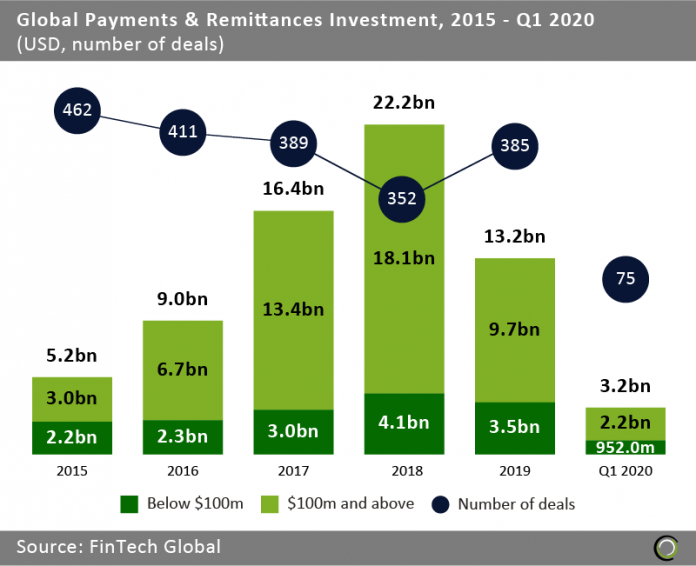

Payments & Remittances deal activity is on track to record its worst year since 2015 as investment slowed down in the first three months of 2020

- Payments & Remittances companies saw a 40.8% decrease in total funding between 2018 and 2019, reaching a two-year low of $13.2bn despite a near 10% increase in the number of deals completed during that period.

- From 2015 to 2018, total funding in the Payments & Remittances sector skyrocketed more than 325%, being driven by large deals over $100m which raised in aggregate $18.1bn of the total funding recorded in 2018.

- Q1 2020 saw an 18.6% decrease in total capital invested compared to the same quarter in 2019 along with a 19.3% decline in deal activity. This run rate puts investment in the sector for its worse year since 2015. While the global economy is looking for virtual payments, remittances, and no contact POS, the decline in both total funding and the number of deals signals investors are not taking any additional risks by making new large investments.

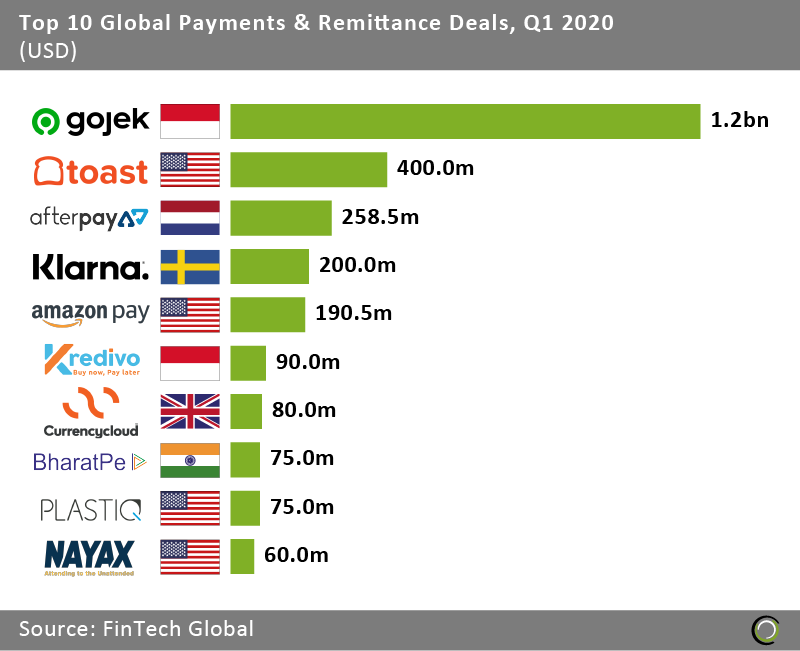

The top ten Payments & Remittances deals in Q1 2020 accounted for 70% of total funding for the quarter

- The top ten Payments & Remittance deals in the opening quarter of the year raised in aggregate $2.6bn, making up 70% of the total funding for the period. In Q1 2019, the top ten deals totaled just over $4.4bn, highlighting the slow start in Q1 2020 due to Covid-19 and rising economic concerns.

- US companies continue to lead the Payments & Remittances sector, capturing four out of the top ten deals. Toast, the all-in-one point-of-sale and restaurant management platform, announced a $400m investment with Alta Park Capital, Bessemer Venture Partners and eight other investors in a Series F round. Toast announced it will use the funding to invest in new products across hardware, software, and financial services.

- Indonesia was home to the largest deal completed in the sector in Q1 2020. Gojek, a “super app” that allows digital payments, food orders, shopping, and a dozen other services, announced a $1.2bn investment from Visa, Mitsubishi Corporation, and three other investors in a Series F round. Gojek said it would use the capital to expand amid sector disruption from COVID-19. The large deal doesn’t come as a surprise as seven of the top ten global Payments & Remittances deals came from Asian companies between 2015 and 2019.

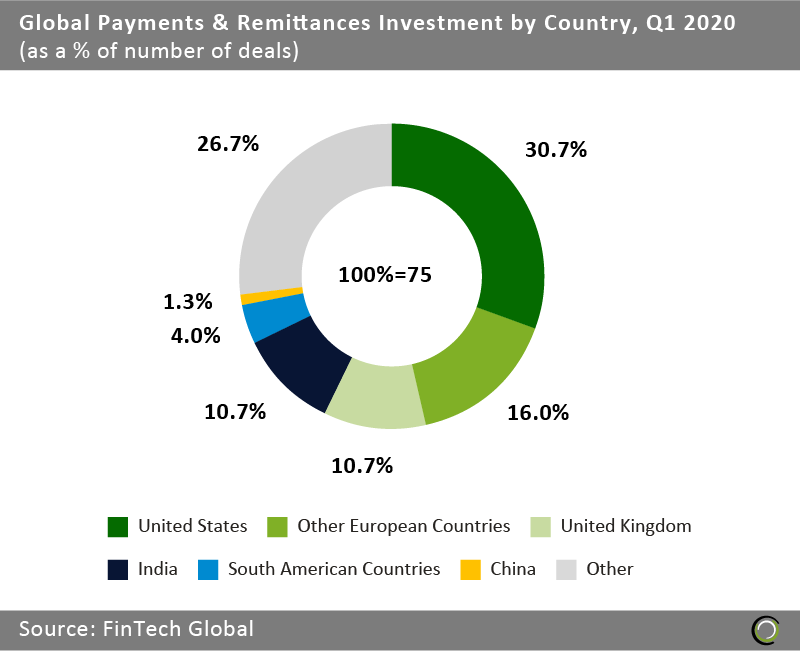

With deal activity declining in Q1 2020, investors are moving to safer markets amid uncertainty

- The United States strengthened its position as a leader in the Payments & Remittances sector, taking a 30.7% deal share in Q1 2020 which is a 7.3 percentage points (pp) increase compared to Q1 2019.

- Payments & Remittances companies offering P2P and B2B payments, e-commerce, PoS, and mobile payments completed 75 transactions in the first quarter of 2020. Companies based in the United States, UK and other European countries captured nearly 75% of all deal activity.

- China’s share of Payments & Remittances deals fell by 8.3 percentage points (pp), leaving the country nearly out of the sector all together. According to The World Bank, remittances are set to fall 20% due to the economic uncertainty induced by Covid-19 and the ensuing shutdown. While the deal activity in China fell, China’s e-commerce giants like Alibaba and JD.com accounted for more than 50% of sales during Q1 2020. This may indicate that investors were shifting focus to other countries as the leaders in the Chinese market have already been established.

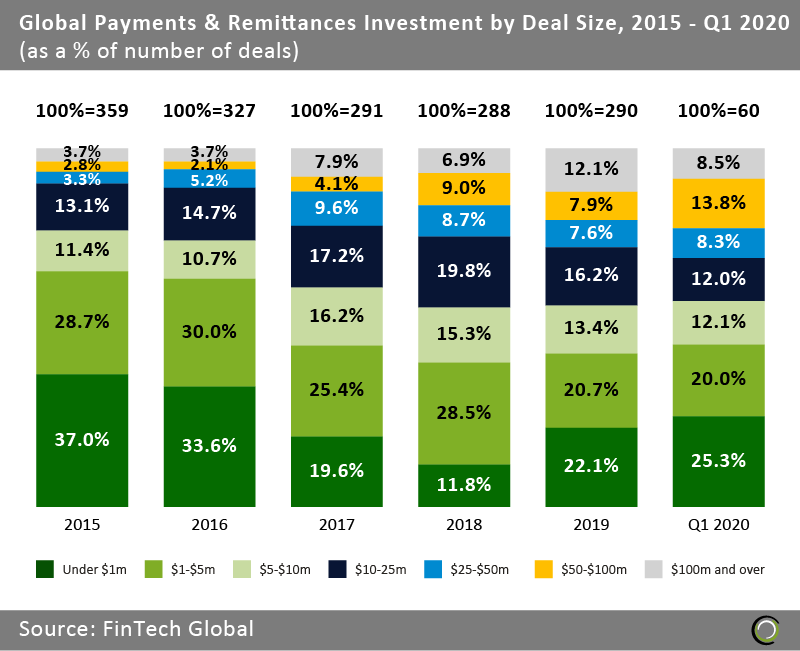

Investors are backing the next wave of innovation with the share of deals under $1m growing since 2018

- From 2015 to 2018, the share of deals under $1m shrank 25.2pp to taking up slightly more than 10% of all deals at the end of the period. Since then, deals under $1m have more than doubled, reaching a three-year high of 25.3% in Q1 2020.

- With nearly a 20% decline in total number of deals from Q1 2019 to Q1 2020 and a 40% drop in funding during the period, investors are balking at deals sized $100m and higher. The sector is propped to see further decline in both deal size and activity as Q2 2020 saw the peak of COVID-19 and the economic affects.

- While the deal share over $10m remained stable, the number of deals above $100m more than halved from Q1 2019 to Q1 2020, highlighting that investors are being more conservative.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global.