Mobile banking platform Varo Money has nabbed $241m in its Series D round, as it moves closer to national charter approval.

The round was co-led by first time Varo backer Gallatin Point Capital and previous investor investor The Rise Fund. Varo’s new funding was also supplied by HarbourVest Partners and Progressive Insurance.

J.P. Morgan acted as the sole placement agent for the deal.

Capital from the round will be used to support Varo’s growth and help create new tools for the platform.

Varo was created to help solve the financial inequality in communities in the US, the company founder Colin Walsh stated.

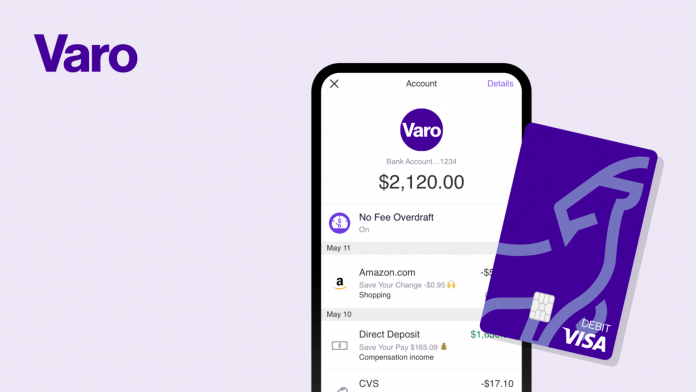

The digital bank initially launched in 2017, offering premium banking products through The Bancorp Bank, to give Americans bank and saving accounts that have no minimum balance.

Varo also offers qualified customers no-fee overdrafts on up to $50, as well as, free ATM withdrawals at more than 55,000 ATMs worldwide.

Last year, Varo bank surpassed the one million customer milestone.

The Rise Fund co-managing partner Maya Chorengel said, “In the midst of all the economic challenges people are facing right now, the digital economy can still be a force for good.

“Varo’s focus on financial inclusion and the support they offer people to help manage their finances and reduce financial stress really matters at a time when so many American families are struggling in a volatile economy. And that’s why RISE chose to partner with the team at Varo.”.

Varo hopes to become the first and only digital bank to receive a national charter.

The bank is in the final stages of its national charter application and pending completion of the conditions of the OCC, the FDIC and the Federal Reserve, the bank expects to have approval by summer 2020. If it receives this approval, it will be able to offer credit cards, loans, and additional savings products.

With the close of the round, the banking platform has raised a total of $419.4m in funding to date.

Earlier in the year, Varo signed a deal with automated digital credit improvement platform Dovly to make it easier for customers to strengthen their credit score.

Varo is the latest US digital bank to receive funding this year. Chime reportedly secured a $200m funding round, despite closing a $500m Series E in late 2019 that valued the business at $5.8bn.

Here are some of the other US challenger banks to close investments this year.

Copyright © 2020 FinTech Global