South African short-term insurer Santam has invested into on-demand InsurTech platform JaSure and established a partnership.

South Africa-based JaSure is a digital insurance platform which provides consumers with on-demand cover for portable items, such as mobile phones, laptops, cameras, sports gear, eyewear, camping equipment, bikes, musical instruments and more.

The insurance can be purchased for a specific period of time and cover can be switched on and off whenever.

As part of the deal, JaSure will operate as a juristic representative on Santam’s FSP licences. Initially, Santam will offer JaSure’s solution to affinity groups through digital channels, but talks have begun around how intermediaries can access and leverage the solutions.

Santam head of Intermediated Business Andrew Coutts said, “We are very impressed with JaSure’s new approach to insurance that uses technology to reduce complexity, cut costs and reach new markets. We look forward to bringing it to our existing and new Santam clients of the future.”

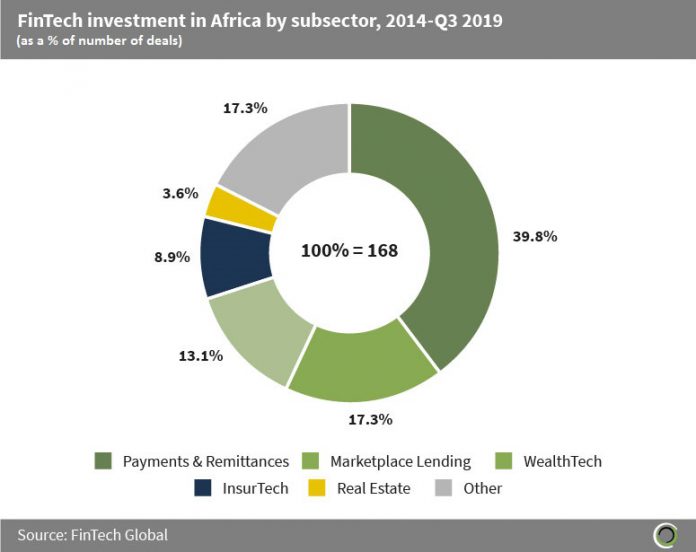

The lion share of FinTech investments in Africa have been in the payments subsector, which is responsible for 39.8% of the total 168 deals in the continent. Marketplace lending is the second percentage of deals with 17.3% share, followed by WealthTech and InsurTech, which have 13.1% and 8.9% percentage shares, respectively.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global