India-based Insurance Samadhan has reportedly secured a seed funding round from Venture Catalysts.

The capital injection will be used to support the development of its technology and boosting its operations, according to a number of reports in the media.

While the value of the deal was not disclosed, Venture Catalysts typically invests around $500,000 to $1m into companies.

Insurance Samadhan helps consumers with any problems they have had with their insurance, whether it is from mis-selling or having a legitimate claim declined. The digital platform leverages AI and machine learning technology to connect claimants with the insurance companies, regulators, watchdogs or courts.

Last year, India’s FinTech sector witnessed $5.1bn invested across 154 deals. While this was up from the $1.7bn injected through 87 transactions during 2018, it is still significantly less than 2017, when a colossal $8.2bn was invested in 116 transactions.

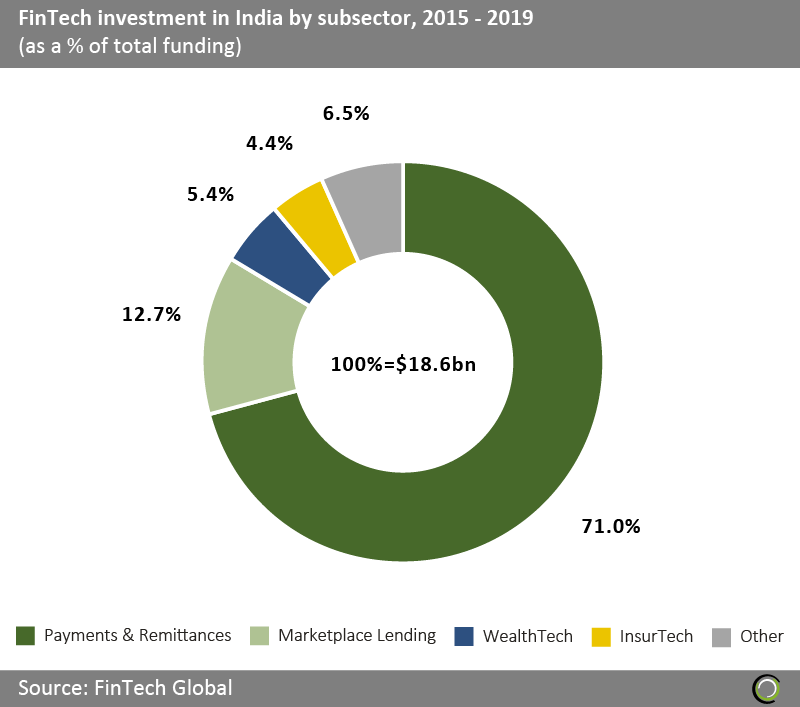

The country’s FinTech sector has been dominated by the payments and remittance space since 2015. Of the $18.6bn deployed to Indian FinTechs since 2015, 71% of this has gone to companies in that subsector.

The country’s FinTech sector has been dominated by the payments and remittance space since 2015. Of the $18.6bn deployed to Indian FinTechs since 2015, 71% of this has gone to companies in that subsector.

Copyright © 2020 FinTech Global