Singapore-based robo-advisor Smartly has closed down operations after competition in the market was too “intense.”

The company has issued a statement on its website stating, “Competition in the digital investment advisory space is intense and maintaining a high service standard on the platform has been challenging. Despite initially contemplating core platform improvements, as indicated earlier on this page, strategic corporate considerations by our parent, VinaCapital Group Ltd, ultimately guided this decision.”

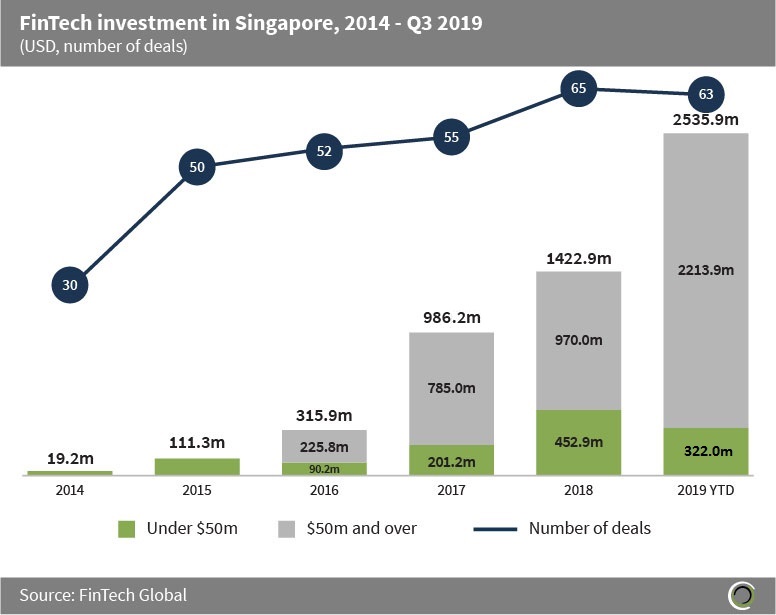

Competition is ripe in Singapore, which is has established a strong FinTech sector. Since 2014, more than $5bn has been invested into FinTech companies in Singapore. Appetite for companies in the country is growing rapidly. More than $2.5bn was invested into the country during 2019.

WealthTech solutions, which robo-advisors like Smartly comes under, are one of the biggest sectors in Singapore. Since 2014, 13.3% of all capital being invested into the country’s FinTech space went to WealthTech companies, with only the payments and remittance sector seeing a larger portion of funding at 21.3%.

WealthTech solutions, which robo-advisors like Smartly comes under, are one of the biggest sectors in Singapore. Since 2014, 13.3% of all capital being invested into the country’s FinTech space went to WealthTech companies, with only the payments and remittance sector seeing a larger portion of funding at 21.3%.

Smartly, which was founded in 2015, was acquired by Vietnam-based investor VinaCapital in July 2019 for an undisclosed amount. When the company was acquired, it was hoping to increase the scale of the business and enter into new markets.

The robo-advisor had offered consumers a digital platform which would help them create a personalised portfolio of investments. It leveraged various datasets to find investment opportunities which met the specific risk profile of investors. Portfolios were diversified by investing across the globe and comprising of stocks, bonds, real estate and gold.

Accounts on Smartly will allegedly be closed from April 17 2020. A report from Finextra claims VinaCapital will be returning all funds held in customer accounts. Additionally, the firm has connected customers with another service provider, after creating a specialised agreement with the new company.

A blog post from Seedly claims the deal has been formed with fellow Singaporean robo-advisor StashAway. All customers of Smartley will be offered a 50% management discount for the first six months for up to the first SGD $50,000 ($34,000).

Smartly claimed it had to close due to the country’s fierce competition. Singapore has seen a number of strong companies establish themselves. StashAway is one of these companies. The FinTech closed a $12m Series B last year led by Fidelity International’s investment division Eight Road Ventures. Private equity firm Asia Capital & Advisors also extended its support of the startup. StashAway, which is also available in Malaysia is hoping to expand further across Southeast Asia.

Singapore’s ride-sharing giant Grab is also extending its reach to the robo-advisor market after acquiring Bento. The company is looking to capitalise on its brand and will release GrabInvest later in the year, offering retail wealth management services to people living in Singapore.

Competition could get even tougher in the country over the coming years. Singapore’s financial regulator Monetary Authority of Singapore (MAS) has been making numerous moves to ensure its FinTech sector continues to grow and attract more players. Earlier in the year, MAS established new framework for financial institutions to promote the use of artificial intelligence and data analytics.

The country has also begun looking for digital banks to enter the market. Last year, it revealed it would be handing out five digital banking licenses. The MAS received a total of 21 applications to this from companies hoping to get their hands on a licence. While only five will be accepted, for now, it shows keen interest from players to build FinTech solutions in Singapore.

Copyright © 2020 FinTech Global