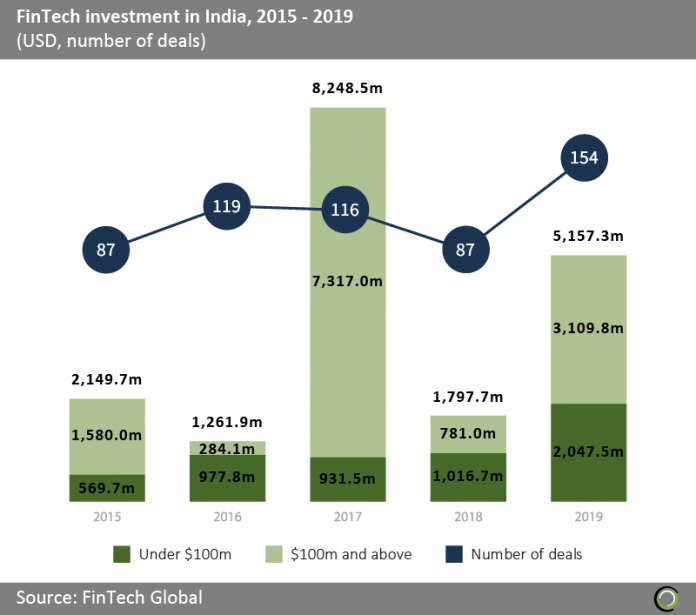

The number of FinTech transactions hit an all-time high of 154 last year

- Indian FinTech companies raised over $18.6bn across 563 transactions between 2015 and 2019, with investment growing at a CAGR of 19.1% during the period. Furthermore, the average deal size has grown from $32.1m in 2015 to $38.9m in 2019, indicating that the Indian FinTech sector has matured over the period.

- FinTech investment in India reached $8.2bn during 2017, which is an abnormally high level of funding compared to historical levels. That year there were five large transactions that collectively accounted for 81.2% of investment, raising $7.3bn in total which pushed funding in the country to record levels as a result.

- However, if we eliminate large deals from the analysis, Indian FinTech funding from transactions valued below $100m almost quadrupled between 2015 to 2019, which demonstrates the strong growth the industry has experienced over the period.

The share of deals under $1m dropped nearly four times since 2015

- FinTech deal activity in India for deals valued less than $5m decreased by 34.1 percentage points (pp) between 2015 and 2019. The shift in deal activity from early to later stage transactions shows that the FinTech sector has become more mature over the period.

- Most of this shift was taken up by transactions in the $5-25m size bracket which more than doubled their share of total deal activity over the last five years as companies raise follow-on financing.

- For deals valued at $25m and above deal activity experienced an increase by 12.9pp since 2015, which indicates that investors are backing the more established FinTech companies in the country.

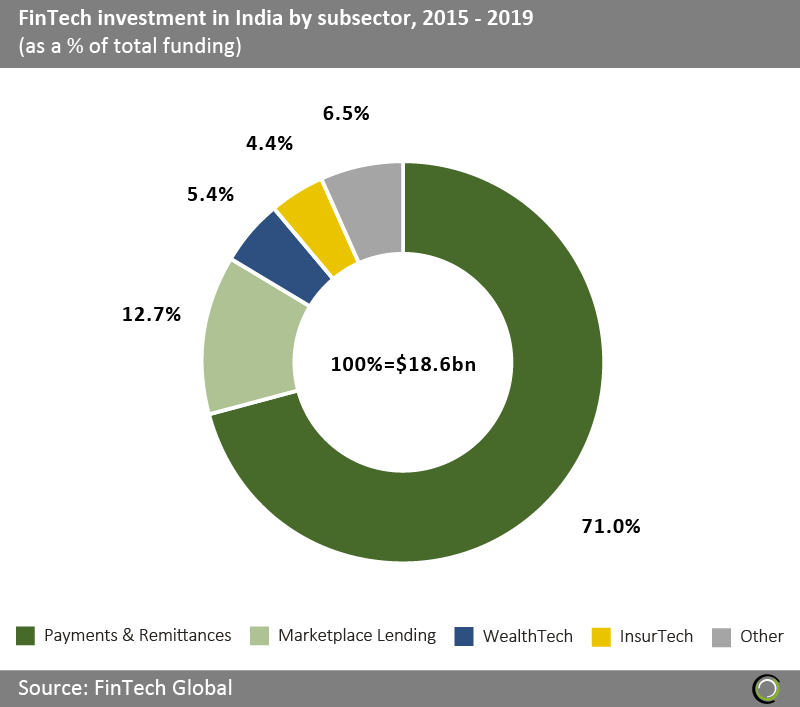

Payments & Remittances companies captured more than three quarters of FinTech investment in India since 2015

- Payments & Remittances companies raised 71% of FinTech investment in the country since 2015, with Marketplace Lending companies coming second with a share of 12.7% of total funding.

- Payments & Remittances was the most well-funded subsector in the country between 2015 and 2019. Unsurprisingly the subsector’s success was due to the efforts of the Indian government through pushing their population away from cash towards digital payments, which incentivised investors to back the subsector and the growing opportunity.

- Payments & Remittances companies completed only nine more deals compared to Marketplace Lending companies, making the Marketplace Lending subsector almost as active as the Payments & Remittances subsector in the country since 2015. Despite this Marketplace Lending companies raised much less funding in comparison to the digital payments companies over the period. The reason for this was due the fact that Payments & Remittances average deal size were $68.6m larger compared to Marketplace Lending average deal size.

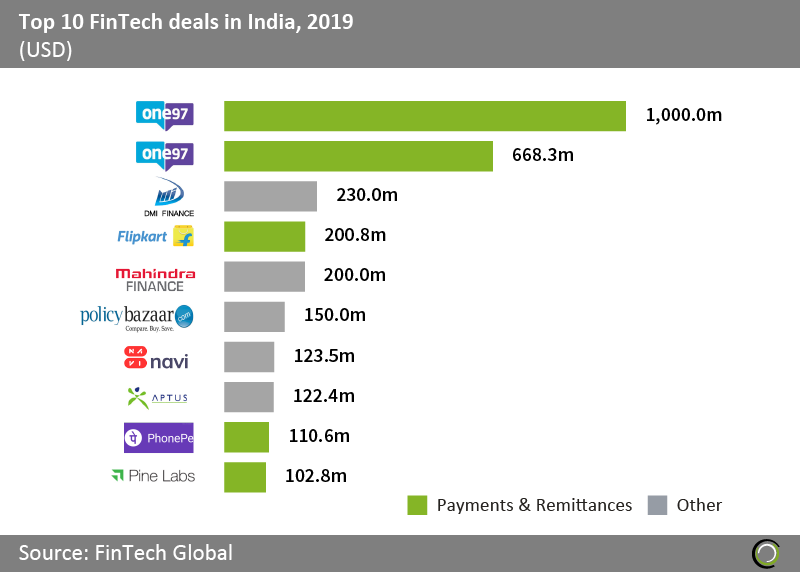

Five of the top 10 FinTech deals in India last year were raised by Payments & Remittances companies

- The top 10 FinTech transactions in India raised more than $2.9bn, with half of these deals being raised by Payments & Remittances companies.

- One97, an Indian commerce services company, raised $1bn through a company it operates (Paytm) in a series G round led by T. Rowe Price in November 2019. The company will use the funding to expand its services to more SME’s and its other financial offerings such as lending and insurance.

- The Other category contains three Marketplace Lending companies (DMI Finance, Mahindra finance, and Aptus), an InsurTech company (PolicyBazaar), and an Infrastructure & Enterprise Software company (Navi Technologies).

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global