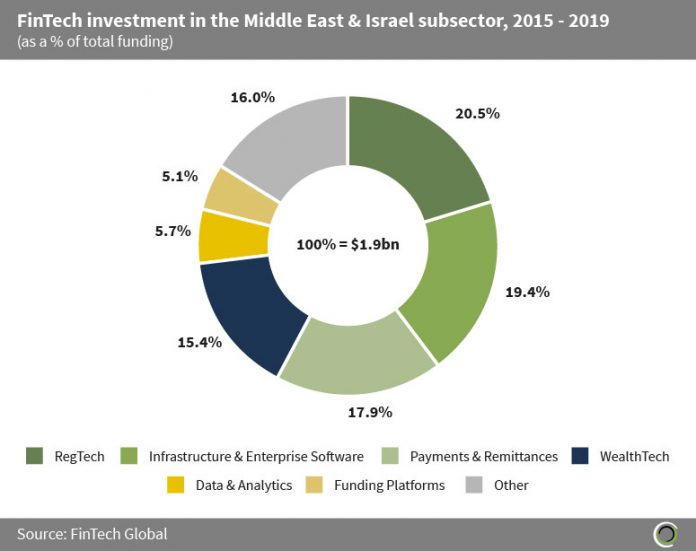

Companies based in the Middle East & Israel raised over $1.9bn across 191 transactions since 2015. RegTech companies captured the lion’s share of funding with 20.5% equal to $391.6m.

Middle Eastern governments have been trying to diversify their economies by attempting to move away from the oil market and create a supportive regulatory system for the FinTech market to expand. The UAE and the financial free zones such as Dubai International Financial Centre (DIFC) are leading the FinTech ecosystem expansion. The support from the regional & financial institutions include accelerators, incubators, regulatory sandboxes, and government initiatives for FinTech startups in the region.

Payments & Remittances companies attracted 17.9% of FinTech investment in Middle East & Israel since 2015. Israel is the driver behind the subsector’s level of funding with companies raising 74.9% of the total capital raised in the subsector. A large penetration of mobile devices and internet access has contributed to the higher growth rates in Israel compared to other countries in the region.

The Other category contains Institutional Investment & Trading, InsurTech, Cryptocurrencies & Blockchain, Marketplace Lending and Real Estate subsectors which collectively received 16% of the funding in Middle East & Israel.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global