Buy now, pay later company Klarna has signed a partnership with the Dune Group as it keeps expanding.

The Swedish FinTech unicorn is seemingly expanding its reach month on month. In May it was revealed that it had acquired the UK e-commerce company Nuji, in March it signed a deal with FinTech Wirecard to launch a joint payment solution and in March it was revealed that Ant Financial had bought a minority stake in the company. That’s on top of it raising a $460m round last summer that pushed its valuation past the $5.5bn mark, which was later followed by a $200m capital injection from Commonwealth Bank as Klarna grew its reach into Australia.

Now Klarna has teamed up with the Dune Group, a fashion footwear and accessories company. The international partnership will give Dune customers shopping online the opportunity to use Klarna’s popular pay in 30 days and instalments services in five European markets – Austria, Germany, The Netherlands, Switzerland and the United Kingdom.

The news comes after Dune recently launched a Spring/ Summer campaign with actress Gillian Anderson.

“We are delighted to partner with The Dune Group to create the best shopping experience for their customers across Europe,” said Luke Griffiths, vice president at Klarna. “With over 85 million customers globally, we know that the addition of Dune London to the Klarna shop directory will be welcomed by millions of shoppers in Europe.â€

Elaine Smith, head of digital product at Dune London, added, “At Dune London it is our aim to provide the best possible shopping experience across all of our customer facing channels and we feel that the addition of Klarna’s payment options will support this objective not just in the UK, but in our markets across Europe. We want our customers to be able to shop and pay however, wherever and whenever they want.â€

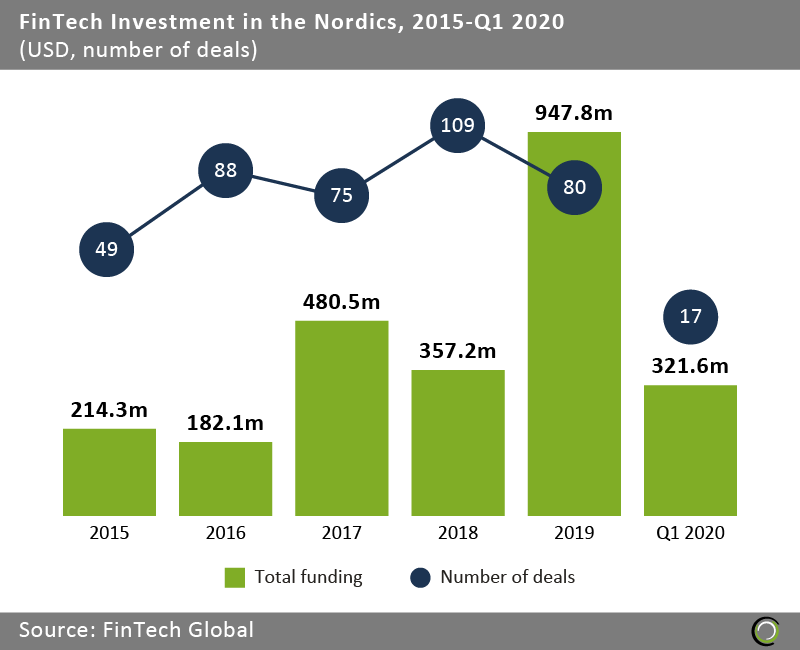

Of course, Klarna is hardly the only Nordic FinTech to reap success. Indeed, the region has gone from strength to strength in recent years. Back in 2015, the region’s FinTech companies managed to attract $214.3m in investment, according to FinTech Global’s research. However, that figure jumped to $947.8m in 2019. Moreover, the first quarter of the year showed great promise too, with the region’s companies being backed by investors to the tune of $321.6m. Although, given the global pandemic, it’s anyone’s guess whether or not this will be another record year for the companies in the north of Europe.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global