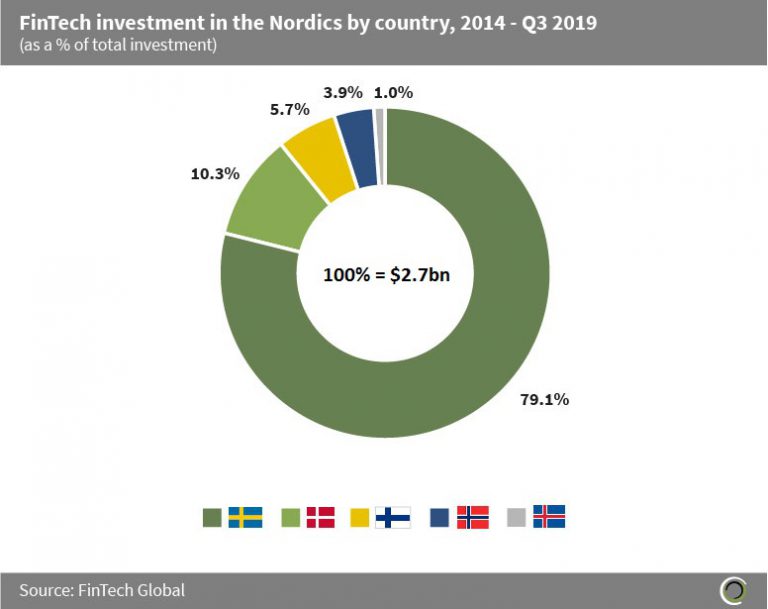

Since 2014, there has been a total $2.7bn invested into FinTechs based in the Nordics. Sweden has taken the lion share of this, representing 79.1% of funding. Denmark follows with a 10.3% share and Finland is third with a 5.7% divide.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global