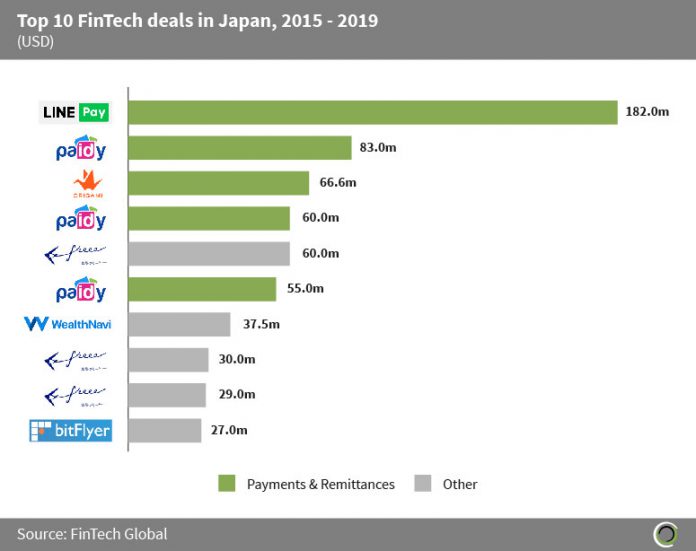

Out оf the 10 largest FinTech deals in Japan since 2015, five were raised by Payments & Remittances companies (Line Pay, Paidy, & Origami). The Japanese FinTech sector has matured during the period, with the average deal size increasing from $6.9m in 2015 to $47.7m in 2019.

Line Pay, a Japanese mobile payments company, raised $182m in a corporate round led by Line Corporation in February 2019, the largest FinTech transaction in Japan so far. The company earmarked the funding to grow its business and expand internationally. As per the latest data Line Pay has reported an average of 165 million monthly users and 40 million registered users.

Freee, a Japanese accounting software company, raised $60m in a series E round in August 2018, which is the largest Japanese Infrastructure & Enterprise Software deal since 2015. The company used the funding to expand its services in other areas of management for its clients.

The Other category contains an Infrastructure & Enterprise Software company (Freee), a WealthTech company (Wealthnavi), and a Blockchain & Cryptocurrencies company (BitFlyer).

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global