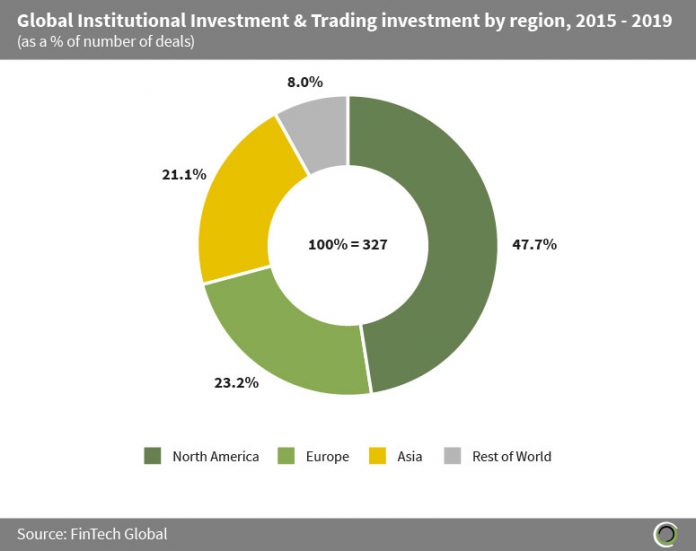

Institutional Investment & Trading companies raised over $11.5bn across 327 transactions between 2015 and 2019, with North American companies receiving 47.7% of global deal activity.

Asian companies accounted for 21.1% of total deals, ranking the continent as the third most active region for Institutional Investment & Trading transactions. However, the region has captured more than half of global investment in the subsector. The reason for this is that Asian companies raised higher average deals of $101m compared to US companies which averaged $23.6m between 2015 and 2019.

Lu.com, an Asian online marketplace for trading of financial assets, raised $1.3bn in a Series C round led by Primavera Capital Group in December 2018. The investment was used to continue funding growth, while the company waits to launch its IPO in Hong Kong, which is on hold due to regulatory purposes.

The Rest of World category comprises of companies based in Australasia, Africa, Middle East & Israel, and Latin America, which collectively accounted for 8% of global deal activity between 2015 and 2019.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global