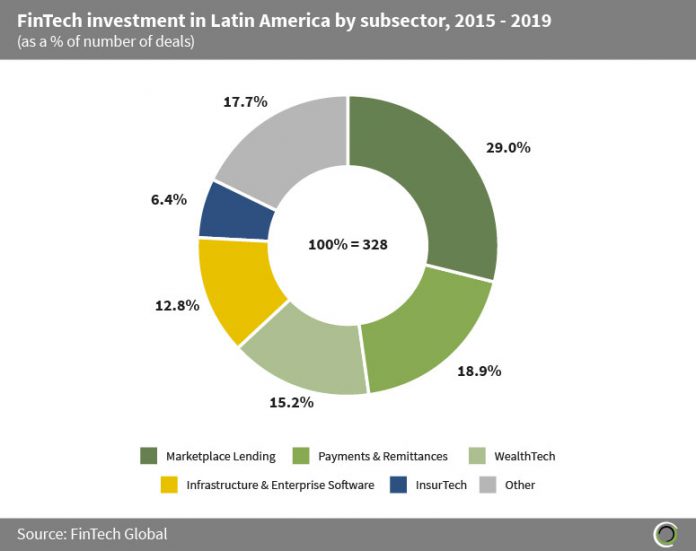

Latin American FinTech companies raised $5.5bn across 328 transactions since 2015. More than half of deal activity has been captured by companies in the Marketplace Lending, Payments & Remittances, and WealthTech subsectors, collectively amounting to 63.1% of transactions in the region since 2015.

Latin America’s financial sector has always differed in comparison to other regions around the world. The region has many challenges such as lack of credit card services, high interest rates, a large unbanked population, and generally a non-inclusive financial sector for the population in the region. The FinTech industry has been rapidly expanding in recent years and is now a top priority for governments in the region. These FinTech startups are taking advantage of the potential growth opportunities in Latin America and are now on the verge of transforming the regions financial system.

Marketplace Lending companies in the region captured the lion’s share of deal activity, accounting for 29% of transactions since 2015. Creditas, a Brazilian consumer lending company, raised $231m in a Series D round lead by SoftBank in July 2019. The funding will be used to grow the product portfolio and to recruit more specialised employees. The investment will allow the company to continue providing their financial services.

The Institutional Investment & Trading subsector received the largest portion of funding amounting to more than $1.8bn since 2015, however this is entirely driven by one transaction. Mercado Libre, a Latin American e-commerce retailer, raised $1.8bn in a post-IPO equity round lead by Dragoneer Investment Group and PayPal in March 2019. The new capital will be used to invest in logistics since its e-commerce business is under large amounts of pressure in its biggest market (Brazil), due to the expanding presence of Amazon, its main competitor in the region.

The Other category contains Blockchain & Cryptocurrencies, Real Estate, RegTech, Data & Analytics, Institutional Investment & Trading, and Funding Platform subsectors collectively amounting to 17.7% of transactions in Latin America since 2015.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global