Despite being slow to join the party, the Asia-Pacific challenger bank sector could be up for a massive growth in the next five years.

A new report from Backbase and IDC has revealed that 63% of customers are interested in switching from traditional lenders to neobanks within the next five years as 100 new financial institutions are estimated to launch in the region during by 2025.

New and more liberal laws and the issuance of new banking licenses – like the ones issued by Singapore earlier this year – are two of the key drivers behind this expected growth, according to the report.

The coronavirus may also play a part in creating an environment where digital banks can thrive. Over the past few weeks, several FinTech stakeholders have suggested that the pandemic sweeping across the globe has made people less inclined to use physical money or to make their banking chores face-to-face.

For instance, the coronavirus has led to the British banking sector to up the limit for contactless payments from £30 to £45, building on a previous trend where most Brits would rather do their banking online.

Moreover, when FinTech Global checked in with European challenger banks to see how they were handling the crisis, German FinTech N26 had noted a slight increase in transactions following the outbreak of the coronavirus.

The Backbase and IDC report echoed these sentiments, saying that the contagion had caused 70% of customers in the Asia-Pacific to feel that the current way of doing banking is too slow and tedious.

“The pandemic has triggered the accelerated digitisation of financial services across the region,” said Jouk Pleiter, CEO and founder of Backbase. “Consumers and small business owners alike expect their banks to truly step up their digital game and provide 100% seamless digital capabilities, any time, any place. Looking beyond, banks and neobanks have to elevate their digital-first capabilities to effectively enable hyper-personalisation for customers.”

It added that a result of incumbent banks’ extreme focus on legacy systems and disregarding digital-first integration, only 30% of the banking customer base in the region are active on digital banking channels.

However, there are some obstacles challenger banks must overcome in order to become more prevalent in the region.

For example, they have to tackle the fact that 80% of the top 250 banks in the Asia-Pacific still prefer to own the entire value chain of banking, with third party-contributed business at a mere 2%.

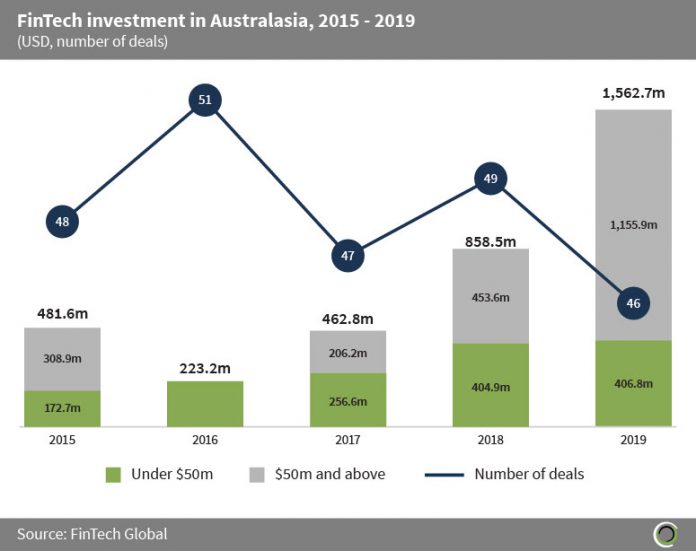

The news about the potential growth of the challenger bank market in the Asia-Pacific comes as FinTech investment in the Australasian region has gone from strength to strength over the past five years.

Back in 2015, the sector attracted $481.6m. In 2019, that figure had jumped to $1.56bn, according to FinTech Global’s research.

Copyright © 2020 FinTech Global

Copyright © 2020 FinTech Global