FinTech Propsa has been granted access to the federal government SME Guarantee Scheme and the markets seem to celebrate the stability this will mean for the company during the COVID-19 crisis.

The news saw the SME financial expert stock jump by 25%, according to The Motley Fool. The governmental scheme is set up to help small businesses soften the financial blow of the coronavirus over the next six months.

For Prospa, the news means the government will guarantee 50% against the outstanding facility balance of eligible products and that the FinTech venture has been allocated AUS$223m. This can be applied to all eligible new lines of credit and loans issued by Prospa between 14 April 2020 and 30 September 2020.

Moreover, the guarantee empowers Prospa to give? small businesses with up to AUS$250,000 in unsecured funding for up to three years and a six-month repayment holiday with interest to be capitalised at the end of the six-month period.

Prospa CEO Greg Moshal welcomed the scheme and was thankful that the government recognised ?what small businesses need right now to survive.He added that the scheme will enable Prospa ?to support thousands of small businesses during this difficult time.p>

Back in 2017, Prospa made the headlines when it raised A$25m in a Series B round led by AirTree Ventures.

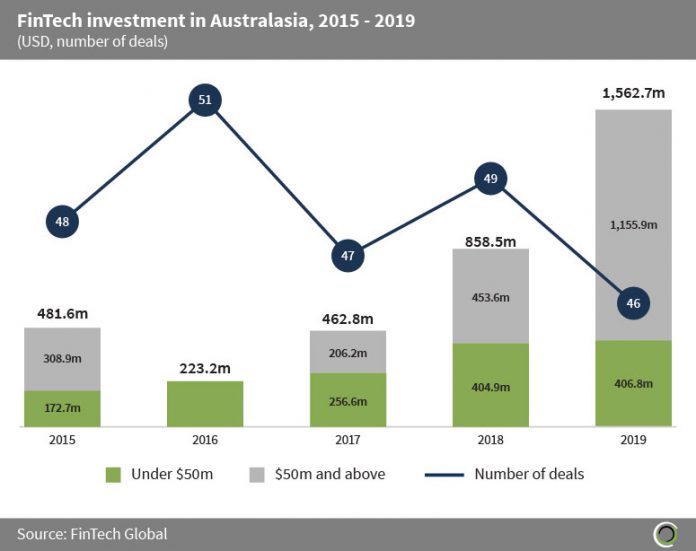

FinTech companies in Australasia has gone from strength to strength recently. Between 2015 and 2019, the region’s industry raised $3.6bn across 241 transactions, with Australian companies capturing 91.1% of the investment on the continent, according to FinTech Global’s research.

Copyright ? 2020 FinTech Global

Copyright ? 2020 FinTech Global