British chancellor of the exchequer Rishi Sunak has announced that the government will carry out a review of the country’s FinTech sector.

He revealed the review as part of his Budget 2020 announcement. The review will look into how the government can support the sector to ensure it remains competitive and keeps on growing.

Ron Kalifa, chairman of payments firm Network International and a non-executive director at the Bank of England and Transport for London, will lead the review.

Charlotte Crosswell, chief executive of Innovate Finance, the industry body, told City A.M., “We are at a crucial moment in FinTech’s development. UK companies are now entering a phase of maturity that requires action to ensure that entrepreneurs can not only establish and scale their businesses in their home market, but also export their products and services internationally.

“By better understanding the needs, requirements and key focus areas for the sector, we will put ourselves in a strong position to boost the FinTech industry, and in turn support the economy as a whole.”

Moreover, the chancellor also revealed that the Tech Nation Fintech Delivery Panel and InsurTech Board will receive funding until 2022 to continue their work in identifying and removing barriers to nation-wide economic growth for the UK FinTech and InsurTech sectors.

Eileen Burbidge, chair of the Fintech Delivery Panel and chair of Tech Nation, welcomed the news. “FinTech has changed dramatically since the Fintech Delivery Panel was first established in 2017,” she said.

Burbidge added that the “announcement of extending the Fintech Delivery Panel to 2022 couldn’t be more timely” and that it showed just how seriously the UK government is taking their commitment “to support the continued growth of the FinTech and InsurTech sectors in the UK.”

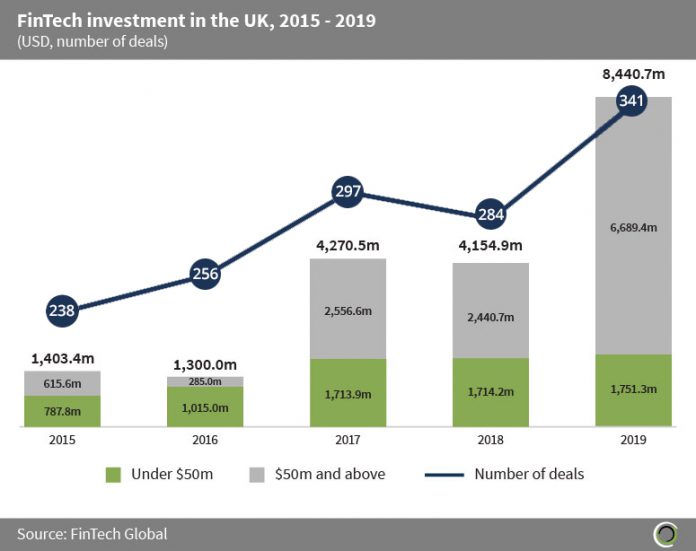

FinTech investment in the UK has increased six times over since 2015, according to FinTech Global’s research. In 2015, $1,4bn were invested into the British industry. In 2019, that figure had jumped to $8.44bn being invested into the UK FinTech sector.

“With FinTech unicorns, Monzo, TransferWise and Revolut becoming household names, the ecosystem is rapidly maturing,” said Gerard Grech, CEO of Tech Nation. “As always, there is more work to do to ensure the continued growth of this valuable part of the UK tech ecosystem.”

However, the UK is only the latest country to launch a review like this. Last year, Australia’s senate set up a similar initiative to find out how its emerging FinTech and RegTech industries could be strengthened.

Copyright © 2020 FinTech Global