The Indian branch of venture capital firm Sequoia Capital has announced that it has raised $1.35bn in an effort to bolster its continuous investment efforts in South-East Asia.

Sequoia Capital India, which has previously supported startups like online marketplace Zetwerk, the digital bank TONIK and digital ledger app Khatabook, has raised a new $525m venture fund and a new $825m growth fund.

“A fundraise represents a massive responsibility to deliver attractive returns to Sequoia’s Limited Partners, the majority of which are nonprofits, foundations and charities,” said Shailendra Singh, a managing director at Sequoia Capital India. “We do this by partnering with outstanding founders who are building category defining companies.”

Singh said that the two new funds will be used to help South-East startups overcoming some of the structural hurdles facing them in the region. He argued that “frequent cycles of intense competition” have held back startups from growing quickly, often leaving them with “very high losses for the scale of business.”

“This has prevented very large profitable technology businesses in our region from emerging,” Singh continued. “To add to these challenges, startups in India do not have the benefit of a regulatory framework that allows listing on foreign exchanges like Nasdaq. In this market context, most startups have chosen to remain private, and raising capital has become a proxy for success. We believe there is an opportunity to choose a different path. Our ecosystem has arrived at a fork in the road.”

The fund comes almost two years after Sequoia Capital India raised its sixth fund in August 2018. As AltAssets reported at the time, the firm failed to reach the $920m it raised in its fifth round, only managing to secure $695m.

The news also comes after Sequoia Capital India launched a new accelerator programme called Surge in 2019.

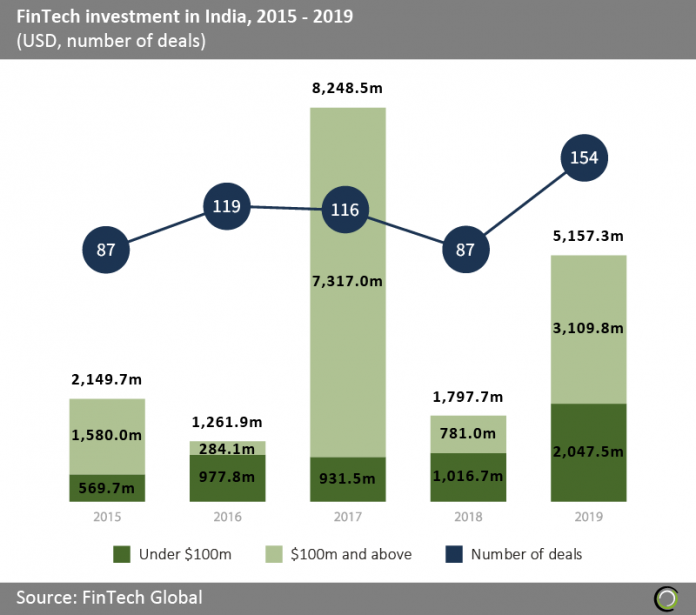

Looking closer at the Indian FinTech market, the nation’s ecosystem has attracted more than $18.6bn worth of investments across 563 transactions between 2015 and 2019, representing a compound annual growth rate of 19.1% during the period, according to FinTech Global’s research. During the same period, the average deal size jumped from $32.1m in 2015 to $38.9m in 2019, indicating that the Indian FinTech sector has matured over the period.

2017 stands out among as a particularly successful year for Indian FinTech investments, with the companies in the industry attracting $8.2bn that year. However, the numbers are slightly eschewed by five large transactions that collectively accounted for 81.2% of investment, raising $7.3bn in total which pushed funding in the country to record levels as a result.Eliminating these giant rounds, Indian FinTech funding from transactions valued below $100m almost quadrupled between 2015 to 2019, demonstrating the strong growth of the industry between 2015 and 2019.

2017 stands out among as a particularly successful year for Indian FinTech investments, with the companies in the industry attracting $8.2bn that year. However, the numbers are slightly eschewed by five large transactions that collectively accounted for 81.2% of investment, raising $7.3bn in total which pushed funding in the country to record levels as a result.Eliminating these giant rounds, Indian FinTech funding from transactions valued below $100m almost quadrupled between 2015 to 2019, demonstrating the strong growth of the industry between 2015 and 2019.

Copyright © 2020 FinTech Global