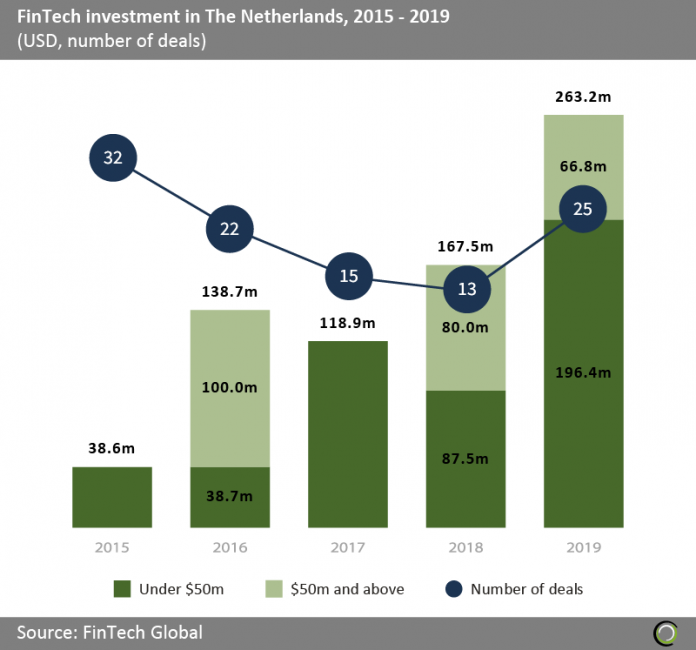

FinTech companies in the Netherlands raised $726.9m across 107 transactions between 2015 and 2019. Funding grew at a CAGR of 46.8% over the period, with the average deal size increasing more than eight-fold from $1.6m in 2015 to $13.1m in 2019, a sign that the Dutch FinTech sector has establishing itself as a leading center for FinTech innovation in Europe.

FinTech deal activity rebounded in the country last year to 25 transactions compered to 13 in 2018, breaking the four-year trend of declining deal volumes. Furthermore, investment reached $196.4m for deals valued under $50m in 2019, which is a record total for transactions in that size bracket. This is a strong proof that investors are increasingly backing companies in the early- to mid-stages of their lifecycle.

The largest funding round in the Netherlands since 2015 was raised by Qredits, a Dutch microcredit provider. The company raised $100m in a debt financing round led by European Investment Bank (EIB) in January 2016. Qredits used the funding to increase the company’s loan capacity in order to provide more loans to Dutch SMEs.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2020 FinTech Global