South African challenger banks TymeBank and Discovery Bank has reportedly thrived during the country’s coronavirus lockdown.

As their customers responded to the government’s social distancing measures to contain the contagion, the digital banks found themselves with more customers signing on to their digital, according to a report by IT Web.

Tauriq Keraan, CEO of African Rainbow Capital-owned TymeBank, told the publication that the lockdown caused more people to sign up for its digital services.

TymeBank boasts having attracted a total of 1.9 million customers since its launch in February 2019

“We have also seen a steady rise in deposit levels during this period, in terms of the deposits in our savings product GoalSave, as well as deposits in the transactional Every Day Account,” said Keeran. “We believe Covid-19 has introduced significant economic uncertainty for consumers and they are exercising cash preservation. However, the fact that TymeBank is offering attractive savings rates, no monthly fees and low transaction fees, should also be seen as a contributing factor for growth.”

Akash Dowra, head of client insights and technical marketing at Discovery Bank, told ITWeb that the digital lender has seen a steady “growth in client numbers and customer engagement,” attributing the increase to its customers not having to go to physical branch to get access to the digital bank’s services.”

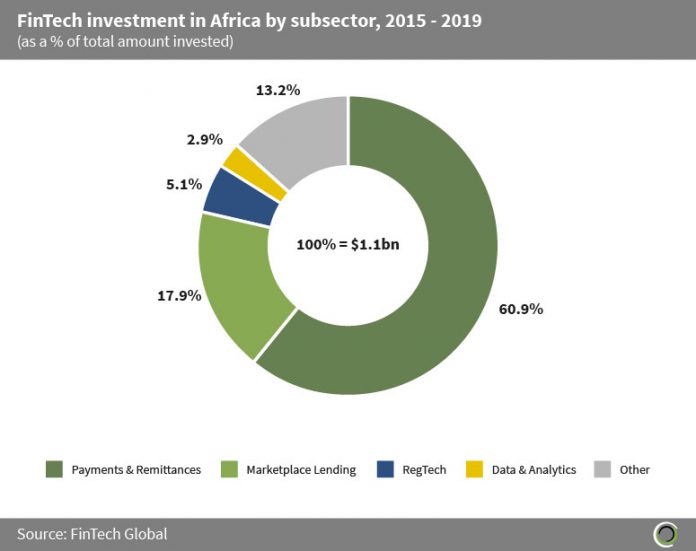

FinTech companies based in Africa raised over $1.1bn across 122 transactions between 2015 and 2019, according to FinTech Global’s research. It also showed that the payments and remittances subsector received 60.9% of African investment amounting to $699.5m in funding during the period. The market lending segment of the industry represented the second largest destination for African FinTech investment, attracting 17.9% of the total funding during the period. The RegTech segment attracted 5.1% of the total funding, followed by the data and analytics segment that bagged 2.9%.

Copyright © 2020 FinTech Global.